Diamond News Archives

- Category: News Archives

- Hits: 1200

Think of the Fed and its interference in the markets as a wanderer in the desert, who despite carrying enough water, can’t help himself from wading into the glorious, shimmering, pristine pool he sees over there in the distance.

Except it’s not water. It’s quicksand. Once the Fed first fell for the mirage that it could somehow execute the job so perfectly executed by free markets better than those free markets on their own, it has been left trying to extricate itself from yet another totally unnecessary, could-have-been-avoided, self-created disaster[1].

But that’s the thing about quicksand. The harder you work to get out of it, the faster you sink. The Fed has already admitted that we’re irrevocably stuck in a permanent QE loop[2] now that we’ve resorted to such wild levels of money printing[3] to solve all our perceived economic woes.

The Fed's own greed and hubris is going to bring the system down faster than was necessary.

If the Fed wanted to do the right thing, the thing that would sustainably benefit the US populous the most, it would die as quickly and quietly as possible[4], let all the dammed up and postponed pain and downside out, so we could try to get through it all and chart a sustainable course without it. Because the current plan, postponing the inevitable misery wrought by profligate debt spending unti the whole rattletrap comes apart at the seams, is the worst plan of all.

But we’re all well-served to remember that the Fed is a privately owned corporation that does not exist to serve the American people[5]. It exists to enrich the private banks that own it...

- Category: News Archives

- Hits: 1352

Argentina is struggling to stop the peso’s plunge just a week after obtaining the biggest[1] loan in the history of the International Monetary Fund.

Traders are desperate for policy makers to lay out a strategy to curb the volatility, and complain that all they’re getting in response is disjointed and unpredictable policy. The rout deepened[2] Thursday as the currency tumbled more than 6 percent against the dollar to a record low, extending its decline since the end of April to almost 27 percent.

Argentina’s peso tumble continued to escalate, upending local businesses, sapping the value of savings account and adding to the woes of a country already under siege from double-digit inflation and fiscal and current account deficits. BlackRock Inc.[3] and Brown Brothers Harriman are among shops calling for further peso declines as outside factors including a resurgent dollar, rising global interest rates and less investor tolerance for risk conspire against an easy solution for Argentina.

“There’s anxiety in the trading desks because there’s no indication of where the peso is going next,” said Jose Nogueira, a partner and trader at ABC Mercado de Cambios in Buenos Aires. “We’re lacking proper signaling from the central bank.”

A surge in dollar demand has meant that the exchange market only has a respite when publicly managed banks buy pesos in the market, according to a note by ABC. The peso slid Thursday with no intervention from the central bank amid rumors that some of its directors will depart[4] from institution. Trading on the MAE electronic market fell to $240 million on Thursday, the lowest since September 2017, and almost half of the past year’s average daily volume of...

- Category: News Archives

- Hits: 1066

Japan's[1] central bank maintained its ultra-loose monetary policy on Friday and downgraded its view on inflation, signalling that it will lag well behind its U.S. and European peers in rolling back crisis-era stimulus.

Markets are on the lookout for clues from BOJ Governor Haruhiko Kuroda's post-meeting briefing on how long the central bank could hold off on whittling down stimulus given recent disappointingly weak price growth.

As widely expected, the Bank of Japan[2] kept its short-term interest rate target at minus 0.1 percent and a pledge to guide 10-year government bond yields around zero percent.

The move contrasts with the European Central Bank's decision to end its asset-purchase program this year and the U.S. Federal Reserve's steady rate increases, which signaled a break from policies deployed to battle the 2007-2009 financial crisis.

"Consumer price growth is in a range of 0.5 to 1 percent," the BOJ said in a statement accompanying the decision. That was a slightly bleaker view than in the previous meeting in April, when the central bank said inflation was moving around 1 percent.

The BOJ stuck to its view the economy was expanding moderately, unfazed by a first-quarter contraction that many analysts blame on temporary factors like bad weather.

But it also maintained its cautious assessment on prospects for hitting its elusive 2 percent inflation target, saying that inflation expectations were moving sideways.

The delay in pulling out of crisis-era stimulus would leave the BOJ with a lack of ammunition to fight another economic downturn, even as its U.S. and European peers start restocking their tool-kit.

Japan's economy shrank an annualized 0.6 percent in the first quarter, though many analysts expect growth to bounce...

- Category: News Archives

- Hits: 1260

BEIJING (Reuters) - Having reduced the amount of reserves that lenders must hold just two months ago, China’s central bank could soon do it again to support a slowing economy and contain risks posed by corporate debt defaults, policy sources said.

A three-year deleveraging drive is making progress, but has also driven up borrowing costs and tightened credit, seen as a factor in some private defaults and hampering local government investment.

Weaker-than-expected activity data on Thursday, following other figures showing a sharp contraction in shadow banking activity, could help tilt the People’s Bank of China (PBOC) towards a slight easing, policy insiders said.

The PBOC’s decision not to follow this week’s U.S. Federal Reserve rate rise with even a symbolic rise - a break from its recent practice - signaled that some policy fine-tuning is in the offing, they said.

“Monetary policy could be slightly loosened under the ‘prudent and neutral’ stance, and such loosening should be targeted rather than across-the-board,” said a policy source who advises the government.

“There is room for cutting RRR (reserve requirement ratio) in the next 1-2 months as China’s economy faces downward pressure and also uncertainties from a trade war with the United States.”

In April, a month after nudging up short-term rates by 5 basis points, the PBOC unexpectedly cut the RRR by 100 basis points. That released about 1.3 trillion yuan ($202.7 billion), with 900 billion yuan used by big banks to repay medium-term lending facility (MLF) loans and 400 billion yuan for small banks to lend to small firms.

“Monetary policy is...

- Category: News Archives

- Hits: 1306

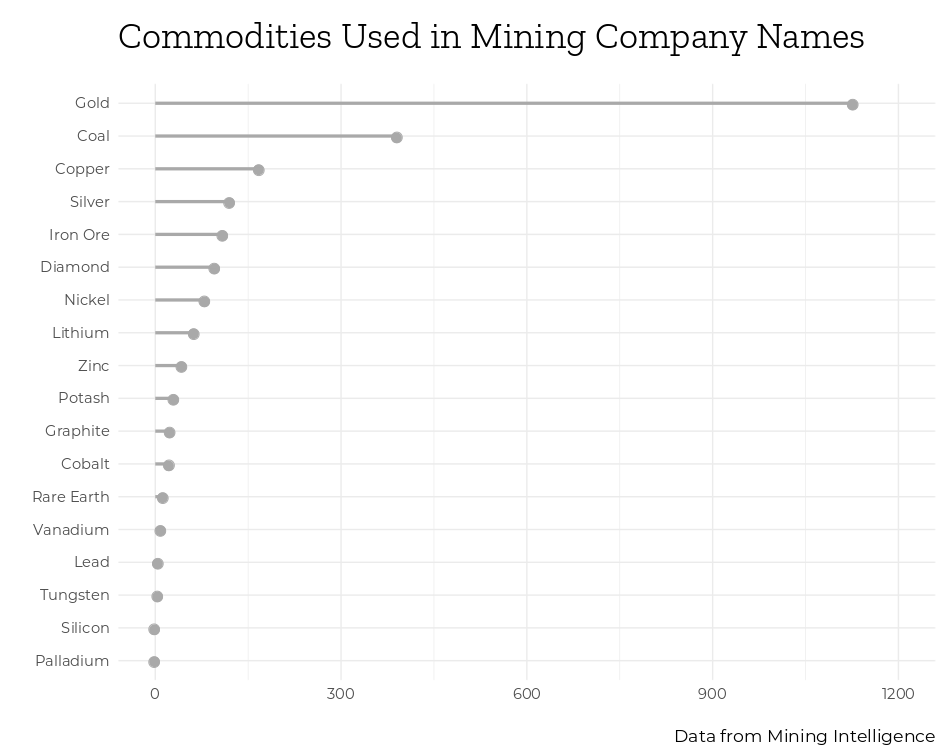

Most mining companies have the word "gold" in their name, according to a study of Mining Intelligence company names.

There are over 1,000 mining companies that use a variant of the word "gold" in their moniker. Some examples would be Barrick Gold (TSE:ABX) or Condor Gold (TSE:COG).

Data comes from Mining Intelligence, which tracks over 13,000 mining companies.

The second and third most popular commodities to add to a company name were "coal" followed by "copper".

Adding a commodity to a name is a handy way to signal to investors what is the company's focus; however most companies opt not to attach a commodity to their name.

With the spike in battery-material prices, there may seem there are more companies popping up using some variant of "cobalt", "lithium", "nickel" or "graphite" in their names, but there hasn't be any recent surge. In 2017 there were eight companies that formed or got renamed that had "cobalt", "lithium", "nickel" or "graphite" in their name, which is about the yearly average over the past four years.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative Commons image of boat christening by US Navy

The post RANKED: Commodities that are added to mining company names appeared first on MINING.com....