Diamond News Archives

- Category: News Archives

- Hits: 1088

Where does gold come from? What does gold represent in different cultures? When did gold start being used as money?

Unique in its endurance and rarity, gold has been valuable throughout the history of mankind. When molten iron formed the Earth's core, it pulled most of the gold on the planet down with it. The gold in the Earth's core could make a 13-inch coating across the entire planet's surface, but of course, it could never be recovered. For the earliest civilizations, gold was a store of value, a medium of exchange, as well as a thing of beauty. For the Egyptians, gold represented the sun that gods, their rulers, and eternal life. The Incas described gold as the tears of the sun. And the Greek Author Homer, in the Iliad and the Odyssey, saw gold as wealth for humans, and the glory of the Immortals. The first use of precious metals as money took place around 700 BC with coins struck by the merchants of Libya, which were actually formed from a naturally occurring mixture of gold and silver known as electrum. Gold's unique properties enabled the Templars to create the first banks in 13th century Europe, as people were able to store their gold in one bank and borrow against it elsewhere as they traveled across the continent....

- Category: News Archives

- Hits: 1205

(IDEX Online) – The Italian Exhibition Group (IEG) will be joining Emerald Expositions at The Las Vegas Convention Center for the launch of PREMIER in 2019. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

IEG is the organizer of approximately 60 events, including the VICENZORO shows, as well as pavilions at other US-based trade events, and it will showcase a significant pavilion of Italian Made jewelry from some of the most highly regarded Italian brands and manufacturers in the world. The addition of these mainstay exhibitors to PREMIER, along with the show’s co-location with AGTA GemFair Las Vegas and the Las Vegas Antique Jewelry and Watch Show, further distinguishes the Las Vegas Convention Center as a destination venue during Las Vegas Jewelry Market Week.

“We are delighted that the Italian Exhibition Group is joining us for the launch of PREMIER,” said Drew Lawsky, Group Show Director, Emerald Expositions. “The landscape has changed in Las Vegas, and based on the enthusiastic feedback we’ve been receiving from our manufacturers and brands, we’re confident that PREMIER will provide the market with the alternative environment it is seeking. IEG’s commitment to our event will serve to augment our already robust presence at The Las Vegas Convention Center, and will have substantial draw among the type of qualified, motivated buyers that all three shows are seeking.”

“Italian Exhibition Group has an established reputation for creating opportunities for Italian companies in one of their most important markets, the United States,” explains Gannon Brousseau, Senior Vice President of Emerald Expositions. “We are thrilled that IEG has determined that joining PREMIER in Las Vegas is an opportunity that will...

- Category: News Archives

- Hits: 1053

- Category: News Archives

- Hits: 1425

If you have credit-card debt, it just got a little more expensive.

The Federal Reserve on Wednesday raised its benchmark federal funds rate[1] by a quarter-percentage point — to a range between 1.75% and 2% — as many economists had expected. What consumers might not expect: Their credit-card bill is going up[2], too.

Consumers with credit-card debt will likely pay an additional $2.2 billion in interest payments annually, according to an analysis from the credit-card website CompareCards.com.

To determine that number, analysts at the site looked how much those carrying a balance pay in interest, based on the current average annual percentage rate (APR). They used a 15.32% APR as a base, which rose to 15.57% after the hike.

Cardholders currently have about $1 trillion in credit-card debt collectively, according to the Federal Reserve. Based on those numbers, CompareCards concluded they will collectively pay $2.2 billion more with a 25-basis point hike.

The Fed raises and lowers interest rates in an attempt to control inflation. When the Federal Reserve raises its rates, it’s costs more for banks to borrow money. And they typically pass on those costs to the consumer.

Credit-card interest rates are variable and tied to the prime rate[3], an index a few percentage points above the federal funds rate. It is a benchmark that banks use to set home equity lines of credit and credit-card rates. As federal funds rates rise, the prime rate does, too.

When the Fed rate goes up, consumers will typically see the impact within about 60 days. People with credit-card debt should consider trying to refinance or consolidate it now, or transfer it to a card with a lower interest rate.

“Rising...

- Category: News Archives

- Hits: 1317

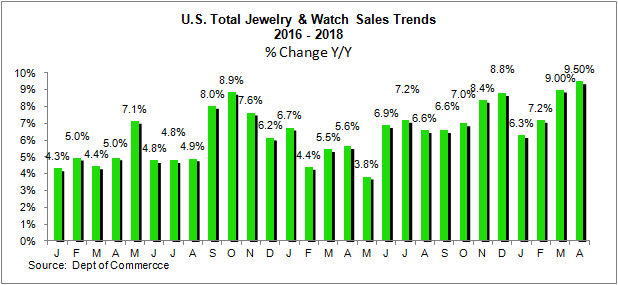

(IDEX Online) – Sales of fine jewelry and fine watches rose by 9.5 percent in the U.S. market in April, when compared to the same month a year ago, as the graph below illustrates. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Sales were an estimated $7.2 billion, according to preliminary data from the U.S. Commerce Department.

<?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>

Strong Start to 2018 Jewelry Sales

American jewelry consumers appear to be in a strong jewelry-buying mood, according to the figures for the first three months of 2018.

With the American economy continuing to improve, it's reasonable to assume that the figures will keep showing a solid performance in the coming months.

The traditionally weaker summer sales months will provide a good indication of the strength of jewelry sales.

Click here[1] to read the full IDEX Online Research report...