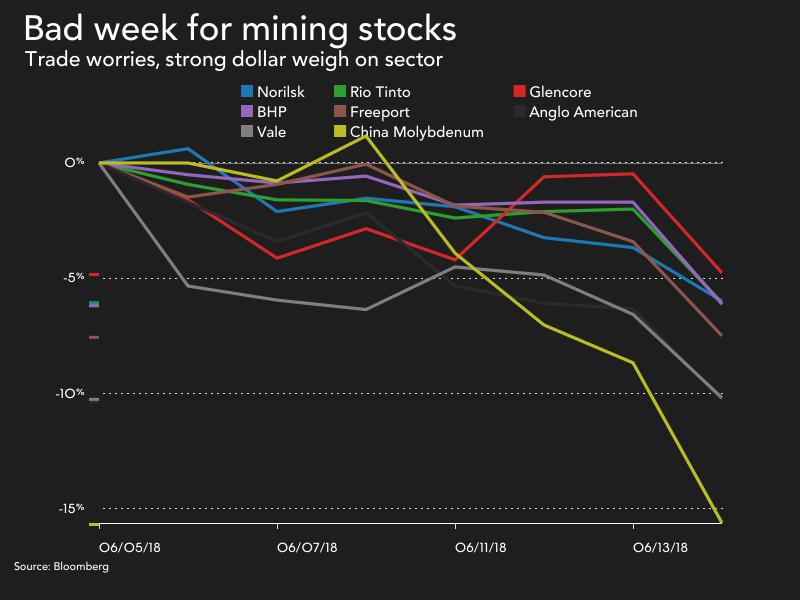

Big mining blasted

Mining and metals investors were offloading the sector's big names on Friday over fears of the impact of a trade war between the US and China, which is responsible for nearly half the world's industrial metal demand and two-thirds of the world's seaborne trade in steelmaking raw materials.

Copper fell nearly 3% to $3.13 a pound or $6,900 a tonne, pushing the bellwether metal back into the red for the year. Last week copper touched the highest levels since January 2014. The S&P GCSI Industrial Metals index also moved back into negative territory for 2018, despite a year-to-date rally in nickel of nearly 20% and stronger aluminum prices.

Friday's sell-off came after a busy week for mining's heavyweights with several big deals which appeared to signal that after years of belt-tightening, the majors are again looking for growth opportunities.

Shares in world number one miner BHP Billiton (NYSE:BHP) lost 4.5% in New York dropping the market valuation of the Melbourne-based company to $125 billion. Yesterday BHP approved construction of a $4.2 billion iron ore mine in Western Australia sparking talk of a new boom time in the Pilbara.

Several big deals this week appeared to signal that after years of belt-tightening, the majors are again looking for growth opportunities

Vale (NYSE:VALE.P), the world's top iron ore and nickel producer, fell 5.6%. Rio de Janeiro-based Vale has been making the most of the rally in battery raw materials with the signing of a $700m cobalt streaming deal on its Canadian nickel mine earlier this week. Vale will use the money to fund a $1.7 billion underground expansion at Voisey's Bay, Labrador.

Vale (NYSE:VALE.P), the world's top iron ore and nickel producer, fell 5.6%. Rio de Janeiro-based Vale has been making the most of the rally in battery raw materials with the signing of a $700m cobalt streaming deal on its Canadian nickel mine earlier this week. Vale will use the money to fund a $1.7 billion underground expansion at Voisey's Bay, Labrador.

Anglo American (LON:AAL) gave up 4.3% in New York, bringing year to...