Diamond News Archives

- Category: News Archives

- Hits: 1001

The Fed continues to operate in search of a mythical, magical set of central-bank-conjured circumstances that allows an economy to grow forever, without recessions, at 2% inflation forever.

Join Ron Paul as he discusses the Fed's recent doubletalk and what it may portend.

...

- Category: News Archives

- Hits: 1049

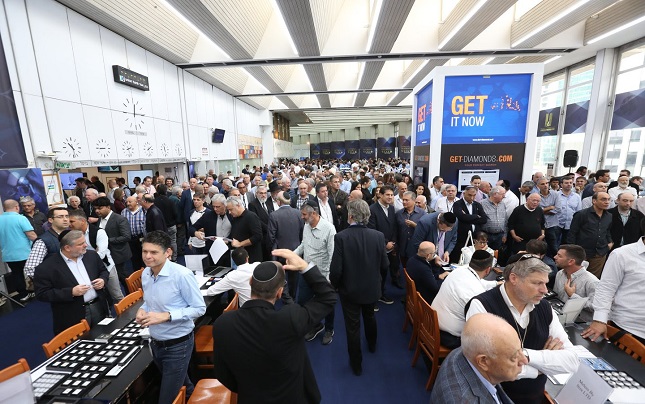

(IDEX Online) – Registration for the next International Diamond Week in Israel (IDWI), to be held January 28 – 30, 2019, is proceeding at a brisk pace, according to the Israel Diamond Exchange (IDE) which is organizing the event. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The IDE noted that buyers had registered from all over the world, and included a high percentage of new participants. Moreover, official delegations are being organized from major bourses around the world.

The IDWI will take place on the trading floor of the Israel Diamond Exchange (IDE), and will feature 200 Israeli exhibitors of polished diamonds, with huge amounts and varieties of goods on offer.

In contrast to the large, expensive trade shows, IDWI is a boutique show, exclusively for diamond buyers, with minimal participation costs. Moreover, eligible buyers will receive three complimentary nights at a local hotel.

This year IDWI will also feature a section devoted to high-end diamond jewelry manufactured by Israeli diamond companies, which in addition to loose diamonds now offer top quality jewelry collections.

The IDWI has become an important annual attraction for the global diamond industry because of the amount and variety of goods offered and the minimal costs.

...

IDWI Chairman Ezra Boaron said, “We are thrilled to see the excitement that this show generates. The event sells itself, attracting hundreds of buyers from dozens of markets. The next show is shaping up to be the biggest ever. We invite you to join us. Register now and secure your place.”- Category: News Archives

- Hits: 976

"Even if central bank policies are fully anticipated by the public, some adjustments could occur abruptly, contributing to volatility in domestic and international financial markets and strains in institutions," the report said.

On the bright side, banks and other financial institutions are seen as well capitalized and thus in a good position to absorb shocks. Consumer debt also has kept pace with GDP increases, indicating little threat there.

For businesses, though, there could be issues, particularly among those that have added to already high debt levels.

So-called leveraged loans have surged recently, as have companies whose bonds are rated near the bottom of the investment-grade ladder and are thus susceptible to slipping into junk territory.

"High leverage has historically been linked to elevated financial distress and retrenchment by businesses in economic downturns," the report said. "Given the valuation pressures associated with business debt ... such an increase in financial distress, should it transpire, could trigger a broad adjustment in prices of business debt."

The Fed noted that the share of investment-grade debt classified at the low end of the range has "reached near-record levels" of $2.25 trillion, or about 35 percent of the total corporate bonds.

Correction: This is the first time the Fed has issued the financial stability report. An earlier version indicated otherwise.

WATCH: Trump not happy with his Fed pick, Jerome Powell[1]...

References

- ^ Trump not happy with his Fed pick, Jerome Powell (www.cnbc.com)

- Category: News Archives

- Hits: 1157

(IDEX Online) – Zimbabwe does not plan to change its ownership rules for diamonds, its mining minister said on Monday, hitting hopes among some investors of a more friendly approach.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The country's indigenization law states that the government must hold 51% of diamond and platinum mines.

Zimbabwe changed its empowerment law in March limiting the rules that mandate majority state ownership to diamond and platinum mines, rather than to the mining sector as a whole.

Speaking on the sidelines of an investment conference in London, Minister of Mines and Mining Development Winston Chitando (pictured above) told Reuters there would be "no change" for diamonds and platinum when asked about industry speculation the indigenization rules could be relaxed further.

Zimbabwe has held a series of conferences in Africa, as well as in London, since the ouster of long-term leader Robert Mugabe a year ago, raising hopes that the mineral-rich country would become more investor friendly.

Progress has been slow but Chitando said the country was determined to bring about change and over the coming weeks would roll out policies for various minerals, including diamonds and gold.

Chitando said the country's diamond policy would focus on beneficiating its stones by seeking to cut and polish them in Zimbabwe rather than simply exporting the rough.

Most of the diamond fields are in Marange in eastern Zimbabwe, where production is dominated by the state-owned Zimbabwe Consolidated Diamond Company. It is expected to produce 3.5 million carats this year, up from 2.5 million in 2017, the report added....

- Category: News Archives

- Hits: 1209

Mountain Province Diamonds (TSX, NASDAQ: MPVD) issued a statement today saying it expects the Gahcho Kué mine, its joint venture with De Beers, to produce between 6.6 and 6.9 million carats in 2019, recovered after processing some 3.1 to 3.2 million tonnes of ore.

This guidance for the new fiscal year estimates that production costs would be of up to CAD$120 per tonne of ore processed and of CAD$50 to CAD$54 per carat recovered. Most of the ore tonnes mined and processed in 2019 are expected to be from the Hearne pit.

Gahcho Kué is Canada’s newest diamond mine and the world’s largest in the last 14 years. Located in the Northwest Territories, the operation officially opened in September 2016 and achieved commercial production the following year.

In addition to the 2019 guidance, Mountain Province presented a 3-year production outlook for the mine, which sees steady recovery rates in 2020 and a growth between 6.8 and 7.1 million carats in 2021.

In the press release, the Toronto-based miner said that, based on the tonnes that are currently being treated, management is confident that Gahcho Kué will achieve and probably surpass its 2018 production guidance of 6.6 million carats.

“With the 2018 fiscal year coming to an end, we are well on our way to exceed the upper end of our 2018 guidance. As we look forward to 2019 and beyond, our business plan demonstrates the quality of our core asset and the excellent work that the operations team has carried out over the past year, both in exceeding the targets for the current year, and building a stronger longer-term business plan that should extend the life of mine beyond 2028,” Stuart Brown, the company's President and CEO, said in the brief....

- Opinion | When Blue Chip Companies Pile on Debt, It’s Time to Worry

- Canada’s Gahcho Kué mine expected to produce up to 6.9 million carats in 2019

- Mike Maloney Video: "I Found a New Recession Indicator That Says LOOK OUT BELOW!"

- Black Friday And Cyber Monday Create Record Start To Holiday Sales Season