Diamond News Archives

- Category: News Archives

- Hits: 975

Australia’s Lucapa Diamond (ASX:LOM) has locked in 100 million rand (about $7m) in development funding from South Africa’s Industrial Development Corporation (IDC) for its 70%-owned Mothae diamond plant, in Lesotho.

Commercial production at the mine, which the Perth-based company acquired in early 2017, began earlier this month via a new 1.1 million tonne-per-year plant that is progressively ramping up to its nameplate capacity.

The government of Lesotho owns the remaining 30% of the mine, which is located 5km from Letšeng, the world’s highest dollars-per-carat kimberlite diamond operation.

The first sale of commercial diamonds from Mothae is scheduled for the first quarter of 2019, the company said in the statement.

In addition to the funding from the IDC, Lucapa now counts $1.5 million from the sale of roughly 4,000 carats produced via bulk sampling at the Lesotho mine.

Lucapa is also furthering two exploration projects in known diamond provinces. One is at Brooking in the West Kimberley lamproite province of Western Australia. The other is a the Orapa Area F project in its namesake mine in Botswana, where it plans to drill kimberlite targets during the first quarter next year.

The company also holds a 40% stake in the prolific Lulo mine, in Angola, which hosts the world’s highest dollar-per-carat alluvial diamonds.

The post Lucapa Diamond locks in Mothae mine funding appeared first on MINING.com....

- Category: News Archives

- Hits: 1158

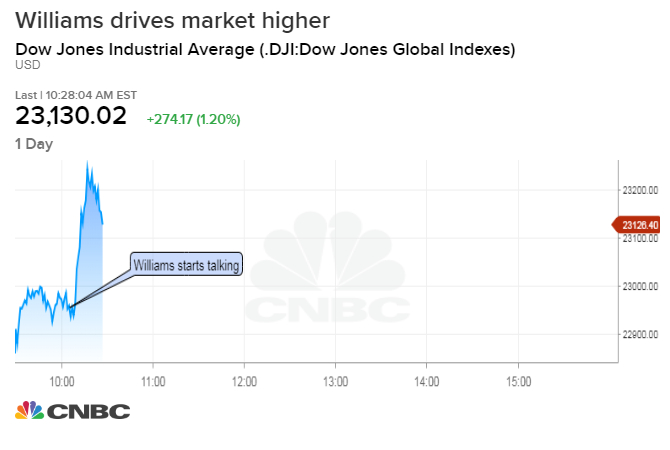

U.S. stocks gained Friday after Federal Reserve Bank of New York President John Williams said that the central bank could reassess its interest rate policy and balance sheet reduction in the new year if the economy slows.

Williams also said the Fed was listening to the market, and could re-evaluate its outlook for two rate hikes next year.

"We are listening, there are risks to that outlook that maybe the economy will slow further," Williams told Steve Liesman[1] on CNBC's "Squawk on the Street" Friday.

"What we're going to be doing going into next year is re-assessing our views on the economy, listening to not only markets but everybody that we talk to[2], looking at all the data and being ready to reassess and re-evaluate our views," he said.

The Dow Jones Industrial Average[3] gained more than 200 points following Williams's comments and as athletic apparel company Nike[4] rallied nearly 9 percent following strong earnings results.[5] The S&P 500[6] added 0.7 percent and the tech-heavy Nasdaq Composite[7] added 0.1 percent.

"This is a real magnificent speech and much different from what most of us are accustomed to," said Anthony Chan, Chief Economist at J.P. Morgan Chase. "The concern of the market was: what is the Federal Reserve going to do with the fed funds rate in 2019? John Williams told us everything's on the table, they can adjust that path."

"Then of course the markets are really worried about that autopilot situation on the balance sheet," Chan added. "Once again, John Williams said even that is on the table, that if things were to shift, that the Federal...

- Category: News Archives

- Hits: 1114

Precious gemstones miner Gemfields (JSE: GML) has announced that the Zambia Revenue Authority (ZRA) has cleared its Kagem emerald mine following a probe into alleged tax evasion.

During an unannounced visit in August, the ZRA seized documents and files including those allegedly used to evade payment of Value Added Tax (VAT), income tax, with-holding tax and other taxes.

Probe was part of a wider effort by Zambia’s government to track down billions it is suspected of losing to foreign miners.

Gemfields, which also owns the Fabergé jewellery brand, said that the ZRA was unable to find evidence of wrongdoing or late payment by either Kagem or Limpopo Polygraphs.

The Kagem probe was part of a wider effort by Zambia’s government to track down billions it suspects of losing to foreign miners.

Mining accounts for more than 70% of the southern African nation's foreign exchange earnings. The government is currently considering an increase to mining taxes and the introduction of new duties. It also plans to replace value-added tax (VAT) with a sales tax and increase royalties beginning January 2019.

Zambia estimates that mining tax revenues will climb to $1.3 billion next year thanks to the tax increases, up from $800 million this year. The country’s Chamber of Mines, however, says revenues will rise to only $840 million approximately.

The post Zambia tax authority clears Gemfields’ Kagem mine of tax evasion appeared first on MINING.com....

- Category: News Archives

- Hits: 1184

HTTP/1.1 200 OK Server: Apache X-Content-Type-Options: nosniff X-Powered-By: PHP/5.6.39 X-Drupal-Cache: HIT Etag: "1545334531-1" Content-Language: en X-Frame-Options: SAMEORIGIN X-Generator: Drupal 7 (http://drupal.org) Link: ; rel="image_src",; rel="canonical",; rel="shortlink" Cache-Control: public, max-age=900 Last-Modified: Thu, 20 Dec 2018 19:35:31 GMT Expires: Sun, 19 Nov 1978 05:00:00 GMT Vary: Accept-Encoding Content-Type: text/html; charset=utf-8 X-Cacheable: YES Transfer-Encoding: chunked Date: Thu, 20 Dec 2018 20:00:03 GMT X-Varnish: 733517197 733517184 Age: 0 Via: 1.1 varnish X-Cache: HIT

It Turns Out That Trump Loves Low Interest Rates and Fed Stimulus After All | Mises InstituteAnd you know the people who are hurt the most are people that saved all their lives, and thought they were going to live off the interest. Those people are getting absolutely creamed.As a wealthy investor, though, Trump says he "loves low interest rates." But those who cut down on debt and save their money are hurt by Fed policies:

...

The ones who did it right — they saved their money [and] they cut down on their mortgages, ... and now they're practically getting zero interest on

- Category: News Archives

- Hits: 1054

(IDEX Online) – The Dubai Diamond Exchange (DDE) is to join the MyKYCBank platform of India's Gem & Jewellery Export Promotion Council. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Ahmed Bin Sulayem, Executive Chairman of DMCC, and Chairman of DDE, and Pramod Kumar Agrawal, Chairman, GJEPC, signed the agreement which enables DMCC members trading in diamonds, gold and precious stones to join the MyKYCBank platform.

DMCC is the fourth trade body to join MyKYCBank, following GJEPC, the Bharat Diamond Bourse and the Antwerp World Diamond Council.

The MyKYCBank platform provides a centralized global platform for companies in the Gems and Jewellery (G&J) industry (including gold, diamonds, precious stones and Jewellery) to complete, manage and share their KYC information so as enable them to meet their obligations under the anti-money laundering AML laws of their respective countries, the sides said in a statement.

Bin Sulayem said, “As a leading global diamond hub, the Dubai Diamond Exchange and DMCC are proud to be part of the MyKYCBank and enable our members to join the leading platform and serve business requirements.”

Meanwhile, Agrawal said, "The UAE is an important trading partner in the industry for India, across gold, diamonds, jewelry and precious stones. The inclusion of DDE registered companies on the platform will go a long way in addressing the concerns of our industry bankers, and support the trade between the countries. The MyKYCBank platform has become a recognition across the world for KYC.”

Members can easily share their own KYC data among trade connections as well as banks and other financial intermediaries. Under the FATF guidelines, companies in the...