U.S. stocks gained Friday after Federal Reserve Bank of New York President John Williams said that the central bank could reassess its interest rate policy and balance sheet reduction in the new year if the economy slows.

Williams also said the Fed was listening to the market, and could re-evaluate its outlook for two rate hikes next year.

"We are listening, there are risks to that outlook that maybe the economy will slow further," Williams told Steve Liesman[1] on CNBC's "Squawk on the Street" Friday.

"What we're going to be doing going into next year is re-assessing our views on the economy, listening to not only markets but everybody that we talk to[2], looking at all the data and being ready to reassess and re-evaluate our views," he said.

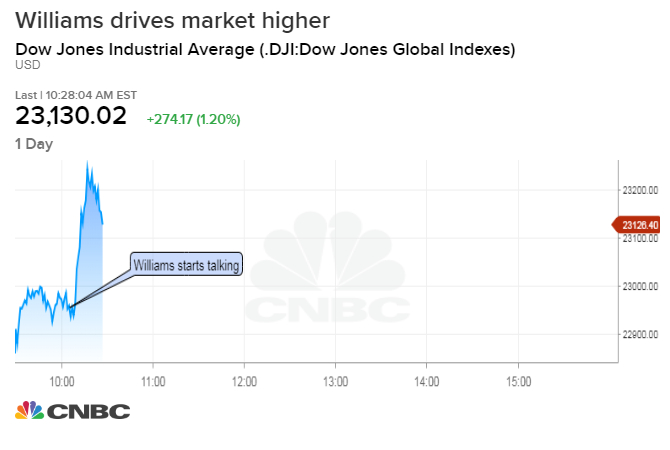

The Dow Jones Industrial Average[3] gained more than 200 points following Williams's comments and as athletic apparel company Nike[4] rallied nearly 9 percent following strong earnings results.[5] The S&P 500[6] added 0.7 percent and the tech-heavy Nasdaq Composite[7] added 0.1 percent.

"This is a real magnificent speech and much different from what most of us are accustomed to," said Anthony Chan, Chief Economist at J.P. Morgan Chase. "The concern of the market was: what is the Federal Reserve going to do with the fed funds rate in 2019? John Williams told us everything's on the table, they can adjust that path."

"Then of course the markets are really worried about that autopilot situation on the balance sheet," Chan added. "Once again, John Williams said even that is on the table, that if things were to shift, that the Federal...