Diamond News Archives

- Category: News Archives

- Hits: 937

Gold was nervous and choppy overnight – typical for a market at long term highs (9-month highs) - trading in a range of $1316.70 - $1322.20.

It traded down to its $1316.70 low during Asian and early European hours, where support from yesterday’s $1317 low essentially held.

Gold was pressured by a firmer US dollar (DX to 95.66), which was supported by weakness in the yuan (6.6995 – 6.7418) from a weaker Chinese PMI report.

Later during European time, gold recovered and reached its $1322.20 high as the DX retreated to 95.45.

The dollar softened against a firming euro ($1.1435 - $1.1475) off of an upbeat Eurozone CPI reading.

Global equities were mixed with the NIKKEI +0.1%, the SCI up 1.3%, European markets ranged from -0.2% to +0.2%, while S&P futures were -0.1%. Weaker oil prices (WTI from $54.19 - $53.38) was a headwind for stocks.

At 8:30 AM, the Non-Farm Payroll component of the US Jobs Report was a blow out: +304k jobs (exp. 165k).

Initially, algorithmic trading drove S&P futures higher (from 2696 to 2709), and took the US 10-year bond yield up from 2.624% to 2.645%.

The DX shot to 95.61, and gold tumbled to $1317.75. After a closer look, the report was seen as less robust as last month’s payrolls were revised down from 312k to 222k, Average Hourly Earnings were less than expected (0.1% vs. exp. 0.3%), and the Unemployment Rate ticked up to 4% (exp 3.9%).

S&P futures retreated to 2700, but the 10-year yield rose further to 2.686%. The DX plunged to 95.39, and gold reversed to take out the overnight high, and reached $1323.50.

At 10AM, stronger than expected reports on US ISM Manufacturing (56.6 vs. exp. 54.2), Construction Spending...

- Category: News Archives

- Hits: 942

As with many terminal patients the initial hope is that aggressive treatment would work and cure the patient. But when the one time emergency round of drugs didn’t cure the patient additional drugs were needed and turned the patient into a hopeless junkie. After multiple injections a sense of dread was making the rounds. QE1 did not cure the patient, QE 2 and 3 were required with a little twist here and there thrown in. But the Fed doctors kept promising all would be well and the addiction could be stopped and the patient returned to normal.

As with many terminal patients the initial hope is that aggressive treatment would work and cure the patient. But when the one time emergency round of drugs didn’t cure the patient additional drugs were needed and turned the patient into a hopeless junkie. After multiple injections a sense of dread was making the rounds. QE1 did not cure the patient, QE 2 and 3 were required with a little twist here and there thrown in. But the Fed doctors kept promising all would be well and the addiction could be stopped and the patient returned to normal.

And so it looks promising for a while. There was that scary flare up in 2016 when the patient regressed and the normalization had to be put on hold, but then a miracle drug came along called Tax Cut and suddenly it seemed as if the removal of drugs from the system could be accelerated.

So jubilant and optimistic were the Fed doctors that they promised further rounds of withdrawal and kept pointing to their dot plot of normalization.

Yet here we are, a mere 3 months later and the Fed doctors are at a loss again. Unable and unwilling to admit to the patient the true nature of the disease the Fed doctors once again decided to stop all withdrawal of the drugs, worse, they indicated they may have to administer new drugs to come. The patient begged for more drugs and the Fed doctors absolved themselves of their hippocratic oath and capitulated once again to the patient’s scream for another high, a scream only drowned out by the dying sigh of the Fed’s credibility, the initial casualty in this war on monetary drug dependency.

For it is true, the Fed doctors failed to wean off the...

- Category: News Archives

- Hits: 1021

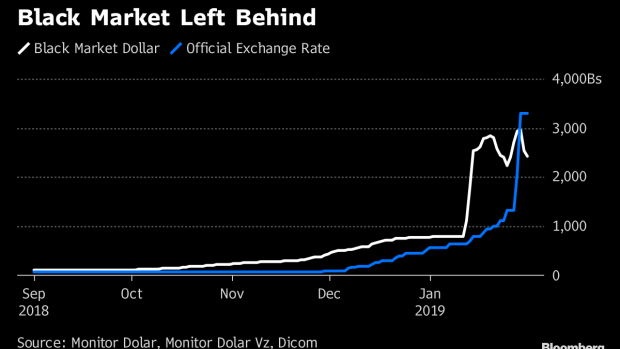

(Bloomberg) -- Even in the upside-down, topsy turvy world that is Venezuela, where dueling presidents reign and cash has become so worthless it doubles as confetti, this one is pretty weird: The going black-market price to buy dollars is lower than in the officially-sanctioned government market.

It isn’t entirely clear what caused the reversal of the long-time dynamic, in which strict government restrictions pushed those who couldn’t access the official rate to pay a premium that sometimes approached 20-fold on the informal market. But it appears there’s been a collapse in the supply of dollars -- or a spike in demand for them -- from the small group of companies and individuals that have access to the central bank auctions, sending the rate plummeting 52 percent this week alone and 83 percent in January. In the black market, a dollar costs 2,500 bolivars, according to MonitorDolarVz, compared with 3,295 bolivars at the government rate.

The government has been trying to stamp out the black market for years, blaming it for price distortions that made shopping trips to the super market incredibly complicated. Now, the higher government rate means that for once, everyday Venezuelans aren’t getting a bum deal because they don’t have access to the government’s friends-and-family rate.

One potential influence on the foreign-exchange rate is that after a decade of strict controls, Venezuela’s central bank unexpectedly introduced Interbanex, an online foreign exchange platform tailored for private clients, last weekend. The exchange platform is owned by Spain’s Ampajesu, which controls a 62.5 percent stake. Bull Equity Management Ltd. set up in Barbados, controls the remaining stake.

Venezuela’s ruling socialists have struggled to tame hyperinflation and address a general collapse marked by widespread hunger and an outpouring of peoples from what once had been one...

- Category: News Archives

- Hits: 940

(IDEX Online News) – Price changes in round and fancy shape diamonds in December were relatively rare. In round goods, stones of 0.80-0.89 carats in E-G, I3, fell 4%; in 2.00-2.99 carat diamonds D, I1-I3, of 2-4%; and in a range of colors and clarities in 3.00-3.99 carats and 4.00-4.99 carat stones. There were rises in a range of colors and clarities in 0.30-0.39 carat stones; in 0.45-0.49 carats, D, VS2-SI2, of 2-3%; and in 1.00-1.24 carats, E-F, VS1-VS2, 1-3%.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Fancy diamonds saw sharp declines in the 0.18-0.22 carat category, F-J, IF-VVS1 of 4-5%; in 1.00-1.24 carat diamonds, D-I, SI2, of 2-3%. Meanwhile, there were increases in 1.00-1.24 carat stones of 2-3% in IF, E-H colors; and in 1.50-1.99 carat stones, E-G, VS1-SI2, of 1-3%.

The following are some of the changes in this week's IDEX Online Diamond Price Report.

To receive a free copy of the full IDEX Online Diamond Price Report, please email us at

Rounds...

- 0.18-0.22 cts I / IF -3%, I / SI +5%

- 0.23-0.29 cts K / VVS1-VVS2 +4%

- 0.30-0.39 cts H-J / IF+2%

- 0.40-0.44 cts G / SI1 -2%, E / VVS1-VVS2 +3%

- 0.45-0.49 cts D / VS2 -2%, D / VS2-SI2 +2-3%

- 0.50-0.69 cts F-G / VS2-SI1 +2-3%

- 0.70-0.79 cts G-H / VVS1 -2-3%, D-E / SI2-SI3 +1-3%

- 0.80-0.89 cts E-G

- Category: News Archives

- Hits: 960

![[https://m.wsj.net/video/20190131/013119polarvortex4/013119polarvortex4_167x94.jpg]](https://m.wsj.net/video/20190131/013119polarvortex4/013119polarvortex4_167x94.jpg)

A slowing global economy and low inflation has central banks around the world rethinking plans to gradually pull back financial stimulus from markets and the banking system.

The role reversal could support the economy in the months ahead and bolster markets and sectors like housing and autos.

Central bankers have geared their messages toward... ...