Diamond News Archives

- Category: News Archives

- Hits: 925

(IDEX Online) – Boaz Moldawsky, who has served as the Acting Chairman of the Israel Diamond Institute (IDI) for the past year, has been elected by IDI’s Board of Directors as its Chairman for a three-year term.<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Moldawsky is a second-generation diamantaire whose family were among the founders of the Israeli diamond industry. He has been active in public service in the industry for many years, serving as Deputy President of the Israel Diamond Exchange, Chairman of the Finance Committee and a member of the board of the Israel Diamond Manufacturers Association. Moldawsky is co-CEO of the Moldawsky Group, which specializes in diamonds, real estate and technology.

Moldawsky said, “I want to thank the members of the Board for putting their trust in me and I am committed to doing everything in my power to move the Israeli diamond industry forward, to strengthen it and to further position Israel as a leading world diamond center.”

The IDI is a non-profit, public interest company representing all institutions involved in the Israeli diamond industry, and works to advance and strengthen the Israeli sector as a global diamond hub, through marketing, technological innovation, rough diamond sourcing and promotion of local manufacturing. IDI is active in business promotion for the industry, through marketing initiatives, public relations campaigns, hosting national pavilions at major trade shows, organizing and hosting trade delegations, and through its dedicated portal site, israelidiamond.co.il.

Aviel Elia is Managing Director of IDI.

...

- Category: News Archives

- Hits: 847

Lack of exploration, mine closures and job losses in rural areas inevitable if MCIII is applied to junior miners

Mining Charter III (MCIII) heaps more pain on South Africa’s alluvial diamond producers who already face enormous cost burdens and high risks. This previously productive and successful small or junior diamond mining industry consists of just 180 remaining entrepreneurial mining operators employing around 5000 people at an annual salary bill of R550million. It is the primary employer in remote rural areas in which alluvial diamond mining is conducted, and where existing unemployment levels are estimated to be as high as 80%.

MCIII fails to acknowledge that South Africa’s mining sector is not a homogenous grouping of only large mining conglomerates but made up of players of all sizes from Junior miners to large multinational and publicly-owned operations

The alluvial diamond mining industry has experienced steady decline since 2004 when the Mineral and Petroleum Resources Development Act (MPRDA) was implemented. At the time of the implementation of the MRDPA, there were 2000 diamond miners employing some 25 000 people. Today that figure has plummeted to 180 small mining operators and a massacre of employment numbers to around 5 000. Since 2013, there has also been a 61% decrease in prospecting right applications in the Northern Cape where the bulk of alluvial diamond mining takes place – largely the ambit of entrepreneurs, local private operators and farmers. Like many other mining sectors, the diamond mining sector is also seeing rapid growth of illegal operations. Much of this on the back of ill-considered policy.

MCIII – which currently makes no distinction between the inherent structural and funding differences between Junior miners versus large publicly listed mining companies – will precipitate further drastic decline of South Africa’s...

- Category: News Archives

- Hits: 895

In my previous post I demonstrated[1] a grim reality: using official government figures that under current accounting conventions, we would need a wealth tax approaching 100% in order to fully finance the enormous unfunded liabilities for Medicare and Social Security.

These unfunded liabilities represent promises made by U.S. policymakers that exceed the dedicated funding set aside to guarantee them. This means that to pay for said promises, we either have to be willing to raise taxes higher than they have ever been, borrow amounts than ever before have been possible or substantially cut back on what has been promised. There is no magic way to square the circle.

For those brave enough to dive deeper into this rabbit hole, I will use today's post to explain the two most important reasons the challenge of funding our two biggest entitlements is far bigger than advertised: the chasm to fill is much larger than the $97.8 trillion problem described in my last post:

- The alternative fiscal scenario demonstrates that Medicare spending is likely to be far larger than current official projections.

- The cost of delay increases with each passing year.

The Alternative Fiscal Scenario

Start with the alternative fiscal scenario. As the Medicare trustees have tried to explain ever since Obamacare was passed, the assumptions underlying projected spending on Medicare over the next 75 years are extremely unrealistic. That is, they will result in provider payment rates so low that Medicare beneficiaries are likely to face severe problems of access to care either because providers refuse to serve them (a problem already endemic among Medicaid beneficiaries) or because institutional providers such as safety net hospitals have literally gone bankrupt as a consequence of being paid too little.

The Medicare...

- Category: News Archives

- Hits: 897

(IDEX Online) – Mountain Province Diamonds Inc. will include an exceptional quality, 60.59-carat, fancy vivid yellow rough diamond in it its upcoming rough diamond sale. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The diamond was recovered at the company's Gahcho Kué Mine last October.

Reid Mackie, Vice President Diamond Marketing, commented: "The discovery of this diamond demonstrates our ability to produce very large, high quality, fancy colored diamonds. We are thrilled to be able to include it in our upcoming sale and present our customers with the opportunity to bid for this important piece of the mine's history".

Also included in the sale will be more than 50 other large, high quality white and fancy colored rough diamonds. Viewings will take place between February 11 to 21 at the offices of Bonas-Couzyn in Antwerp.

Mountain Province's Gahcho Kué Mine, located at the edge of Canada's Arctic Circle, is the world's largest and richest new diamond mine and since the start of production in late 2016 has established itself as a regular producer of exceptional, gem quality, large diamonds, the miner said. In 2018, Mountain Province sold more than 400 individual diamonds larger than 10.8 carats.

Mountain Province Diamonds is a 49% participant with De Beers Canada in the Gahcho Kué diamond mine located in Canada's Northwest Territories. ...

- Category: News Archives

- Hits: 928

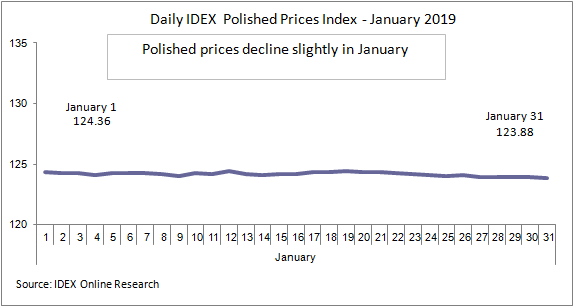

(IDEX Online) – The IDEX polished diamond price index was almost flat on the month in January. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The Index began the month at 124.36 and ended at 123.88.

<?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>

Outlook

Ahead of the Chinese New Year, polished trading slowed down in the Far East. The market will be looking for signs of where it is heading from the results of sales to China as the Year of the Pig begins.

Meanwhile, in the United States, job creation in January came in at twice the expected level, with more than 300,000 jobs created, while inflation remains benign. That is something of a sweetspot for American finances.

Is the US economy powering ahead, or are the employment indicators lagging behind? That is a question that will only be answered in the coming months, although it was telling that the Conference Board consumer confidence index dropped 5% to an 18-month low, impacted by stock market volatility and the lengthy government closedown.