Diamond News Archives

- Category: News Archives

- Hits: 871

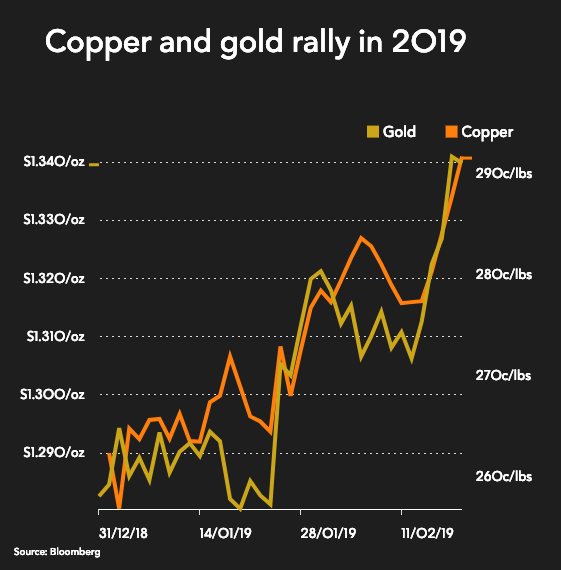

On Wednesday, hopes that an escalation of the trade war between the US and China can been avoided (or at least postponed) sparked a massive rally in mining stocks – already buoyed by climbing metals prices.

US President Donald Trump said yesterday he may not increase tariffs on Chinese products on March 1, as talks about the trading relationship between the world's two largest economies continue in Washington.

The US imposed an import duty of 10% on $200B worth of Chinese goods in September. The rate was scheduled to rise to 25% at the beginning of the year before being postponed.

Gold reached a fresh 10-month high just shy of $1,350 an ounce, iron ore's rally was sustained at $88 a tonne and copper finally broke out of its recent trading range to exchange hands at $2.92 a pound, or $6,445 a tonne.

Investors piled into the sector’s big names at the open, but enthusiasm waned in afternoon trading. Glencore got the ball rolling with strong financials for 2018 and a $2 billion share buyback program. Sector watchers are also anticipating bumper profits when BHP, Rio Tinto and Anglo American report in the next fortnight.

Sector watchers are also anticipating bumper profits when BHP, Rio Tinto and Anglo American report in the next fortnight

Swiss-based Glencore added 2.6% in over-the-counter trading in the US while BHP added 2% — lifting the market valuation of world’s largest mining company by revenue to $140B in New York and bringing it within shouting distance of a one year high.

Number one and two iron ore miners Vale and Rio Tinto’s gains were more modest on the day, but Rio is now nearly 16% up since the start of the year. Vale,...

- Category: News Archives

- Hits: 1339

An investor told me he only buys gold. No silver. His reason?

“Silver spiked in 1980 only because the Hunt Brothers were trying to corner it.”

It’s true the Hunt Brothers bought a lot of silver back then. And it’s hard to imagine their involvement didn’t impact the price. If you recall, silver rose a whopping 3,105% from its 1970 low to 1980 high.

But were the Hunt Brothers the primary reason for such a dramatic spike in price? This is an important topic, because if silver’s biggest modern-day mania was the result of a one-off event, then maybe we shouldn’t expect it to rise like that again.

In my opinion, the investor is wrong. And there are three core reasons why.

But first…

Just How Much Silver Are We Talking About?

It’s true the Hunt Brothers were literally hoarding silver (along with their Saudi business partners), both physical metal and futures contracts. At their peak, they controlled about 250 million ounces of silver – 100 million in physical and 150 million in futures contracts. That’s a lot, and most reports conclude this is why silver skyrocketed in the 1970s.

How much of the silver market did they control? Several reports estimate the Hunt’s stash equaled 20% of silver supply. One account claimed it was one-third of global supply. Really?

According to the 2018 Silver Yearbook from CPM Group, there was roughly 2.8 billion ounces of above-ground investable silver in 1980. So the Hunts controlled about 8.9% of investable silver at their peak.

That figure, however, excludes rare coins and all silver used in jewelry, silverware, decorative items, etc. – throw all that in and we’re probably looking at something like 12 billion ounces of total above ground...

- Category: News Archives

- Hits: 909

De Beers Group’s latest course ‘Synthetic Diamond Detection’, is to be held at the Birmingham Assay Office on Tuesday 26th March 2019. The one-day intensive course has been designed by the De Beers Group Institute of Diamonds, in response to the rise in synthetic diamonds and the risk they pose to the integrity of the jewelry industry.

Marion Wilson, Director of AnchorCert Academy, Birmingham Assay Office’s educational division said: “We understand the need to ensure the integrity of the industry against synthetic diamonds and greatly support De Beers Group’s aim to enhance the industry’s confidence in synthetic detection. We are therefore very pleased to be hosting the Synthetic Diamond Detection course here at the Birmingham Assay Office.

The course looks at detailed information on HPHT and CVD production methods which can, in turn, be used to demonstrate visual techniques for the identification of synthetic diamonds and simulants. Delegates will spend time completing practical exercises on studying a wide range of selected products including HPHT and CVD diamonds and using verification equipment.

De Beers Group Institute of Diamonds intermediate one-day intensive course, Synthetic Diamond Detection, is being held on Tuesday 26th March 2019, 8.45-17.00 at Birmingham Assay Office, 1 Moreton Street, Birmingham, B1 3AX. To book a place on this course please visit https://www.debeersgroupinstitute.com/en-gb/products/synthetic-diamonddetectioncourse and enter code BAO_SDD to take advantage of $200 discount.

[1]...

References

- ^ https://www.debeersgroupinstitute.com/en-gb/products/synthetic-diamonddetectioncourse (www.debeersgroupinstitute.com)

- Category: News Archives

- Hits: 1023

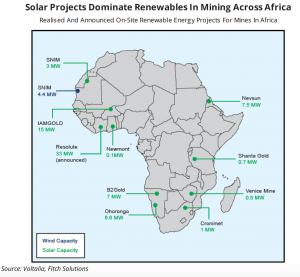

A report published by Fitch Solutions states that due to the prevalence of off-grid remote mineral deposits in Sub-Saharan Africa and the fact that traditional grid-power tends to be unreliable in those mines, mining companies operating in the region should invest in renewable energy.

According to the market research firm, off-grid mines could benefit from reducing their dependency on diesel while taking advantage of the favourable climate conditions in the area.

“In SSA, the remote location of many important mineral deposits in combination with the underdeveloped state of power and transport infrastructure means that there are a large number of mines that are not connected to national or regional electrical grids. As a result, many of these mining operations are highly dependent on diesel-generated power, which is expensive to transport and subject to significant volatility in terms of pricing,” the document reads.

Fitch’s own forecast predicts global diesel prices to average $96.2/bbl by 2022, up from $89.6/bbl this year.

In the analyst's view, miners’ dependency on the fossil fuel would be significantly reduced if they decide to adopt renewable power, something that a few companies such as Newmont, IAMGOLD, and B2Gold, who are operating in remote locations in Sub-Saharan Africa and have invested in solar power, are already experiencing.

“In all cases these projects are hybrid in nature, meaning they combine solar and/or wind power, and in many instances energy storage, with diesel or HFO (heavy fuel oil) through microgrids that are not connected to the state-grid. Decentralised power generation in the form of hybrid microgrids has advantages beyond price, allowing miners not only to reduce their exposure to expensive fossil fuels but also make use of them as back-up power when solar or wind power is unavailable,”...

- Category: News Archives

- Hits: 853

NEW YORK (Reuters) - New York Fed President John Williams on Tuesday said he was comfortable with the level U.S. interest rates are at now and that he sees no need to raise them again unless economic growth or inflation shifts to an unexpectedly higher gear.

In an interview with Reuters, Williams estimated the Federal Reserve would continue trimming its bond portfolio well into next year. He also said he felt rates had reached his current view of a lower “neutral” level, with growth and unemployment leveling off and inflation, if anything, a bit weaker than hoped.

Asked if it would take some sort of shock to resume rate increases, he said it would require one or more of those factors to surprise to the upside.

“I don’t think that it would take a big change, but it would be a different outlook either for growth or inflation” to return to hiking rates, Williams, one of the Fed’s three vice chairs and a key voice on rate policy, told Reuters.

Williams’ comments, made just weeks after the U.S. central bank paused its once quarterly rate hikes, underscore just how high the bar would be for tighter monetary policy, and suggest that such a move may not come anytime soon.

The Fed could also keep levels of bank reserves on its books that are far closer to current levels than previously thought, Williams said.

Along with its rate-hike holiday, Fed policymakers are finalizing plans on how they would end the reduction of their balance sheet, which includes holdings of bank reserves bulked up in part by the Fed’s need for cash to buy bonds to halt the global financial crisis a decade ago.

Williams estimated...