A report published by Fitch Solutions states that due to the prevalence of off-grid remote mineral deposits in Sub-Saharan Africa and the fact that traditional grid-power tends to be unreliable in those mines, mining companies operating in the region should invest in renewable energy.

According to the market research firm, off-grid mines could benefit from reducing their dependency on diesel while taking advantage of the favourable climate conditions in the area.

“In SSA, the remote location of many important mineral deposits in combination with the underdeveloped state of power and transport infrastructure means that there are a large number of mines that are not connected to national or regional electrical grids. As a result, many of these mining operations are highly dependent on diesel-generated power, which is expensive to transport and subject to significant volatility in terms of pricing,” the document reads.

Fitch’s own forecast predicts global diesel prices to average $96.2/bbl by 2022, up from $89.6/bbl this year.

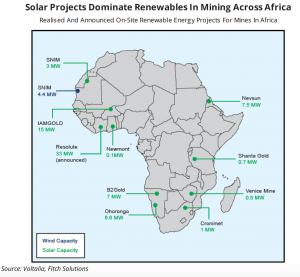

In the analyst's view, miners’ dependency on the fossil fuel would be significantly reduced if they decide to adopt renewable power, something that a few companies such as Newmont, IAMGOLD, and B2Gold, who are operating in remote locations in Sub-Saharan Africa and have invested in solar power, are already experiencing.

“In all cases these projects are hybrid in nature, meaning they combine solar and/or wind power, and in many instances energy storage, with diesel or HFO (heavy fuel oil) through microgrids that are not connected to the state-grid. Decentralised power generation in the form of hybrid microgrids has advantages beyond price, allowing miners not only to reduce their exposure to expensive fossil fuels but also make use of them as back-up power when solar or wind power is unavailable,”...