Diamond News Archives

- Category: News Archives

- Hits: 816

HTTP/2 200 server: nginx date: Fri, 01 Mar 2019 16:00:03 GMT content-type: text/html; charset=UTF-8 content-length: 49707 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Fri, 01 Mar 2019 15:54:03 GMT etag: W/"1551455643" x-backend-server: drupal-76b7bc867c-hvnvt age: 359 varnish-cache: HIT x-cache-hits: 110 x-served-by: varnish-1 accept-ranges: bytes ...

"We Are Concerned About A Slight Recession" - US Manufacturing Survey Plunges To 26-Month Lows | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1122

Since the start of the Global Financial Crisis (GFC) and through subsequent Euro area crises, the EU frameworks for reforming financial services have invariably been anchored to the need for reducing the extent of systemic risks in European banking. While it is patently clear that Euro area's participation in the GFC has been based on the same meme of 'too big to fail' TBTF banks creating a toxic contagion channel from banks balance sheets to the real economy and the sovereigns, what has been less discussed in the context of the subsequent reforms is the degree of competition within European banking sector. So much so, that the Euro area statistical boffins even stopped reporting banking sector concentration indices for the entire Euro area (although they did continue reporting the same for individual member states).

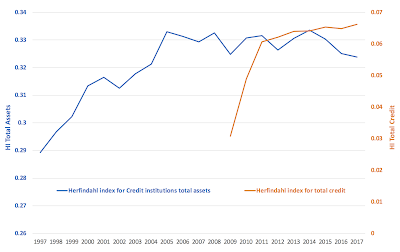

Chart below plots weighted average Herfindahl Index for the EA12 original Euro area states, with each country nominal GDP being used as a weight....

The picture presents a dire state of the Euro area reforms aimed at derisking the bank channel within the Eurozone's capital markets:

- In terms of total assets, concentration of market power within the hands of larger TBFT banks has stayed virtually unchanged across the EA12 between 2009 and 2017. Herfindahl Index for total assets was 0.3249 in 2009 and it is was at 0.3239 in 2017. Statistically-speaking, there has been no meaningful changes in assets concentration in TBTF banks across the EA12 since 2003.

- In terms of total credit issued within the EA12, Herfindahl Index shows a rather pronounced trend up. In 2010 (the first year for which consistent data is provided), Herfindahl Index for total credit shows 0.0602 reading, which rose to 0.0662 in 2017.

- Category: News Archives

- Hits: 859

The Antwerp-based IGC Group, one of the oldest diamond companies in the world, was inducted into the ALROSA ALLIANCE.

In a statement, IGC Group said that its membership in the ALROSA ALLIANCE opens the way “to become a long-term client of ALROSA, the world leader in rough diamond mining.

“We are delighted to enter the ALROSA ALLIANCE and partner with one of the world’s largest diamond suppliers. As a manufacturer of diamonds in the finest make and a preferred supplier of luxury jewellery and watch brand houses worldwide, we welcome this partnership with ALROSA. Stable and transparent rough diamond supply is essential in today’s business environment. ” Jacques Claes, Hon. President of IGC Group, said.

IGC Group has been a Sightholder of The De Beers Group of Companies since 1955.

...

- Category: News Archives

- Hits: 951

QMC Quantum Minerals (TSXV: QMC; US-OTC: QMCQF) has visually identified spodumene in the first diamond holes it has drilled into its Irgon lithium project in the Cat Lake-Winnipeg River rare-element pegmatite field in southeast Manitoba.

The company is currently amid phase one of a two phase drill program at Irgon, designed to confirm and expand the project’s historical resource that Lithium Corporation of Canada tabled in 1956. According to the historical resource, the project contains 1.08 million tonnes grading 1.51% lithium oxide over a 365 metre strike length and to a 213 metre depth.

During the 1950s, Lithium Corporation of Canada installed a mining plant on-site designed to process roughly 450 tonnes of ore per day and sank a three compartment shaft 74 metres below surface. At the 61-metre level, it dug 366 metres of lateral drifting. It suspended work in 1957, waiting for a more favourable market. Eventually the mine buildings were removed.

During its phase one program, QMC will drill 1,500 metres at Irgon across 12 holes. With its first eight holes, the company aims to confirm historical grades and widths from 1953 and 1954 drill results. It will drill its four remaining holes into a possible western extension of the current Irgon resource area.

After completing the phase one program, QMC aims to table an updated National Instrument 43-101 resource estimate for Irgon. It says the phase two program will test additional targets on the property.

This article first appeared in The Northern Miner.

The post QMC confirms spodumene in first holes at Irgon appeared first on MINING.com....

- Category: News Archives

- Hits: 1091

A 2018 research paper from the Federal Reserve Bank of Chicago estimates that 60 percent of all U.S. bills and almost 80 percent of all $100 bills are now overseas. That's up from 15 to 30 percent around 1980, according to research from Federal Reserve Board economist Ruth Judson. She found that economic and political instability contribute to this demand.

Projecting future demand for U.S. currency is "challenging" and depends on how quickly the economy grows, interest rates, new payments technologies, and on whether people in other countries continue to see U.S. dollar bills as a useful asset — "all factors that are, to say the least, uncertain," according to the Chicago Fed.

A surge in digital payments may be contributing to the lessening demand for lower denomination bills. Rising smartphone use, a shift toward online shopping and improvements in network bandwidths pushed global digital commerce volume above the $3 trillion mark in 2017, according to a recent McKinsey report[1]. That is on track to more than double by 2022, according to McKinsey.

There has been pressure to get rid of high denomination notes to curb international crime. Lawrence Summers, former Treasury secretary and director of the National Economic Council in the White House, has argued for abolishing $100 bills. Summers wrote an op-ed[2] in The Washington Post in 2016 titled, "It's time to kill the $100 bill."

"A moratorium on printing new high denomination notes would make the world a better place," Summers said, citing its potential for crime. "Here is a step that will represent a global contribution with only the tiniest impact on legitimate commerce or on government budgets. It may not be a free lunch, but it is a very cheap lunch."

He...