Diamond News Archives

- Category: News Archives

- Hits: 949

RJC has launched its new Code of Practices (COP).The COP defines responsible, social and environmental business practices for companies in the jewelry supply chain and commits members to adhere to a robust set of comprehensive auditable standards.

This is the third occasion for RJC to adapt its COP since being formed in 2005. The changes reflect "the evolving needs of the industry and demands of consumers globally."

The most significant changes are:

- the expansion of the scope of materials to include colored gemstones (rubies, emeralds and sapphires) and silver;

- the alignment of due diligence requirements with the Organisation for Economic Co-operation and Development (OECD) Guidance for Responsible Mineral Supply Chains;

- New requirements on the detection of laboratory-grown diamonds.

The changes are the result of an 18-month consultation process by the RJC, discussing proposed changes with members, civil society organizations and leading global standards bodies. More than 300 stakeholders were consulted via webinars and workshops across Asia, Europe and North America ensuring that those who are responsible for adhering to the changes have been a key part of their development.

David Bouffard, RJC Chairman said: "We are proud to launch the latest Code of Practices because it builds on RJC's 15 years of experience and data and addresses the rapidly changing demands of the industry, from mine to retail. Consultation has been key, listening to the valuable feedback provided by our stakeholders. It was an essential part of the review process, with members, civil society organizations and leading global assurance and industry bodies all incorporated into its development."...

- Category: News Archives

- Hits: 915

Not everyone in the chain is breaking the law. Miners, some of them working legally, typically sell the gold to middlemen. The middlemen either fly the gold out directly or trade it across Africa’s porous borders, obscuring its origins before couriers carry it out of the continent, often in hand luggage. For example, Democratic Republic of Congo (DRC) is a major gold producer but one whose official exports amount to a fraction of its estimated production: Most is smuggled into neighbouring Uganda and Rwanda. “It is of course worrisome for us but we have very little leverage to stop it,” said Thierry Boliki, director of the CEEC, the Congolese government body that is meant to register, value and tax high-value minerals like gold.

The customs data provided by governments to Comtrade, a United Nations database, shows the UAE has been a prime destination for gold from many African states for some years. In 2015, China – the world’s biggest gold consumer – imported more gold from Africa than the UAE. But during 2016, the latest year for which data is available, the UAE imported almost double the value taken by China. With African gold imports worth $8.5 billion that year, China came a distant second. Switzerland, the world’s gold refining hub, came third with $7.5 billion worth.

Most of the gold is traded in Dubai, home to the UAE's gold industry.

The UAE reported gold imports from 46 African countries for 2016. Of those countries, 25 did not provide Comtrade with data on their gold exports to the UAE. But the UAE said it had imported a total of $7.4 billion worth of gold from them.

In addition, the UAE imported much more gold from most of the other 21 countries than those countries said...

- Category: News Archives

- Hits: 820

Anglo American Plc is no longer a darling at JPMorgan Chase & Co.

After almost three years of rating the mining giant’s stock as overweight, the firm downgraded it to neutral on Wednesday citing a trio of concerns — shares no longer look as cheap, the company’s 2020 earnings may see a cut and capital returns may be constrained in the first half of the year. Shares slid as much as 3 percent in London, leading declines among basic-resource companies in the Stoxx 600.

Anglo, which was “excessively cheap” relative to peers in the past, has narrowed the gap since, and no longer carries an “obvious South Africa risk premium,” JPMorgan analyst Dominic O’Kane wrote in a note. He recommends a “tactical” long on Glencore Plc against a short Anglo American based on momentum, superior shareholder returns and better risk/reward ahead of the next earning season.

Anglo American now faces serious risks ahead, with a high degree of uncertainty about its Minas Rio tailing dam project in Brazil, O’Kane wrote. Without an approval by the end of the year, it would have a 20 percent negative impact on 2020 earnings, he estimates. The potential delay in the approval could also weigh on Anglo’s capital return when the company reports its first-half earnings on July 25.

The miner’s stock has jumped about 170 percent since JPMorgan turned overweight in July 2016, including a boost from Indian billionaire and Vedanta Ltd. owner Anil Agarwal increasing his stake in the miner in 2017.

(By Michael Msika)

The post JPMorgan ends a three-year bullish call on Anglo American shares appeared first on MINING.com....

- Category: News Archives

- Hits: 825

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term.

Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one's family.

The opportunities for this mobility in the post World War 2 era broadened as civil rights and equal rights expanded. The 1970s saw a disruption of working-class mobility as high-paying factory jobs disappeared, leaving services jobs that paid less or required more training, i.e. a college degree.

The U.S. economy took off in the 1980s for a number of reasons, including computer technologies, federal stimulus (deficit spending) and financialization (a topic I've covered many times). With millions more college graduates entering the workforce and the Internet creating entire new industries, the opportunities to "get ahead" increased across the social and economic spectrum.

But something changed in the aftermath of the dot-com bubble bursting. The fruits of financialization--highly leveraged debt gambled for short-term gains in markets--were extended to everyone with a job (or a willingness to lie) via liar loans, no-document loans and subprime mortgages.

Just like bigshot financiers on Wall Street, J.Q. Citizen could leverage a couple thousand dollars in cash (or even better, borrow the closing costs via a 105% of value mortgage and put nothing down) and buy a McMansion worth $250,000 or even $500,000.

The only difference between bigshot financiers and J.Q. Citizen was the scale of the leverage and gamble: J.Q. Citizen could leverage a few grand into hundreds of thousands, while the financier could leverage...

- Category: News Archives

- Hits: 913

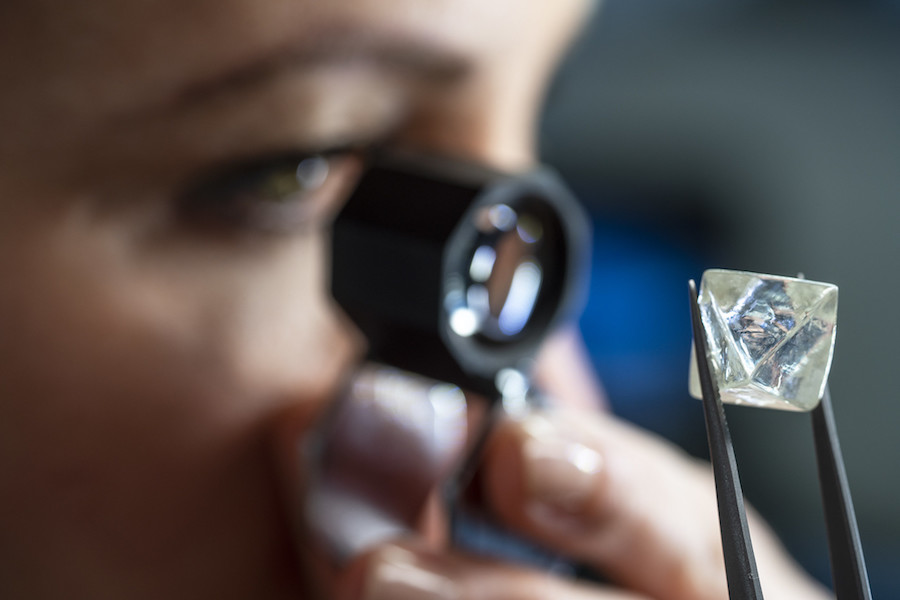

Rio Tinto’s (ASX, LON: RIO) iconic Argyle mine in Western Australia has yielded one of the largest rare, gem-quality white diamonds in its 35-year history.

The 28.84-carat stone, named Argyle Octavia for its unusual octahedral shape, was found in March, the miner said.

The octahedral-shaped 28-carat stone is one of the largest ever produced by Rio Tinto's Argyle diamond mine, located in east Kimberley. (Image: Rio Tinto | Flickr.)

The find, said Argyle Diamonds' general manager Andrew Wilson, is unique in its size and shape, and it will take its place in the mine’s history.

With the mine due to shut down next year, the Argyle Octavia could be the last major diamond it produces.

The gem, named Argyle Octavia, will be auctioned in Antwerp, Belgium, and could sell for millions. (Image: Rio Tinto | Flickr.)

In operation since 1983, the Argyle mine is renowned as the world's largest producer of coloured stones, particularly pink ones, with a much more sporadic presence of large white diamonds (0.00007% of its production in the last 36 years.)

Rio Tinto did not provide a price estimate for the diamond, which will be sold by tender at the world's diamond trade capital, Antwerp, later this year.

The post Rio finds one of its largest white diamonds ever at Argyle mine appeared first on MINING.com....