Diamond News Archives

- Category: News Archives

- Hits: 893

You’ve heard a lot in recent years about ‘negative interest rates’.

The idea is simple.

Instead of the bank paying you interest on money you have in the bank, you pay the bank for holding your money.

Normally, if you put $100,000 in the bank and it has a 2% interest rate, then at the end of one year, you have $102,000 in your account.

But if the bank has an interest rate of negative 2%, then you put $100,000 in the bank and come back a year later to find $98,000 in the account. The bank took $2,000 (or 2%) as a ‘negative interest rate’.

Who would leave money in the bank on those terms?

Stuck in the system

The simple solution is to pull your money out of the bank and put it in a safe place. At least that way, you’ll still have $100,000 a year later, not $98,000.

The proponents of negative interest rates — such as the IMF, academics and central banks — understand this.

That’s why they want to eliminate physical cash and force everyone into digital accounts at the banks.

That way, you can’t withdraw the money in physical form and stash it away.

You’re stuck in the bank, where negative interest rates will eventually confiscate all of your money (unless you do what the government and Wall Street want, which is to buy government debt and approved stocks).

The elite monetary institutions are not even trying to hide this play.

Hiding in plain sight

On the official IMF website, the authors lay out a ‘how to’ plan for negative rates. Getting rid of cash is an easy way to do this.

As stated on...

- Category: News Archives

- Hits: 880

A London judge rejected fugitive diamantaire Nirav Modi’s third attempt to get bail, after his lawyer said that Indian authorities have seized or liquidated the equivalent of $860 million of his funds and he doesn’t have access to enough resources to flee.

Judge Emma Arbuthnot ruled that even though Modi was willing to double his proposed security to 2 million pounds ($2.6 million), the risk of interfering with witnesses and destroying evidence remained too high. He had also only moved to the U.K. in 2017, so lacked the kind of community ties that would make him more likely to stay while he awaits a decision on whether he should be extradited to India, Arbuthnot said Wednesday.

"I still have substantial grounds to find that he will refuse arrest and interfere with witnesses," Arbuthnot said. "He has access to resources."

Arbuthnot rejected bail for Modi twice before since his March 19 arrest by U.K. police at the request of Indian authorities. The tycoon, who dressed stars including Kate Winslet, Dakota Johnson and Priyanka Chopra, faces charges of fraudulently acquiring guarantees from Punjab National Bank that were later used to obtain loans from abroad, according to complaints filed by the lender.

Arbuthnot said Modi had destroyed phones and servers, was telling a witness what to say and luring others to Egypt to influence them with the help of associates.

Modi’s lawyer, Clare Montgomery, had told the judge that her client’s funds in India were frozen or liquidated. Montgomery went on to say that Modi, who looked on from the dock, had not threatened a potential witness, as claimed by the Indian government.

“Central parts of the claims made by the government of India are false," Montgomery said. “Their efforts to describe him as a...

- Category: News Archives

- Hits: 962

A report published by Rapaport this week reveals that polished-diamond prices declined in April with 1-carat diamonds sliding 1% year-to-date and 3-carat diamonds falling by 6.1% year-to-date.

Right behind 3-carat diamonds, the price of 0.30-carat diamonds fell by 5.9% year-to-date, while 0.50-carat diamond prices dropped by 1.2% year-to-date.

According to Rapaport, the fall is caused by continued oversupply and selective Far East demand.

“Large inventories of lower-quality old goods are available, and suppliers are willing to discount them to raise cash. Liquidity is tight, as Indian credit lines declined after the March 31 fiscal year-end. Manufacturers reduced rough purchases in the first quarter, hoping to ease liquidity concerns by depleting polished stock,” the report states.

Demand is down everywhere but in the US, where purchases of 1.00 to 1.50-carat diamonds remain steady ahead of the summer wedding season.

But manufacturers' strategy may not be working as supply of polished gems continues to rise. Rapaport says the volume of diamonds listed on RapNet as of May 1 was up 7% since the beginning of the year, coming to 1.6 million stones valued at $8.23 billion.

Demand, on the other hand, seems to be down almost everywhere. The international firm’s document mentions that combined rough sales by De Beers and Alrosa dropped 19% by volume and an estimated 30% by value in the first quarter.

“Mining companies are planning to reduce supply, with global production down approximately 6% during the period.”

Rapaport’s analysis is based on the RapNet Diamond Index (RAPI), which is the average asking price in hundred $/carat of the 10% best-priced diamonds, for each of the top 25 quality round diamonds offered for sale on the Rapaport Diamond Trading Network.

The post Polished diamond prices drop...

- Category: News Archives

- Hits: 1045

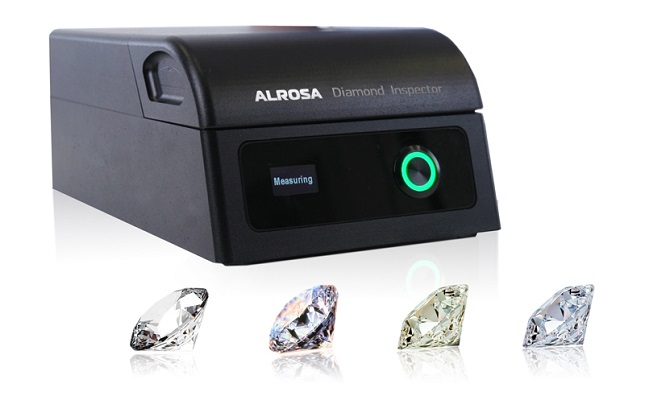

ALROSA TECHNOLOGY, the diamond science and technology firm that is jointly owned by ALROSA and the Technological Institute for Superhard and Novel Carbon Materials (FSBI TISNCM) of Russia, will present its new-generation ALROSA Diamond Inspector for the screening and identification of natural diamonds, treated diamonds, laboratory-grown diamonds (LGDs) and simulants at the Fifth Mediterranean Gemmological and Jewellery Conference in Cyprus (May18) and at a special seminar session at the Israel Diamond Bourse (May 21). [1]

The ALROSA Diamond Inspector is a portable mini-laboratory for complex optical diamonds testing. It is designed to identify the natural origin of polished diamonds using three different analytical methods.

Vladimir Sklyaruk of ALROSA TECHNOLOGY will demonstrate the ALROSA Diamond Inspector on Saturday, May 18, the second day of the Conference. Representatives of ALROSA TECHNOLOGY will also present the new tool on May 21 (02.30-04.30 pm) at the Israel Diamond Exchange in Ramat Gan during a post-conference "Diamond Day in Israel."[2]

Here, MGJC Co-Chair Branko Deljanin will speak about "The provenance of pink Diamonds from four continents and seven countries," as well as about "Steps in the identification of synthetic diamonds." The "Diamond Day in Israel" will include a workshop where, at five different stations, a choice of different, advanced diamond identification tools will be demonstrated. The "Diamond Day in Israel" will conclude with a visit to the factory of DDS Company, the Sarine offices and laboratory at the exchange, and a visit the Israel Diamond Exchange complex and trading floor.

The Fifth Mediterranean Gemmological and Jewellery conference will take place at Limassol, Cyprus, May 17-19, 2019. For more information on conference program, the workshops and lectures, the pre-conference Cyprus tours and the...

- Category: News Archives

- Hits: 998

.jpg)

Russia's Alrosa, the world’s leading diamond miner in volume, continues to sell off assets in 2019, with the purpose to improve its financial performance and to focus on the company's core diamond mining business.

In 2018, ALROSA sold its gas assets, the Geotransgaz and Urengoy gas companies, and more than 250 properties that included real estate, in-progress construction projects, as well as stock in housing and land plots. In 2018, Alrosa sold about $2.66 billion of assets. At the end of 2018, the firm’s supervisory board approved a new version of its non-core assets disposal program, approving another 500 assets listed for disposal.

Alrosa reported it sold about $18.6 million of non-core assets in the first quarter of the year, noting that the most significant transaction sale was its 100 percent stake in JSC Golubaya Volna Resort.

"A total of 21 non-core assets were successfully disposed of in Q1 2019, including subsidiary equity stakes, residential and other real estate properties. The overall target for 2019 is to sell 90 non-core assets with a total book value of six billion Rubel ($400 million)," said Konstantin Mashinsky, Deputy CEO of Alrosa.

Keyword

...