Diamond News Archives

- Category: News Archives

- Hits: 833

Risk assets have taken a fresh thumping in May. As of last night, the S&P 500 index was down 5.5% on the month, with energy (-9.2%), technology (-8%), materials (-7.4%), industrials  (-7.1%) and financials (-5.6%) faring worst, and so-called ‘defensives’: real estate (-.05%), utilities (-1.6%),

(-7.1%) and financials (-5.6%) faring worst, and so-called ‘defensives’: real estate (-.05%), utilities (-1.6%), health sick care (-2.3%) and consumer staples (-2.9%) faring less bad, as shown above from Yardeni Research[1].

Canada’s TSX stock index lost about half as much as the S&P 500 this month, but still -2.7%, again with economic ally sensitive energy stocks (-9.77%), materials (-7.66%) and financials (-3.43%) faring worst, real estate (1.5%) best; gold producers (-1.4%), and dividend-paying stocks (-2.33%) less bad, as shown above from my partner Cory Venable.

ally sensitive energy stocks (-9.77%), materials (-7.66%) and financials (-3.43%) faring worst, real estate (1.5%) best; gold producers (-1.4%), and dividend-paying stocks (-2.33%) less bad, as shown above from my partner Cory Venable.

Copper (-8.6% on the month) has tumbled with global sentiment, along with oil (WTI -9.6%) while gold is just flat (.55%).

The most sketchy credits have followed equities lower (as they normally do) with US Junk bonds (-1.19%) and high yield (-1.13%). Investment grade corporate bonds are higher by a percent.

Traditional safe havens–government treasuries and the US dollar (vs. loonie)–have gained on bets that weakening demand and stock markets will prompt central bank rate cuts in 2019 (80% probability of US cuts now priced in). Yesterday, Bank of Canada head Stephen Poloz said the BOC remains on hold, but with a tiny 1.2% 2019 GDP growth forecast, rate cuts loom likely in the second half of the year.

Acknowledging that the BOC is probably done hiking this cycle, Canada’s 10-year treasury price rose this month, and its yield has fallen from 1.73% on April 30 to 1.56 today. This is back at the level it was just before the Trump election when tax  cut promises drove dreams of inflation and...

cut promises drove dreams of inflation and...

- Category: News Archives

- Hits: 830

HTTP/2 200 server: nginx date: Thu, 30 May 2019 16:00:03 GMT content-type: text/html; charset=UTF-8 content-length: 44982 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Thu, 30 May 2019 15:57:04 GMT etag: W/"1559231824" x-backend-server: drupal-6f7cdc5966-b5sx9 age: 179 varnish-cache: HIT x-cache-hits: 29 x-served-by: varnish-1 accept-ranges: bytes ...

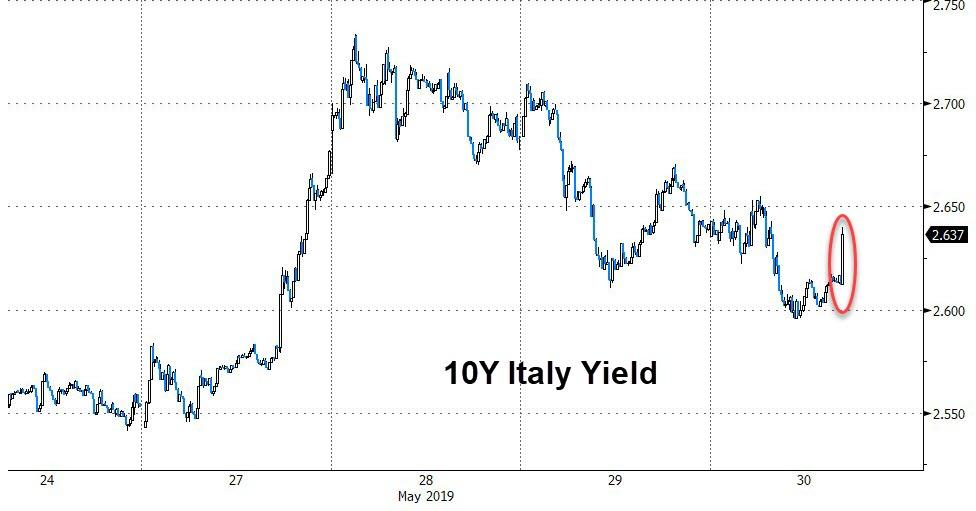

Italian Yields Jump As Salvini Threatens To Crash Government | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 798

Venus Jewel, one of India's and the world's leading and innovative diamond manufacturers, have obtained RJC certification which includes the first audited providence claim on rough diamond origin and traceability for each diamond Venus Jewel they sells in polished form. This provenance claim is reportedly the first of its kind and as such Venus Jewel is the first diamond manufacturing company to provide the complete audited history of each of the diamonds it they polishes by utilizing a certificate of origin that takes the customer on a journey through the history of that particular diamond.

Venus Jewel has been promoting the Diamond journey downstream for the past four years and also created a virtual experience for each diamond it polishes above half a carat, "to enhance the customer experience and move the industry into a new era of technology supported customer experience."

"The Venus "Diamond Journey" is the story of every diamond right from its origin through the final polish. The journey helps to educate every customer about how the diamond which he or she is purchasing was crafted to perfection. It includes all stages of polishing - from its origin, i.e. from which mine/country it originated, the weight of the rough diamond how it was planned cut, prepared and polished.

In addition to becoming the first company to have a third party auditing firm validate its diamond origin provenance claim, Venus Jewel has also been one of very few companies to partner with TRACR to help the development of a true blockchain system that begins the blockchain process from the mine (or mines) of origin.

"Venus Jewel is committed to ethical and transparent business practices as they lie at the...

- Category: News Archives

- Hits: 989

Gold traded higher last night, climbing in a range of $1279.10 - $1285.65. The yellow metal was lifted by a further drop in global bond yields (Japan’s 10-year to -0.096% - near 3-year low, German 10-year bund to -0.174% - near 3-year low, UK gilt to 0.901% - 19-month low, US 10-year to 2.226% - 20-month low) and continued weakness in global equities. The NIKKEI fell 1.2%, the SCI gained 0.2%, European shares were off from 1.3% to 1.7%, and S&P futures were -0.8%. Stocks were hurt by the ratcheting up of tensions in the US-China trade war, with China’s state-run media saying Beijing is considering limiting the export of rare earths, and Huawei filing a motion for summary judgment in its lawsuit against the US government. A decline in oil (WTI from $59.09 - $57.43, worries of eco slowdown from prolonged trade dispute overshadow ongoing supply issues) contributed to the weakness in equities. A modestly firmer dollar limited gold’s gain, however, as the DX rose from 97.95 – 98.06. The DX was lifted by continued weakness in the euro ($1.1172 - $1.1147, weak German employment data, ECB’s Rehn says first rate hike is now further away) and softness in the pound ($1.2665 - $1.2626, growing concerns of a no-deal Brexit).

US stocks opened weaker (S&P -25 to 2779) with losses in the Energy, Health Care and Consumer Discretionary sectors leading the decline. The US 10-year bond yield continued to plunge, making a fresh 20-month low at 2.22%. The DX firmed, however (DX to 98.14), lifted by further weakness in the euro ($1.1135). Gold was caught in the cross currents, but traded lower to $1282 in a choppy fashion.

Equities continued to soften into mid-day (S&P -36 to 2766), with a further decline in oil...

- Category: News Archives

- Hits: 849

Golden Share Resources (TSXV: GSH) announced that it acquired the Basking project in Ontario, Canada.

In a press release, the miner indicated that Basking, which is made up of four small non-contiguous claim blocks totaling 34 single cell mining claims, was acquired through map staking.

In detail, the project is located near the western edge of the James Bay Lowlands and approximately 100 kilometres north-northwest of the Ring of Fire nickel and chromite deposits in northern Ontario.

Two of the Basking claim blocks are centered on base metal targets and the other two are diamond and/or base metal targets

According to Golden Share, two of the Basking claim blocks are centred on base metal targets in an area of linear, northwest-trending magnetic axes immediately north of an interpreted belt of metavolcanics north of the North Kenyon fault.

"The other two claim blocks are diamond and/or base metal targets (coincident EM and magnetic anomalies) in mafic to ultramafic intrusives just south of the North Kenyon fault," the company's media statement reads. "It has an aeromagnetic signature similar to other important structural features in the Superior Province that are known to host important gold mining camps."

The Markham, Ontario-based firm said that following small confirmatory airborne or ground geophysical surveys, all four targets should be ready for drill testing.

The post Golden Share acquires Basking project in Ontario appeared first on MINING.com....