Diamond News Archives

- Category: News Archives

- Hits: 745

Listed gold miners were the exception to the broader rule with the ASX All Ords gold index soaring 6.75 per cent, the largest one-day percentage gain since November 9, 2016. The biggest gain was a 10.3 per cent rise in Resolute Mining, but the most points were added by a 4.6 per cent rise in Newcrest Mining from $34.45 up to $36.05. Evolution Mining also rose, up 9 per cent $5.33.

By sector, energy suffered the largest decline at 3.1 per cent, weighed down by weakness in crude oil prices which briefly fell to a one-week low in early Asian trade. Healthcare and information technology both posted falls of 2 per cent while consumer discretionary slid by a smaller 1.5 per cent.

Elsewhere, all other sectors fell by between 1 to 1.2 per cent for the session.

Gold hits record highs

The gold price hit record highs of $US1550 ($2320), as investors look for somewhere to store wealth other than risky equities and low interest rate accounts. Demand from domestic retail investors has been high over the last few months, according to business development manager at gold dealer ABC Bullion, John Feeney.

"There is definitely a lot more interest, but 90 per cent on the buy-side,'' he says. Buying volumes are two to three times higher than usual as investors seek an exposure to gold. He has not seen much increase in people who own gold trying to cash in at the record high prices.

The global general manager at ABC Bullion, Nick Frapell, says gold prices will keep rising.

"Once the rally got above the $US1530 level that opened the way for a move upwards. Now that we have got through $US1530, actually where it is going is $US1590...

- Category: News Archives

- Hits: 746

Miranda Hollingshead wasn't going to search for diamonds - she only wanted to know HOW to find them. She still ended up leaving with a 3.72-carat rough stone.

Hollingshead, of Bogata, Texas, visited Arkansas's Crater of Diamonds State Park for the first time. But according to Hollingshead, that wasn't her original plan. "I was just going to pick up a transmission that day, but my siblings were in town and wanted to do something fun together.

Hollingshead, who had known about the Crater of Diamonds for years, decided to go diamond searching when she found out the park wasn't too far from her home. "When I realized it was only a couple hours away, I knew we had to go!"

After searching for about an hour, Hollingshead found the diamond at the base of a hill on the northeast side of the park's 37.5-acre diamond search area. "I was sitting in the shade, watching a YouTube video on how to find diamonds. I looked over at my kid for a second, and when I looked down, I saw it mixed in with other rocks."

Park staff registered it as a 3.72 ct. yellow diamond. It is the largest registered at the Crater of Diamonds since March 2017. It is the largest yellow diamond since a visitor found a 3.85-carat diamond there in October 2013.

Park Interpreter Waymon Cox said, "It's about the size of a pencil eraser, with a light yellow color and a sparkling, metallic luster."...

- Category: News Archives

- Hits: 696

HTTP/2 200 server: nginx date: Mon, 26 Aug 2019 16:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 56919 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Mon, 26 Aug 2019 14:59:53 GMT etag: W/"1566831593" x-backend-server: drupal-564fdd5d7d-92frq age: 3610 varnish-cache: HIT x-cache-hits: 49 x-served-by: varnish-0 accept-ranges: bytes ...

Forget The 2s10s: The Fed Has Lost Control Over The Most Important Yield Curve | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 884

With gold prices having broken out recently, many banks and analysts have released updated price projections. And in every case I’ve seen, those predictions are higher.

Yes, banks and brokerage houses are not the best source for analysis of the precious metals market—they’re heavily biased toward stocks, and their track record with gold has been notoriously wrong.

But it’s worth looking at what they’re saying, because their clients listen to them.

Institutions control billions of dollars, and as a result hold sway in the markets. Wall Street piles into trends, so if they see higher gold prices coming then widespread bullish predictions could serve as its own catalyst.

I put the banks that have recently released an updated gold price prediction into a chart. In most cases, it is an analyst at the bank making the prediction, not the bank itself. But since these are mostly analysts for the resource industry, their predictions are frequently used to make investment decisions for the institutional side of the firm, as well as to make recommendations to advisors who manage money for thousands of clients.

In some cases they don’t give a specific date or price, but here’s what these banks and analysts have publicly stated over the past couple weeks.

Every bank I found shows gold ending the year higher than where it’s at now.

And all but one thinks the gold price will be above $1,600 next year, with all the others projecting anywhere from $1,680 to $2,400.

You’ll also notice that Morgan Stanley’s “#1 commodity pick” is gold, something we haven’t seen from a bank in a long time.

Taken as a whole, this does show that institutional investors have become decidedly more bullish. Wall Street...

- Category: News Archives

- Hits: 922

Gold had a slight pullback last night, trading in a relatively narrow range of $1493.60 - $1499. It failed to hold the pennant up trendline at $1499 and slumped to support at $1493-4 (4 bottoms 8/14, 8/19, 8/20, and 8/22 lows). Gold was pressured by a firmer US 10-year bond yield (1.611% -1.661%) and stronger global equities (NIKKEI +0.40%, SCI up 0.49%, European markets were up from 0.45% to 0.74%, and S&P futures were +0.4%). A stronger US dollar was also a headwind for gold as the DX rose from 98.20 to 98.45, where resistance at 98.45-46 (double top, 8/2 and 8/20 highs) held.

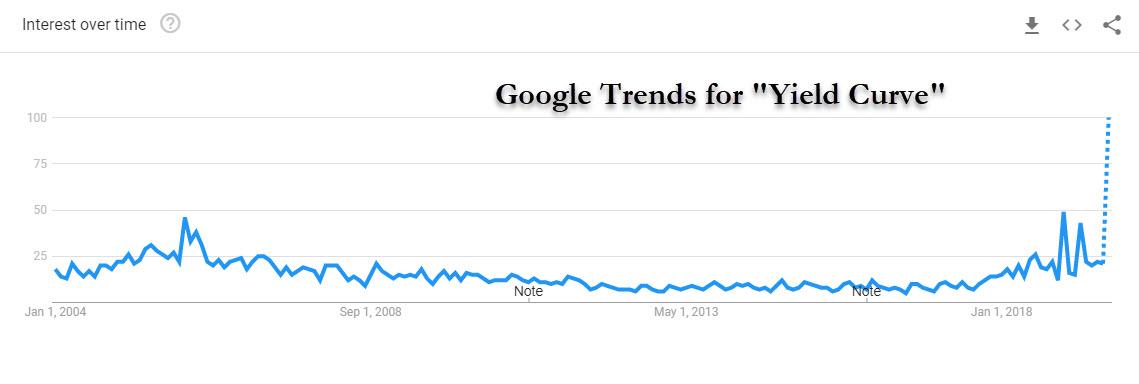

Ahead of the NY open, some dovish comments from the Fed’s Bullard (concern over inverted yield curve, lower rates will help hit inflation target, been below inflation target since 2012, prefers insurance against downturn) lifted S&P futures (2934). The 10-year bond yield was tugged down to 1.637%, and the DX slipped to 98.38. Gold came off its low, and edged up to $1496.

At 8:00 AM, markets were shaken on news that China was imposing new tariffs of 5-10% on $75B of US goods, including autos. S&P futures sank (2902), along with the 10-year bond yield (1.601%). The DX slipped to 98.29, and gold broke through resistance at $1500 and $1504 (yesterday’s high) to reach $1507, where resistance in front of $1508 (double top - 8/20 and 8/21 highs) held.

At 10AM, Powell’s much awaited Jackson Hole address was mildly dovish (pointed out that the global growth outlook has been deteriorating, trade policy uncertainty playing a role in the global slowdown and in weak manufacturing and capital spending in the US, and that the Fed “will act as appropriate to sustain the expansion”). US stocks rebounded (S&P +4 to 2927), the...