Diamond News Archives

- Category: News Archives

- Hits: 1036

confoundedinterest17[1] Agency MBS[2], Banking[3], ECB[4], Economy[5], fannie mae[6], Fed[7], Freddie Mac[8], Housing[9], Mortgage[10], Powell[11], REITs[12], Swaps[13], Treasuries[14], Treasury[15], Uncategorized[16], Volatility[17], Yield Curve[18] 4 Minutes

As the US Treasury 10-year yield approaches 2% … again, we begin to worry about issues such as extension risk and convexity risk (collectively known as “The Wings”[19]) given their propensity to drive hedging.

Extension Risk

Historically, the risk of sudden yield curve movements has greatly affected the market for MBS, which represent claims on a pool of underlying residential mortgages. The interest rate risk of MBS differs from the interest rate risk of Treasury securities because of the embedded prepayment option in conventional residential mortgages that allows homeowners to refinance their mortgages when it is economical to do so: When interest rates fall, homeowners tend to refinance their existing loans into new lower-rate mortgages, thereby increasing prepayments and depriving MBS investors of the higher coupon income. However, when rates rise, refinancing activity tends to decline and prepayments fall, thereby extending the period of time MBS investors receive below-market rate returns on their investment. This is commonly known as “extension risk” in MBS markets.

Duration and Convexity

The effect of the prepayment option can be seen in the chart below, which displays the relationship between yield changes (x-axis) and changes in the value of an MBS (black) and a non-prepayable ten-year Treasury...

- Category: News Archives

- Hits: 833

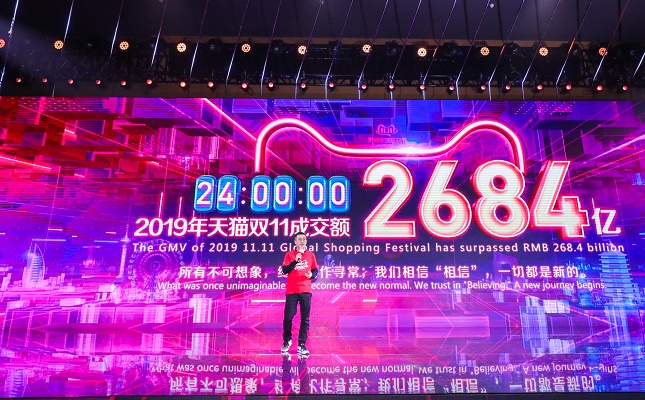

(IDEX Online) - After taking in a billion dollars in just over a minute, this year's Singles Day has broken all records. The final total for the 24-hour shopping frenzy was $38.4 billion.

This was an increase of 26 percent compared to 2018.

"Today we showed the world what the future of consumption looks like for brands and consumers," said Fan Jiang, president of Taobao and Tmall. "We are meeting the growing demand of Chinese consumers and helping them upgrade their lifestyles, while introducing new users to our digital economy from across China and around the world."

Over 200,000 participating brands took part in the global shopping festival.

Singles Day was created by single students at Nanjing University in China back in 1993 as a type of anti-Valentine's day; one on which people could treat themselves to some retail therapy. The "modern day" 11.11 Shopping Festival was launched by the Alibaba Group in 2009 with just 27 retailers and has evolved into the most important retail event of the year....

- Category: News Archives

- Hits: 824

HTTP/2 303 p3p: CP="This is not a P3P policy! See http://support.google.com/accounts/answer/151657?hl=pt-BR for more info." content-type: text/html; charset=utf-8 x-content-type-options: nosniff x-frame-options: SAMEORIGIN location: https://www.youtube.com/watch?v=YmSuFq9fjGc&feature=em-uploademail expires: Tue, 27 Apr 1971 19:44:06 GMT content-length: 0 strict-transport-security: max-age=31536000 cache-control: no-cache date: Tue, 12 Nov 2019 16:00:06 GMT server: YouTube Frontend Proxy x-xss-protection: 0 set-cookie: YSC=rzg8dH4vfew; path=/; domain=.youtube.com; httponly set-cookie: GPS=1; path=/; domain=.youtube.com; expires=Tue, 12-Nov-2019 16:30:06 GMT set-cookie: VISITOR_INFO1_LIVE=1w6iRWplkng; path=/; domain=.youtube.com; expires=Sun, 10-May-2020 16:00:06 GMT; httponly set-cookie: PREF=f1=50000000; path=/; domain=.youtube.com; expires=Mon, 13-Jul-2020 03:53:06 GMT alt-svc: quic=":443"; ma=2592000; v="46,43",h3-Q050=":443"; ma=2592000,h3-Q049=":443"; ma=2592000,h3-Q048=":443"; ma=2592000,h3-Q046=":443"; ma=2592000,h3-Q043=":443"; ma=2592000 HTTP/2 200 cache-control: no-cache x-frame-options: SAMEORIGIN expires: Tue, 27 Apr 1971 19:44:06 GMT x-content-type-options: nosniff p3p: CP="This is not a P3P policy! See http://support.google.com/accounts/answer/151657?hl=pt-BR for more info." content-type: text/html; charset=utf-8 strict-transport-security: max-age=31536000 date: Tue, 12 Nov 2019 16:00:06 GMT server: YouTube Frontend Proxy x-xss-protection: 0 set-cookie: VISITOR_INFO1_LIVE=0B1WD1F1pIc; path=/; domain=.youtube.com; expires=Sun, 10-May-2020 16:00:06 GMT; httponly set-cookie: PREF=f1=50000000; path=/; domain=.youtube.com; expires=Mon, 13-Jul-2020 03:53:06 GMT set-cookie: YSC=RJGECxXKUfI; path=/; domain=.youtube.com; httponly set-cookie: GPS=1; path=/; domain=.youtube.com; expires=Tue, 12-Nov-2019 16:30:06 GMT alt-svc: quic=":443"; ma=2592000; v="46,43",h3-Q050=":443"; ma=2592000,h3-Q049=":443"; ma=2592000,h3-Q048=":443"; ma=2592000,h3-Q046=":443"; ma=2592000,h3-Q043=":443"; ma=2592000 accept-ranges: none vary: Accept-Encoding

Why You Should be Paying Attention to Silver Now - Keith Neumeyer, First Majestic Silver - YouTubeSelecione seu idioma.

Saiba mais[1]

View this message in English[2]

Fila de exibição

Fila

__count__ / __total__...

- Category: News Archives

- Hits: 835

(IDEX Online) - The World Gold Council (WGC) today launched its new consumer research report. The report, which surveyed 18,000 respondents in China, India, North America, Germany and Russia highlights insights into attitudes towards and perceptions of gold, how and why people buy gold and also their reasons for not buying.

The survey found that 56 percent of consumers have bought find gold jewelry compared to 34 percent who have purchased platinum jewelry.

In addition, over a third (38 percent) of retail investors and fashion enthusiasts have never bought gold, but are open to the idea. This shows a huge potential for the gold market to grow if untapped sources of demand can be converted.

"The retail gold market is healthy, with gold being considered a mainstream choice," commented WGC CEO David Tait. "But what really excites me is the untapped part of the market: those people who have never bought gold but are warm to the idea of doing so in the future."

The survey also uncovers some barriers to purchasing - namely lack of trust. "That could be mistrust around fake or counterfeit bars and coins, product purity, or the trustworthiness of some retailers," says the report.

In addition, two thirds (66 percent) of potential gold consumers globally say they lack the necessary knowledge to buy the yellow metal.

"Two issues need to be addressed to engage with these potential gold buyers: trust and awareness. This market can flourish if we can build trust across the broad spectrum of gold products being sold and raise awareness around the positive role gold can play in protecting people's wealth," said Tait....

Clickhere[1]to see the full WGC

- Category: News Archives

- Hits: 938

Stocks rose to records in October. One corner of the debt market had a rougher time.

Some securities in the $680 billion market for collateralized loan obligations, or CLOs, lost about 5% in October, reflecting worries about rising risk in the complex investment vehicles. The declines were a rare stumble for the CLO market, which has grown by about $350 billion in the past three years, according to data from S&P Global Market Intelligence, fueled by demand[1] from government pensions, hedge funds and other yield-hungry investors.

“We think there’s more volatility coming,” said Maggie Wang, head of U.S. CLO strategy at Citigroup. “We recommend investors reduce risk and stay with cleaner portfolios and better managers.”

Newsletter Sign-up

The trouble hitting CLOs could be a sign that the trillion-dollar market for high-yield bonds also is headed for a rough patch.

CLO managers buy bundles of below-investment-grade, or “leveraged,” corporate loans using money raised by selling bonds and stock to outside investors. Cash flow from the bundled loans pays interest and principal on the CLO bond with any surplus going to the CLO shareholders.

CLOs resemble the mortgage-backed bonds that imploded in 2008, but very few defaulted in the credit crisis, a key driver of their recent popularity. Prices for their shares and bonds, however, plummeted at the time, and holders who sold out took heavy losses.

Now some CLO bond prices are falling again. That is because the riskier loans the CLOs own are dropping in value[2] as the companies that borrowed them start running out of cash. CLO bonds rated double-B, which are among...