Diamond News Archives

- Category: News Archives

- Hits: 598

(IDEX Online) - Alrosa has announced that it plans to hold 34 auctions for or special size rough diamonds (weighing over 10.8 carats) during 2020. According to Russian law, these specials must be auctioned.

Eleven of the planned Russian auctions will take place in Moscow with three further sales being held in Vladivostok.

Other tenders will take place in the centers in which Alrosa has trading representative offices. Three will take place in Antwerp, four in Dubai, five in Ramat Gan, four in Hong Kong and four in New York.

Alrosa deputy CEO Evgeny Agureev said that auction sales account for about 10 percent of Alrosa's overall sales volumes. ...

The full schedule of international auctions can be seenhere[1].

- Category: News Archives

- Hits: 708

For obvious reasons, Congress does not want people to know about the Creeping Tax Increases for 2020[1].

Millions of Americans are paying more to Uncle Sam because there’s no indexing for a variety of tax provisions, including homeowner benefits, tax thresholds on Social Security and investment benchmarks among others. The 2017 tax overhaul added more to this list.

The lack of an inflation adjustment is often intentional, says Len Burman, a tax economist who is a professor at Syracuse University and co-founder of the Tax Policy Center....

- Home Ownership: Once, home buyers could deduct the interest on any amount of mortgage debt. In 1987, Congress limited this break to deductions on up to $1 million of debt used to buy up to two homes, unindexed for inflation. If this limit had been adjusted, it would have been more than $2 million by 2017’s tax overhaul.

- In 2017 Instead of adjusting the home ownership limit upward, the overhaul pared it to $750,000, again unindexed for inflation.

- State and Local Tax Writeoffs: Lawmakers capped write-offs for state and local property and income or sales taxes, or SALT, at $10,000 per return, with no inflation adjustment.

- Profit on a Sale of a Home: A popular exemption of up to $500,000 per married couple of profit on the sale of a house ($250,000 for single filers) enacted in 1997 also isn’t adjusted for inflation.

- Social Security: The income thresholds for including Social Security payments in taxable income haven’t changed since they were enacted in the ‘80s and ‘90s. The income thresholds requiring filers to report 85%

- Category: News Archives

- Hits: 682

“You don’t make mistakes when you don’t have money. When you have too much money, you will make a lot of mistakes.”

– Jack Ma, founder of Alibaba, the Amazon of China

“My view is simple and starts with the observation that gold is a lot like religion. No one can prove that God exists…or that God doesn’t exist…Well, that’s exactly the way I think it is with gold. Either you’re a believer or you’re not.”

– Howard Marks, founder of OakMark, whose newsletter Warren Buffett reads “religiously”

“Because of Paul Volcker, our financial system is safer and stronger. I’ll remember Paul for his consummate wisdom, untethered honesty, and a level of dignity that matched his towering stature.”

– Barack Obama

“Every penny of QE undertaken by the Fed that cannot be unwound is monetized debt.”

– CNBC regular and former senior advisor to the president of the Dallas Fed, Danielle DiMartino Booth

______________________________________________________________________________________________________...

SUMMARY

- Interest rates and inflation couldn’t be more different today than they were in the 1970s.

- One of the shocking surprises of the last decade is that despite ultra-low, zero, or, even, negative interest rates inflation has generally fallen rather than risen.

- Yet, when it comes to asset prices (US stocks, global bonds, and real estate), it has been a completely different story.

- One asset class that hasn’t risen as swiftly as others is gold and other precious metals.

- This underperformance has caused most American investors—be they retail or institutional—to give up on precious metals as an essential asset class.

- However, John Hathaway, who is considered to be the “Warren Buffett of the precious metals space,” is much more bullish given

- Category: News Archives

- Hits: 683

(IDEX Online) - Sales of fine jewelry and fine watches increased by 3.2 percent in the U.S. market in October compared to October 2018, as shown in the graph below. This is the fourth successive month in which sales have increased since the start of the year, evidence that the market is solidly picking up at last.

Outlook

Retailers are anxiously awaiting the outcome of the all-important fourth quarter. According to all the pre-holiday surveys and research, consumers were eager to spend with predictions of a positive season. The NRF expects holiday retail sales in November and December to increase between 3.8-4.2 percent over 2018. Total spending is expected to reach between $727.9- $730.7 billion.

This year, a record 189.6 million people shopped during the five days following Thanksgiving, up 14 percent from 165.8 million in 2018. Early results indicate that consumers put jewelry front and center this year with Mastercard SpendingPulse reporting that total U.S. jewelry sales increased 1.8 percent over the holiday shopping period. According to Mastercard's research, online jewelry sales grew by 8.8 percent from November 1-December 24, putting a positive spin on what has been a difficult year for the diamond and jewelry trade.

Click here[1] to see the full IDEX Online Research article.

...

- Category: News Archives

- Hits: 692

There is evidence that US Treasury bond yields may continue to rise, exposing the debt trap in which the US government finds itself. Market participants don’t realise it yet, but the dollar-based monetary system is spinning out of control. This will become obvious as the crisis stage of the credit cycle, which we now appear to be entering, becomes evident.

The outlook for monetary inflation is dire. Not only will governments fund themselves through QE, but central banks will be forced to inflate even more to pay for government deficits significantly greater than currently forecast. And when markets stop taking government statistics on inflation as the Gospel Truth, the interest cost of government funding will rise and rise, reflecting an increasing rate of time preference for fiat currencies which will be losing their purchasing power at an accelerating rate.

In a world where all fiat currencies will face enormous challenges, using yardsticks such as trade weighted indices will be misleading. The best gauges of the slide in fiat currencies will be commodities, particularly commodity monies, gold and silver.

Introduction

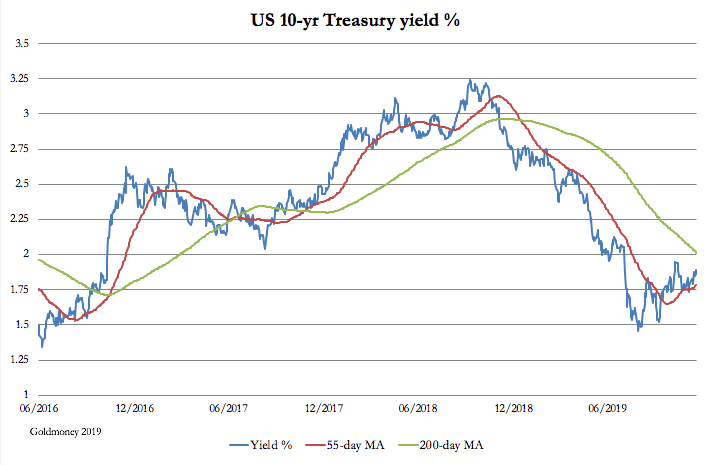

The chart above, of the US 10-year Treasury yield is shows that its yield bottomed at the end of August, when it had more than halved from the levels of October 2018. What, if anything, does it mean? Some would argue that it is good to see a positive yield curve again, implying the recession, or the risk of one, has gone away. But if US Treasury yields have bottomed out, then in the fullness of time they will continue to rise. Chartists might even claim it is setting up for a bullish golden cross, like the one earlier in the chart on 17 November 2016, which marked the beginning of a significant rise...