There is evidence that US Treasury bond yields may continue to rise, exposing the debt trap in which the US government finds itself. Market participants don’t realise it yet, but the dollar-based monetary system is spinning out of control. This will become obvious as the crisis stage of the credit cycle, which we now appear to be entering, becomes evident.

The outlook for monetary inflation is dire. Not only will governments fund themselves through QE, but central banks will be forced to inflate even more to pay for government deficits significantly greater than currently forecast. And when markets stop taking government statistics on inflation as the Gospel Truth, the interest cost of government funding will rise and rise, reflecting an increasing rate of time preference for fiat currencies which will be losing their purchasing power at an accelerating rate.

In a world where all fiat currencies will face enormous challenges, using yardsticks such as trade weighted indices will be misleading. The best gauges of the slide in fiat currencies will be commodities, particularly commodity monies, gold and silver.

Introduction

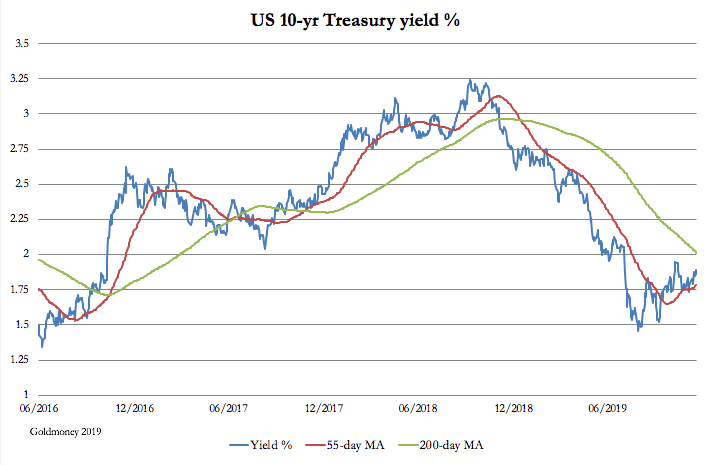

The chart above, of the US 10-year Treasury yield is shows that its yield bottomed at the end of August, when it had more than halved from the levels of October 2018. What, if anything, does it mean? Some would argue that it is good to see a positive yield curve again, implying the recession, or the risk of one, has gone away. But if US Treasury yields have bottomed out, then in the fullness of time they will continue to rise. Chartists might even claim it is setting up for a bullish golden cross, like the one earlier in the chart on 17 November 2016, which marked the beginning of a significant rise...