Diamond News Archives

- Category: News Archives

- Hits: 1617

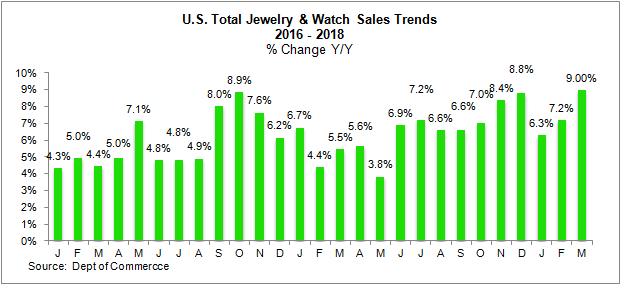

(IDEX Online) – Sales of fine jewelry and fine watches rose by 9.0 percent in the U.S. market in March, when compared to the same month a year ago, as the graph below illustrates. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

Sales were an estimated $8.8 billion, according to preliminary data from the U.S. Commerce Department.

<?xml:namespace prefix = "v" ns = "urn:schemas-microsoft-com:vml" /?>

Strong Start to 2018 Jewelry Sales

American jewelry consumers appear to be in a strong jewelry-buying mood, according to the figures for the first three months of 2018.

With the American economy continuing to improve, it's reasonable to assume that the figures will keep showing a solid performance in the coming months.

- Category: News Archives

- Hits: 1662

Central Banks Really, what do they know?, probably more than we think. Global central banks have been increasingly loading up for years especially Russia and china. Even Alan Greenspan[1] had something to say about this recently, you see it here[2].

From The World Gold Council: Net central bank purchases totalled 116.5t in Q1, 42% higher y-o-y and the highest Q1 total since 2014. Since becoming net buyers in 2010, central banks have bought – on average – 114.9t per quarter. Net purchases have become more concentrated since the 2013 peak: Russia, Turkey and Kazakhstan collectively account for nearly 50% of net purchases over the last five years.1

Central banks added 116t to reserves, matching long-term average purchases

Russia continues to be the most prolific purchaser of gold, adding 41.7t in Q1.2 Russian gold reserves have grown to 1,890.8t since the start of the year, now accounting for 18% of total reserves. The Central Bank of Russia has purchased gold for 38 consecutive months, accumulating 683.1t in that time. This commitment to growing gold reserves – a directive by authorities3 – shows no signs of abating and reinforces the view of gold as a strategic asset.

ORIGINAL SOURCE: Central bank demand was up 42% y-o-y, the highest first quarter since 2014[3] by World Gold Council of gold.org[4] on 5/3/18...

References

- ^ Alan Greenspan (twitter.com)

- ^ here (twitter.com)

- ^ Central bank demand was up 42% y-o-y, the highest first quarter since 2014 (www.gold.org)

- ^ gold.org (www.gold.org)

- Category: News Archives

- Hits: 1333

A 6.16-carat blue diamond that was secretly passed down through European royalty over three centuries has fetched $6.7 million at a Sotheby’s auction in Geneva — $1.4 million more than what experts expected it to be sold for.

The pear-shaped, dark grey-blue gem, known as The Farnese Blue, is believed to be one of the most important historical diamonds left in private hands until today, which was the first time the stone was put up for sale.

Found at India’s Golconda mines, it was given to Elisabeth Farnese, daughter of the Duke of Parma, in 1715 to mark her marriage to King Philip V of Spain.

The royal couple descendants owned the Farnese Blue, as they married into other European families, travelling from Spain to France, Italy and Austria. During more than 300 years, nobody — except from close relatives and the family jewellers — knew of the gem's existence.

Philip V and Elisabeth in 1739. (Image: Louis-Michel van Loo | Wikimedia Commons.)

“All this time, it was hidden away in a royal jewellery box,” Philipp Herzog von Wurttemberg, chairman of Sotheby's Europe, said in a statement.

"With its incredible pedigree, the Farnese Blue ranks among the most important historic diamonds in the world," he noted.

The last person to own the diamond before today was one of Elisabeth’s descendants.

Sotheby's has not released the identity of the buyer.

The post Historic blue diamond auction exceeds expectations — sold for $6.7 million appeared first on MINING.com....

- Category: News Archives

- Hits: 1702

HTTP/1.1 200 OK Server: nginx/1.13.5 Date: Tue, 15 May 2018 20:15:03 GMT Content-Type: text/html; charset=UTF-8 Content-Length: 155471 Connection: keep-alive Vary: Accept-Encoding, Cookie Cache-Control: max-age=3600, public X-UA-Compatible: IE=edge Content-language: en X-Content-Type-Options: nosniff X-Frame-Options: SAMEORIGIN Expires: Sun, 19 Nov 1978 05:00:00 GMT Last-Modified: Tue, 15 May 2018 20:15:03 GMT ETag: W/"1526415303" X-Backend-Server: drupal-788787d496-pxbzh Age: 1 Varnish-Cache: HIT X-Cache-Hits: 2 X-Served-By: varnish-1 Accept-Ranges: bytes ...

Prop Trading Returns As Volcker Rewrite Allows Banks To Engage In Short-Term Trades | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1814

World’s No.2 miner Rio Tinto (LON, ASX:RIO) said Tuesday that cost inflation driven by rising oil prices and a resurgence of resource nationalism are increasingly affecting mining companies’ investment decisions.

Speaking at the Bank of America Merrill Lynch conference in Miami, chief executive Jean Sebastien-Jacques said he remained optimistic about the medium to long-term global growth outlook. However, he mentioned volatility in markets, trade wars and governments efforts to get greater share of their mineral wealth — most times to the detriment of private companies — as growing concern for investors in the natural resources sector in the short-term.

“From the DRC and South Africa to Mongolia and Australia [resource nationalism] is gaining momentum,” he said, adding he was optimistic that common sense in all those cases would prevail.

Major miners operating in the Democratic Republic of Congo, Africa’s top copper producer and source of over 60% of the global cobalt supply, are vigorously fighting a new mining code. The fresh legislation strips away a stability clause protecting existing investments from changes to the fiscal and customs regime for 10 years, introduces a 50% windfall profits tax and gives powers to the mines minister to hike royalties on minerals considered “strategic”.

It all began in Indonesia, which imposed new rules on the exports of unprocessed ore early last year. Tanzania followed suit imposing two months later a ban on exports of gold concentrates. Something similar happened in South Africa, which last year unveiled a revised mining code that would have imposed a 1% tax on mining companies’ revenues – as opposed to their profits, as is common.

In Mongolia the government claims that Oyu Tolgoi, a copper joint venture run by Rio, owes $155 million in unpaid taxes....