Diamond News Archives

- Category: News Archives

- Hits: 1478

The U.S. economy is booming this quarter as tax cuts power consumers and businesses. Yet risks are mounting that the high will be short-lived.

The housing market is struggling to build on its progress thanks to supply constraints and soaring property values, with data Tuesday[1] showing an unexpectedly large drop in construction permits. Manufacturing is coming off the boil amid lengthening order backlogs and accelerating input prices, particularly for oil and partly due to tariffs on metals. On top of that, President Donald Trump has brought the U.S. to the verge of a trade war[2] with China that could see levies on hundreds of billions of dollars in goods.

It all amounts to increasing headwinds on economic growth that has a fair shot this quarter at reaching 4 percent, the fastest since 2014. While the Trump administration said such strength makes it a good time[3] to tighten the screws on U.S. trading partners, especially China, markets gave a less-sanguine judgment[4] on Tuesday, and economists caution that prolonged pain from trade will complicate the path for companies and consumers.

With the U.S. economy about to enter the 10th year of expansion -- a time where growth typically faces hurdles in reaching new heights -- any slowdown would arrive just as the rest of the world[5] shows signs of losing steam.

U.S. growth “is close to a peak” and momentum will be “cooling from here,” said Gregory Daco, head of U.S. macroeconomics at Oxford Economics in New York. The trade risks “come at a point when the economy itself is in the late stage of the business cycle, it’s already close to capacity, where you can’t...

- Category: News Archives

- Hits: 1423

(IDEX Online) – Lucara Diamond Corp.'s 12th Exceptional Stone Tender has achieved gross revenues of $32.5 million, or $22,356 per carat. <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The tender consisted of 10 single stone lots, ranging from 40.4 carats to 472.37 carats, totaling 1,453.06 carats and included two diamonds greater than 300 carats. The 327.48 carat diamond sold for $10.1 million, or $30,900 per carat.

All 10 tendered diamonds sold for more than $1.0 million each, and four diamonds sold for more than $3 million each.

The average price per carat, excluding the 472.37 carat top light brown diamond, was $30,712/ct.

Lucara CEO Eira Thomas stated, "The quality of Karowe's large diamonds continues to attract the attention of the world's foremost manufacturers and diamantaires, with 29 companies attending the sale and eight individual companies winning lots. All 10 diamonds sold for more than $1 million each, and the 327.48-carat diamond sold for $10.1 million."

Lucara has now sold 168 diamonds for in excess of $1 million and 10 single diamonds have been sold for greater than $10 million.

The average price per carat for Karowe diamonds sold year to date is $893.3/ct....

- Category: News Archives

- Hits: 1480

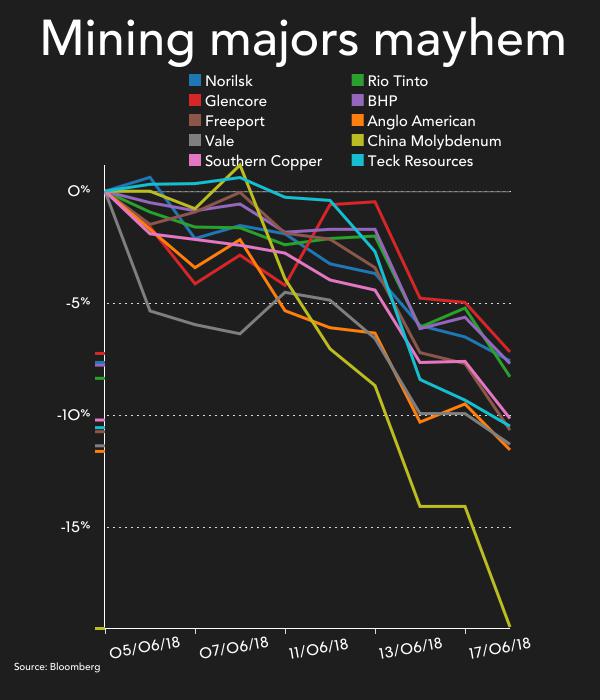

Mining and metals stocks came in for more punishment on Tuesday as the trade spat between the US and China escalated amid a war of words between Washington and Beijing.

Mining and metals stocks came in for more punishment on Tuesday as the trade spat between the US and China escalated amid a war of words between Washington and Beijing.

On Tuesday, Donald Trump threatened to impose a 10% tariff on $200 billion of Chinese goods in retaliation for what the US president called the country's "predatory" trade practices. Beijing also ratcheted up the rhetoric accusing the US of "extreme pressure and blackmailing".

Copper – used as barometer for economic prospects thanks to its widespread use in industry, transportation, power networks and construction – fell to $3.036 a pound or $6,700 a tonne, down over 8% or $600 since touching four-year highs just a fortnight ago.

Nickel, which has been immune to weakness in the sector also succumbed on Tuesday and is now trading 6% below multi-year highs hit earlier in June at $14,820 a tonne. Among industrial metals only nickel remains in positive territory for the year. Zinc down 8% year to date is the worst performer as the price declines to just above $3,000 a tonne.

Aluminum prices have given up all the gains from a sharp rise following the US imposition of sanctions on Russia and tariffs on imports from China, Europe, Canada and others.

China consumers more industrial metals and minerals than the rest of the world combined and the country imports more than two-thirds of the world's seaborne iron ore.

The import price of the steelmaking raw material declined 3% on Tuesday to $66.45 a tonne according to Metal Bulletin data. Iron ore has lost 9% of its value so far in 2018. The benchmark Australian export price of premium steelmaking coal at just below $200 a tonne is up year to date, but down sharply from...

- Category: News Archives

- Hits: 1055

- Category: News Archives

- Hits: 1191

Wondering[1] how the U.S. stock market keeps skirting disaster? It’s not complicated. For all the drama at their doorstep, trader positioning remains overwhelmingly bullish.

It’s visible in manager surveys[2], which last week showed equity funds only a trifle less long than at the height of January’s euphoria. It’s in markets for call options, where individual investors are engaged in a buying binge of historic dimensions. It’s tech IPOs, stocks favored by short sellers and ones with shaky balance sheets, all of which recently surged.

For traders so inclined, each trauma is just another test, even as their frequency quickens. In Tuesday’s version, Donald Trump’s threat to slap on $200 billion more in goods from China[3] sent the S&P 500 down as much as 1.1 percent, while the Dow Jones Industrial Average fell for a sixth day, the longest streak since March 2017.

“We’ve had more negative catalysts and more negative pull this year than we’ve had for a long time, but the positives continue to prevail in the investor’s mind,” Jeff Carbone, a managing partner at Cornerstone Wealth in North Carolina, said by phone. “They’re shrugging off the negativity and taking the positive to a greater extent that this is not the end.”

It’s not that people haven’t been warned. They have their memories of February and March, and strategists at banks from Morgan Stanley[4] to Goldman Sachs have repeatedly urged investors to rein in optimism, citing everything from politics to peak earnings and monetary tightening. Earlier today, Citigroup flagged a potential bubble in growth stocks.

But the caveats have gone unheeded. In one example, smaller options investors, defined as those who typically trade 10 contracts or...