Diamond News Archives

- Category: News Archives

- Hits: 1355

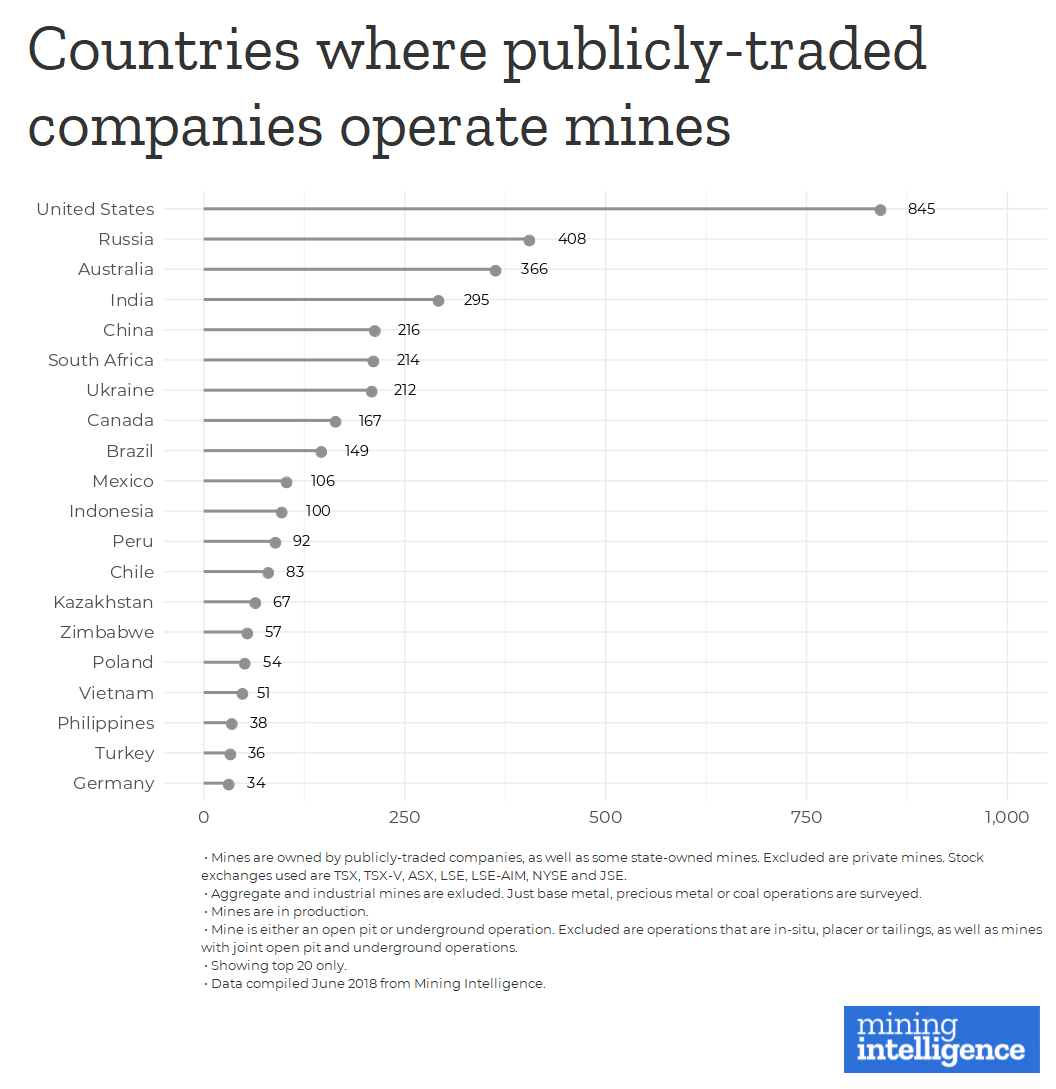

The United States has twice as many operating mines owned by publicly-traded companies than any other country, according to data from Mining Intelligence.

As of this month there are 845 operating mines in the U.S., giving it 20% of the world's total.

Russia is second with 408. Canada ranked eighth with just 167 operating mines.

Mines considered in the survey had the following criteria:

- Mines are owned by publicly-traded companies and some state-owned mines. Excluded are private mines. Stock exchanges used are TSX, TSX-V, ASX, LSE, LSE-AIM, NYSE and JSE.

- Aggregate and industrial mines are exluded. Just base metal, precious metal or coal operations are surveyed.

- Mines are in production.

- Mine is either an open pit or underground operation. Excluded are operations that are in-situ, placer or tailings, as well as mines with joint open pit and underground operations.

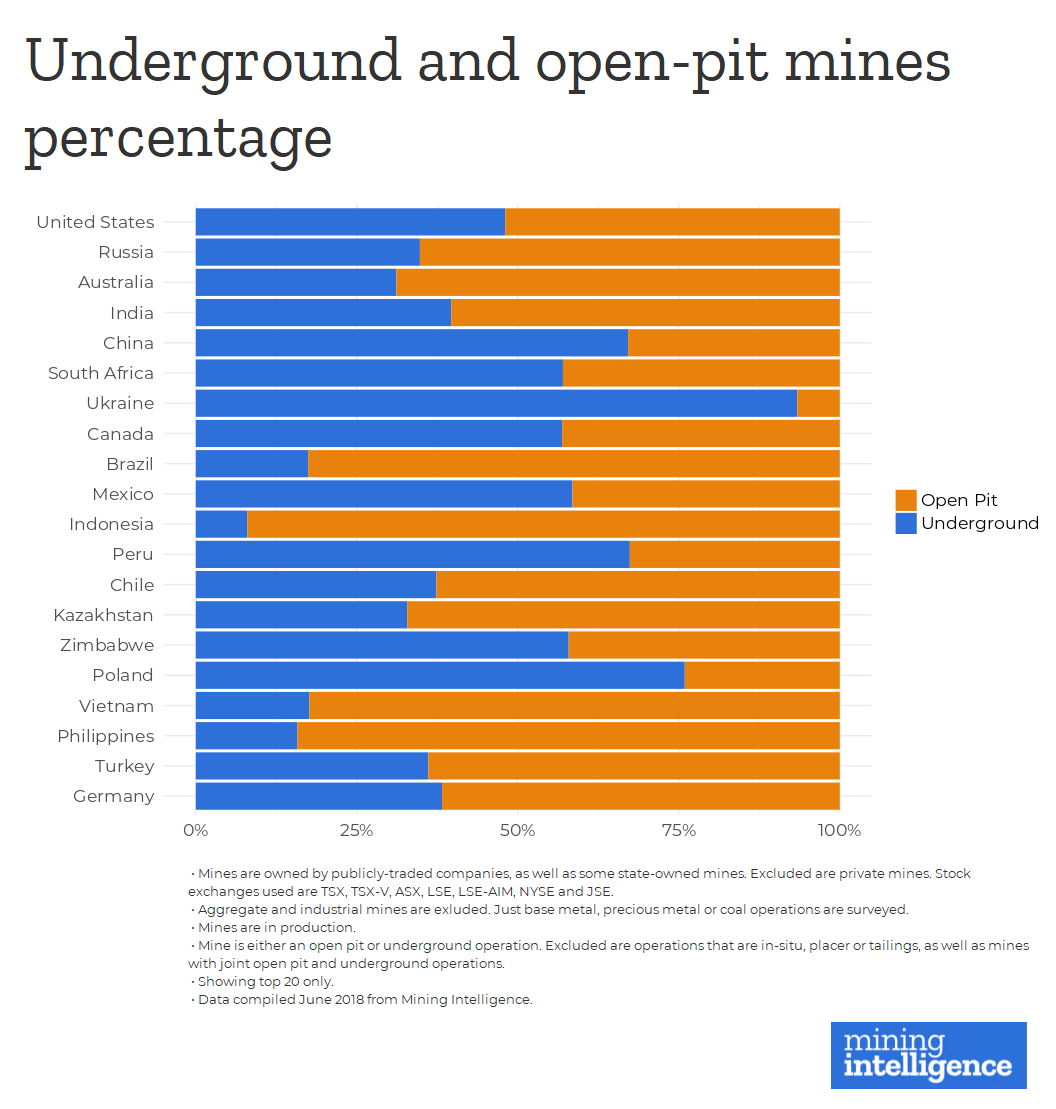

About half the American mines are open pit with the other half being underground.

Ukraine, Poland and China have the highest percentage of operating underground mines. Indonesia, Philippines and Vietnam have the most open pit mines.

Despite America having so many mines, the industry often gets overlooked in the US, says Jennifer Leinart, Mining Intelligence analyst and vice president of CostMine.

"While the regulatory environment makes it tough on miners, the United States continues to lead. The industry supports over 188,000 direct jobs according to Bureau of Labor Statistics, and there are another 10 supporting jobs for each direct mining job," says Leinart.

Mining still only amounts to 1.2% of total US employment, notes Leinart.

"Mining is not noticed in the United States because America has such a big, diversified economy. Mining has much more...

- Category: News Archives

- Hits: 997

Russia is rethinking what counts as a haven asset as it duels with the U.S.

Although investors usually seek safety in U.S. debt, Russia cut its holdings of Treasuries nearly in half in April as Washington slapped the harshest sanctions to date on a selection of Russian companies and individuals. In a shift Danske Bank A/S attributed to a deepening “geopolitical standoff,” Russia is instead keeping up its purchases of gold.

“Some people ask whether the Russian central bank sold them to support the ruble in April, but it’s about changing allocation as reserves continue to grow,” said Vladimir Miklashevsky, a senior economist at Danske Bank in Helsinki. “Rising U.S. yields have fueled the sell-off.”

Russia sold $47.4 billion of Treasuries in April, more than any other major foreign holder of the U.S. securities, even as its reserves grew on the back of rising oil prices. Its stockpile of $48.7 billion is down from a 2010 peak of over $176 billion, ranking it only 22nd worldwide, according to data released Friday.

By contrast, the central bank keeps adding to its gold hoard, bringing the share of bullion in its international reserves to the highest of President Vladimir Putin’s 18 years in power. The Bank of Russia said on Wednesday that its holdings of gold rose by 1 percent in May to 62 million troy ounces, valuing them at $80.5 billion. In May, Governor Elvira Nabiullina said gold purchases help diversify reserves.

With the geopolitical stakes so high, Russia may not be overly concerned about returns on its investment. Still, gold has underperformed U.S. debt so far this year, losing over 2 percent as the outlook for higher borrowing costs dimmed prospects for the metal, which doesn’t pay interest. Meanwhile, after handing investors positive...

- Category: News Archives

- Hits: 1046

- Category: News Archives

- Hits: 1200

Please Join Greg Hunter as he goes One-on-One with Craig Hemke, founder of TFMetalsReport.com[1].

<span class="fr-marker" data-id="0" data-type="true" style="display: none; line-height: 0;"></span><span class="fr-marker" data-id="0" data-type="false" style="display: none; line-height: 0;"></span>

Financial writer and precious metals expert Craig Hemke warns, “It’s pretty obvious to anyone that we are in this parabolic Ponzi scheme. The debt is now increasing globally at such an exponential rate that, at some point, it becomes unserviceable. Then, at that point, you get this reset they’ve been talking about....

References

- ^ TFMetalsReport.com (tfmetalsreport.com)

- Category: News Archives

- Hits: 1190

The Federal Reserve is releasing the results of its annual stress tests of big banks in two parts, on Thursday, June 21, and Thursday, June 28. Here is what you need to know to understand the news.

What is a stress test?A stress test is an examination of what would happen to a bank under difficult conditions. The Fed conjures up hypothetical scenarios, such as massive unemployment and other doomsday conditions. Then it looks at the bank’s real-life balance sheet and calculates how much money it could lose....

...