Diamond News Archives

- Category: News Archives

- Hits: 1155

HTTP/1.1 200 OK Server: Apache X-Varnish: 1524594051 1524588397 Vary: Accept-Encoding Cache-Control: public, max-age=300 Content-Type: text/html; charset=utf-8 Access-Control-Allow-Credentials: true Date: Thu, 21 Jun 2018 18:15:05 GMT Link: ; rel="amphtml",; rel="image_src",; rel="canonical",; rel="shortlink",; rel="publisher" Expires: Sun, 19 Nov 1978 05:00:00 GMT X-Drupal-Cache: MISS Transfer-Encoding: chunked Content-Language: en Access-Control-Allow-Origin: http://commons.commondreams.org http://twitter.com http://www.twitter.com http://shareaholic.com https://shareaholic.com http://dsms0mj1bbhn4.cloudfront.net X-Content-Type-Options: nosniff Etag: "1529604632-1" X-Generator: Drupal 7 (https://drupal.org) Via: 1.1 varnish Connection: keep-alive Set-Cookie: X-Mapping-fjhppofk=B79A65A56A9B274187714E3174802174; path=/ X-UA-Compatible: IE=edge X-Frame-Options: SAMEORIGIN Last-Modified: Thu, 21 Jun 2018 18:10:32 GMT Age: 272 Imperial President or Emperor With No Clothes? Skip to main content[1]

We will get straight to the point: Today we ask you to help Common Dreams during our mid-year fundraising drive. To maintain our independence, we will never run ads or take corporate funds. To maintain your privacy, we will never rent or sell your email address or your meta-data. Over twenty years ago, we created our media model -- non-profit, funded by thousands of small contributors -- guaranteeing us the independence to speak truth to power. We rely on readers, like you, to provide the "people power" that fuels our work - with donations averaging about $31. If you agree that non-profit, reader-supported independent media is needed now more than ever, please donate today. We can't do it without you. Thank you. -- Craig Brown, Co-founder

...

References

- ^ Skip to main content (www.commondreams.org)

- Category: News Archives

- Hits: 1248

The January high in the S&P 500 will prove to be the peak of the bull market and a U.S. recession may start in the next 12 months, said David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates Inc.

“Cycles die, and you know how they die?” Rosenberg told the Inside ETFs Canada conference in Montreal on Thursday. “Because the Fed puts a bullet in its forehead.”

Photographer: Misha Friedman/Bloomberg

The S&P 500 reached a record on Jan. 26 and has since dropped about 4 percent.

The market is in a classic late cycle, with wages rising at full employment, cooling commodities and potential trade wars, said Rosenberg, who was one of the first economists to warn of the Great Recession when he was at Merrill Lynch before the financial crisis. The result will be higher inflation, he said.

“We are seeing a significant shift in the markets,” he said. “The Fed was responsible for 1,000 rally points this cycle so we have to pay attention to what happens when the movie runs backwards.”...

- Category: News Archives

- Hits: 969

HTTP/1.1 200 OK Date: Thu, 21 Jun 2018 14:45:46 GMT Cache-Control: max-age=1800, public X-Cacheable: 1 Content-Type: text/html; charset=UTF-8 Age: 1760 X-Cache: HIT X-Cache-Hits: 20 Connection: keep-alive Accept-Ranges: bytes Set-Cookie: cookiesession1=4BD8220DF6EVLNTBDT2KU36INIH20E21;Path=/;HttpOnly Content-Encoding: gzip Transfer-Encoding: chunked ...

- Category: News Archives

- Hits: 904

HTTP/1.1 200 OK Date: Thu, 21 Jun 2018 13:59:37 GMT Cache-Control: max-age=1800, public X-Cacheable: 1 Content-Type: text/html; charset=UTF-8 Age: 929 X-Cache: HIT X-Cache-Hits: 10 Connection: keep-alive Accept-Ranges: bytes Set-Cookie: cookiesession1=4BD8220DQYKHDPLJI2T62ZAQPAMI9989;Path=/;HttpOnly Content-Encoding: gzip Transfer-Encoding: chunked ...

- Category: News Archives

- Hits: 1309

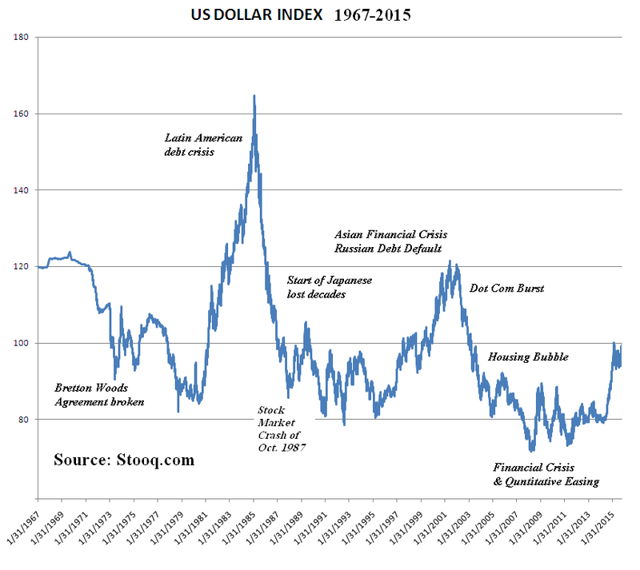

The US dollar is continuing strength this week. While the dollar index (basket of major trading partners euro, yen, sterling, CAD, krona, franc) is up just over 3% year to date, its gains against emerging market currencies have been multiples more. Because periods of free-flowing dollars (via international trade, easy credit and low rates) tend to weaken the greenback and encourage U$ indebtedness in emerging economies, cycles of dollar appreciation then tend to wallop the heavily- indebted with leaping carrying costs and incidents of financial crisis. As international liquidity and solvency problems surge, safety-seeking capital flows into the dollar and treasuries typically intensify. This chart on left of the dollar index shows the pattern between 1967 and 2015.

indebted with leaping carrying costs and incidents of financial crisis. As international liquidity and solvency problems surge, safety-seeking capital flows into the dollar and treasuries typically intensify. This chart on left of the dollar index shows the pattern between 1967 and 2015.

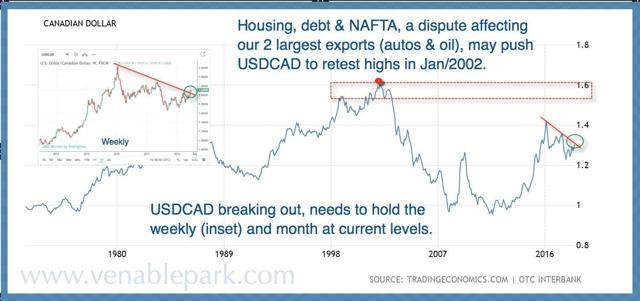

Year to date, greenback, is up more than 5% against the Canadian loonie (its largest export market), making US goods more expensive for Canadians.

This chart from my partner Cory Venable offers a big picture view on the US/Canadian dollar exchange rate since the 1970s.

Here we can see on a weekly view (upper left inset) that the US dollar has broken through the near term resistance which has dominated since January 2016. If it closes the month at or above current levels it will suggest higher highs with a potential re-test of the 2002 cycle top around 1.60 (red box).

In the process, however, the strong dollar and its deflationary effects in the US, along with ongoing havoc in global trade and emerging economies, will prompt the US Fed to stall in their rate hiking plans. The weak dollar pendulum began swinging back in 2011; those who missed this turn and banked on continued weakness are likely to be heavily hit in the months ahead. It is important to note that...