Diamond News Archives

- Category: News Archives

- Hits: 1617

Perhaps Venezuelan President Nicolas Maduro wanted to go down in history as having the WORST hyperinflation in history. If that was his goal, he is doing quite well!

(Reuters) – Venezuela’s inflation rate is likely to top 1,000,000 percent in 2018, an International Monetary Fund official wrote on Monday, putting it on track to become one of the worst hyperinflationary crises in modern history.[1]

The South American nation’s economy has been steadily collapsing since the crash of oil prices in 2014 left it unable to maintain a socialist system of subsidies and price controls.

“We are projecting a surge in inflation to 1,000,000 percent by end-2018 to signal that the situation in Venezuela is similar to that in Germany in 1923 or Zimbabwe in the late 2000’s,” Alejandro Werner, director of the IMF Western Hemisphere department, wrote in a post on the agency’s blog.

Venezuela’s Information Ministry did not immediately reply to a request for comment.

Consumer prices have risen 46,305 percent this year, according to the opposition-run legislature, which began publishing its own inflation data in 2017 because the nation’s central bank had halted the release of basic economic data.

The difference between 1923 Germany and 2018 Venezuela is that Germany had lost World War I and the country was in economic ruins, aided by reparations against Germany and absurd monetary policy (e.g., endless money printing).

But Venezuela did not engage in a catastrophic war nor did it has ruinous sanctions and reparations imposed on it. Venezuela had promised too many subsidies and enacted price controls that doomed them to eventual collapse after oil prices collapsed in 2014.

While crude oil prices have been rising again, Venezuela’s oil production has essentially collapsed. And...

- Category: News Archives

- Hits: 1265

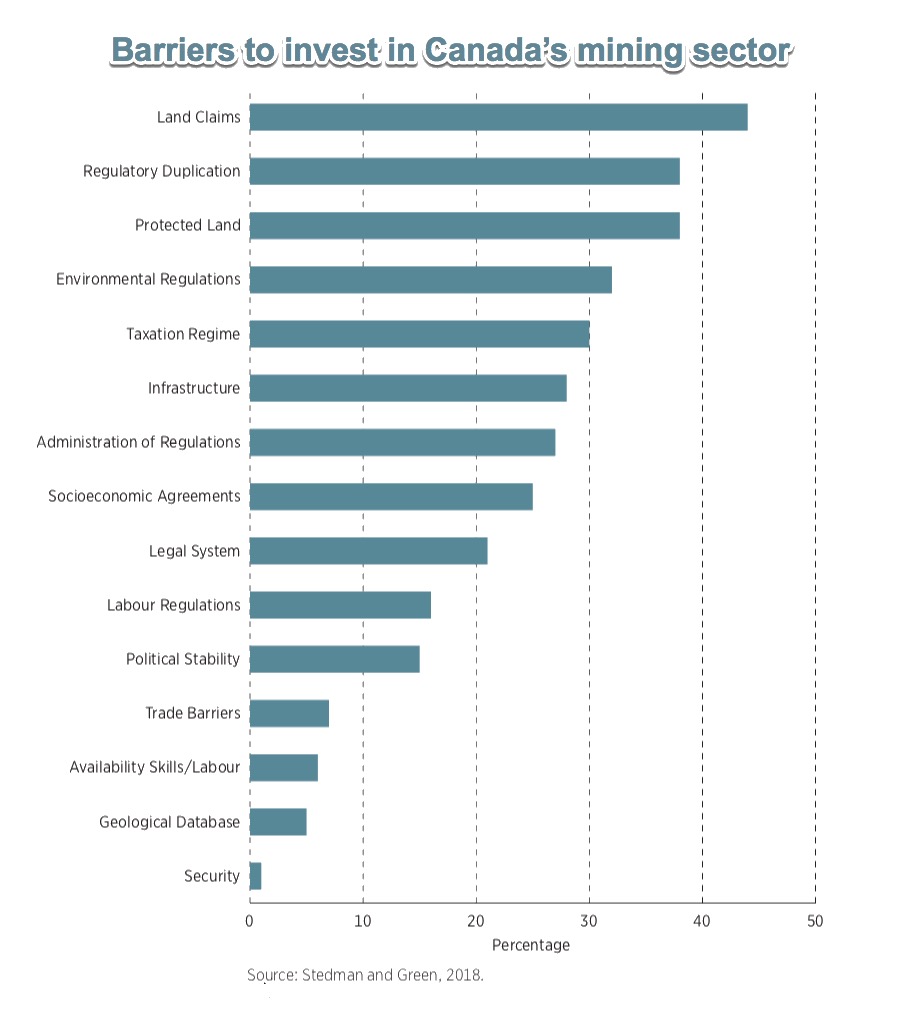

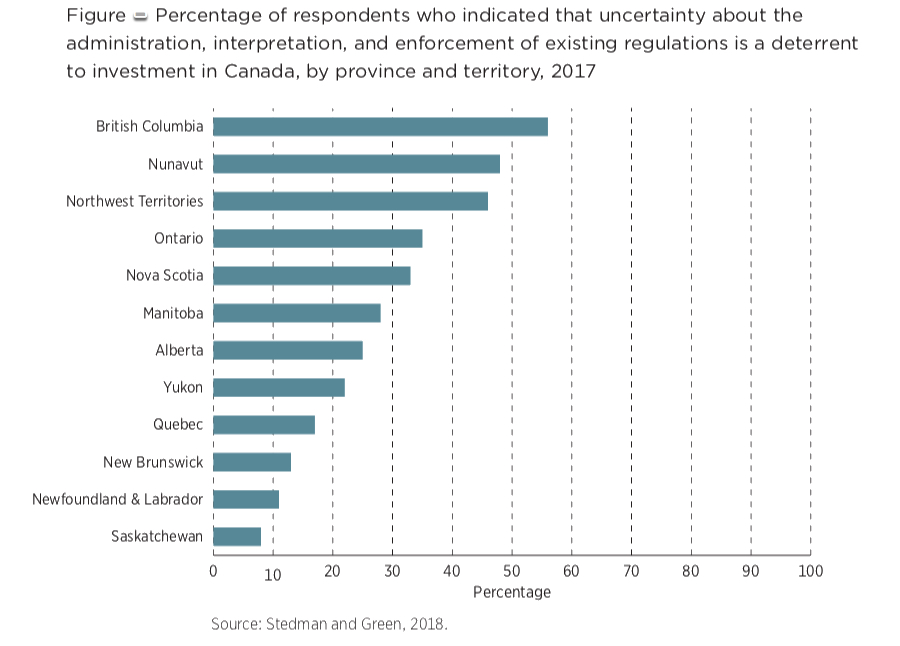

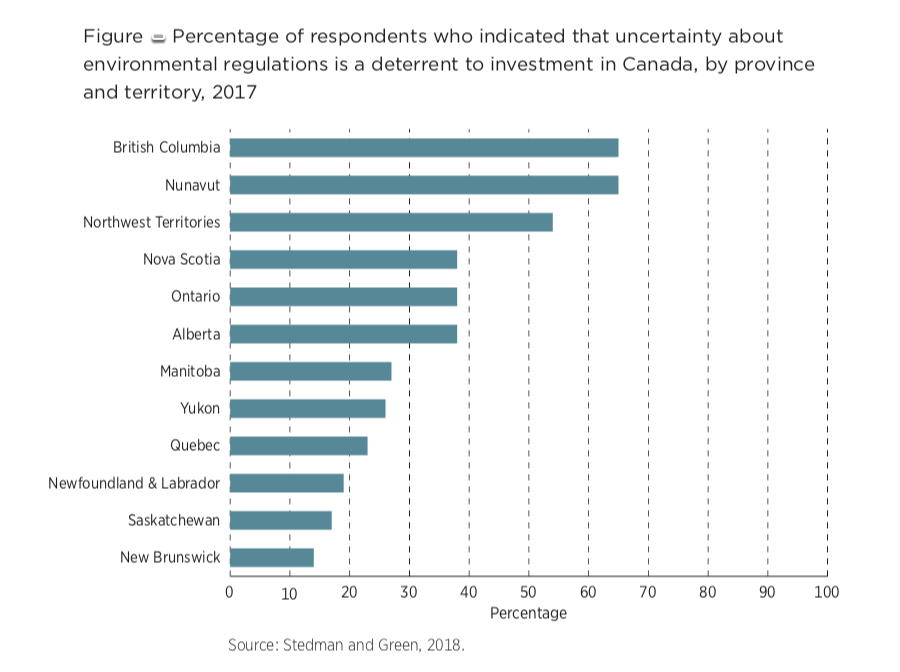

Mining investors are losing confidence in the mineral exploration permit process in most Canadian provinces, with applications taking longer to be approved and a lack of transparency, a new study released Tuesday shows.

According to the Fraser Institute, an independent, non-partisan Canadian policy think-tank, British Columbia, Ontario and Quebec are the three main provinces where exploration requests have grown longer and less transparent over the past 10 years.

In fact, 50% of the mining executives that participated in Fraser’s latest “Mining Survey”, indicated a lack of transparency in Ontario deters investment, followed by 48% of respondents in B.C. and 40% in Quebec.

In 2017, 83% of respondents in Ontario said that permit times had lengthened over the last ten years compared to 73% in B.C. and 50% in Quebec. On average, more respondents in the Canadian jurisdictions indicated that permit times were getting considerably longer compared to respondents in Australia and Scandinavia.

In 2017, 83% of respondents in Ontario said that permit times had lengthened over the last ten years compared to 73% in B.C. and 50% in Quebec. On average, more respondents in the Canadian jurisdictions indicated that permit times were getting considerably longer compared to respondents in Australia and Scandinavia.

Kenneth Green, Fraser Institute resident scholar and co-author of “Permit Times for Mining Exploration in 2017” says the situation no only deters investment, but also “hinders Canada’s ability to realize its considerable resource potential.”

“Ultimately, uncompetitive mining policies send valuable investment dollars—and the jobs and prosperity they create—elsewhere,” he says.

The survey’s results were broken into three areas: the length of time it takes to be approved for the necessary permits, the transparency of the permitting process, and the certainty of the permitting process.

As a conclusion, Green says, we don’t suggest that regulations should be lessened in order to reduce the risks and costs to industry; rather we argue that regulations should be as efficient and cost effective as possible while trying to address concerns like externalities that can result...

- Category: News Archives

- Hits: 1511

HTTP/1.1 200 OK Server: nginx/1.13.5 Date: Tue, 24 Jul 2018 13:15:04 GMT Content-Type: text/html; charset=UTF-8 Content-Length: 177408 Connection: keep-alive Vary: Accept-Encoding, Cookie Cache-Control: max-age=3600, public X-UA-Compatible: IE=edge Content-language: en X-Content-Type-Options: nosniff X-Frame-Options: SAMEORIGIN Expires: Sun, 19 Nov 1978 05:00:00 GMT Last-Modified: Tue, 24 Jul 2018 13:15:03 GMT ETag: W/"1532438103" X-Backend-Server: drupal-658fc5867d-g5gkq Age: 0 Varnish-Cache: HIT X-Cache-Hits: 3 X-Served-By: varnish-1 Accept-Ranges: bytes ...

Global Stocks, US Futures Jump After China Launches Fiscal Stimulus | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1150

(IDEX Online) – World Diamond Council (WDC) executives visited Angola for a series of meetings with stakeholders involved in the Kimberley Process (KP). <?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

WDC Acting President Stephane Fischler and Executive Director Marie-Chantal Kaninda made the trip at the invitation of Angolan authorities, marking the first time there has been a WDC mission to Angola outside of a formal KP meeting.

The meetings are part of a larger effort by the diamond industry to raise awareness of the challenges and opportunities for African countries as part of their participation in the KP. The trip follows a meeting in Antwerp earlier this year between the WDC, the Antwerp World Diamond Center (AWDC) and the President of Angola.

The WDC also recently completed a visit with KP stakeholders in the Democratic Republic of Congo.

An estimated 60 percent of the world’s diamonds are sourced from African countries. In Angola, diamonds are the country’s second-largest export. For the whole of 2017, diamond exports brought in gross revenues to Angola of $1.1 billion.

“With diamonds being such a critical part of African economies, I cannot underscore enough how critical it is to listen and engage directly not only to help reach a more sustainable global diamond industry, but one that brings back to local communities the social and economic benefits they rightly deserve and ensures fair income for African governments and their trading partners,” said Stephane Fischler, Acting President of the World Diamond Council. “This mission is yet another example of our commitment to this process and to fulfilling the duty of care...

- Category: News Archives

- Hits: 1110

Petra Diamonds Ltd forecast lower-than-estimated production for 2019 after reporting 2018 output at the bottom end of its previously guided range, sending its shares down more than 8 percent on Monday.

The miner said it expects to produce 4.6 million to 4.8 million carats in 2019, well below the 5.0-5.3 million carats it forecast in July last year.

The company, which has been hit by production delays, a confiscated consignment of diamonds in Tanzania and a strong South African rand, warned in May that production would be lower than expected, but did not provide a number.

The forecast spooked investors, overshadowing positive news that the company had managed to keep its debt in check after years of heavy spending.

Petra shares fell to their lowest in more than 2-1/2 years in early trade before recovering a bit to trade down 4.2 percent at 47.93 pence at 0736 GMT.

Its net debt fell to $436.1 million as of June 30 from $513.9 million at the same time last year, the company said.

Total production rose 15 percent to 4.6 million carats, helped by the ongoing ramp-up of its new Cullinan plant in South Africa, but was still at the lower end of its forecast of 4.6-4.7 million carats.

Production at Cullinan rose 74 percent in the full year, but FinnCap analyst Martin Potts expressed concern on the quality and price of diamonds from the mine.

"Overall price per carat was a long way below expectation as the mine has been recovering less of the higher value stones," Potts said.

"It suggests that Cullinan may have a problem and therefore may be less valuable as an asset than had previously been thought."

The company, which operates four mines in South...