Diamond News Archives

- Category: News Archives

- Hits: 1126

Moscow, 3 October 2018 – ALROSA Group proceeds with the non-core assets disposal program.Major assets belonging to JSC Almazy Anabara (ALROSA's affiliated company), 9.2% of shares of Almazergienbank, and a workshop of Voskhod Mechanical Plant were sold in July-September. In both cases, the assets were sold at a market price determined by an independent appraiser.

The shares of Almazergienbank were bought by OJSC RIK Plus.The transaction value exceeded RUB 200 million.The shares are to be transferred by the end of November this year.

Besides, one of the workshops of Voskhod Mechanical Plant (Yakutsk) was sold at the auction in September.The workshop was bought by the Plant.The cost of the sold property exceeded RUB 105 million.

ALROSA is implementing the Program of alienation of non-core assets approved by the Supervisory Board. As planned, in 2018, the Company is going to sell more than 350 units of real estate, construction in progress, housing, and plots of land. The year-to-date amount of the assets sold is about RUB 31 billion.

The Program of alienation of non-core assets was approved by ALROSA's Supervisory Board.Its implementation is expected to have a positive impact on the economic efficiency of ALROSA Group and the quality of management, will allow ALROSA's management to focus on developing the Company's core diamond business. 3

The post ALROSA proceeds with non-core assets disposal program appeared first on MINING.com....

- Category: News Archives

- Hits: 928

By Rajendra Jadhav

MUMBAI (Reuters) - India's gold imports may rise in the fourth quarter as investors seek alternatives to faltering equity markets and a plunging rupee at the same time traditional buying will rise during the festival season, said multiple sources involved in the market.

Increased buying by the world's second-biggest gold consumer would support global prices that have traded roughly near $1,200 an ounce since late August, but also widen India's trade deficit and add to pressure on the Indian rupee, which fell to a record low on Wednesday.

In the fourth quarter of 2018, gold imports could rise 9 percent from a year ago to 250 tonnes, said Bachhraj Bamalwa, a bullion dealer based in Kolkata who was formerly the Chairman of the All India Gems and Jewellery Trade Federation.

"In the December quarter, festival demand would be robust. Investment demand is also gaining traction," said Bamalwa.

Demand for gold usually strengthens at the end of the year on purchases for the traditional wedding season and major festivals including Diwali and Dussehra, when bullion buying is considered auspicious.

In the fourth quarter of 2017, India imported 229.6 tonnes of gold, according to metals consultancy GFMS.

Gold investment demand may rise as falling stock markets have prompted investors to diversify their portfolios, Bamalwa said.

India's NSE equity index has fallen 7 percent from a record peak in August, while local gold futures have risen 6 percent since the recent low hit in mid-August.

"Rupee is consistently falling and we don't know how much it will fall further. It is prompting investors to hedge their risk with exposure to gold," said Daman Prakash Rathod, a director at MNC Bullion, a wholesaler in Chennai.

The rupee has fallen...

- Category: News Archives

- Hits: 989

(IDEX Online) – Hundreds of buyers have registered for the seventh Israel Diamond Week in New York, to be held October 15-17 which is jointly organized by the Israel Diamond Exchange (IDE) and the Diamond Dealers Club of New York (DDC).<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" /?>

The annual event will again be held on the DDC’s new trading floor in the International Gem Tower in Manhattan.

The IDE said that 30 bourse member companies will be making the trip from Israel to take part in the event. They will be joined by dozens of DDC member companies on the trading floor. All will offer a wide selection of goods at a variety of price points. The hundreds of registered buyers include traders, jewelry manufacturers and retailers from the New York metropolitan area and beyond.

IDE Board Member Ezra Boaron said, “We are thrilled to once again hold the Israel Diamond Week in New York in conjunction with the DDC, and we expect that it will be a very exciting show. It’s a great opportunity to stock up before the busy holiday season.

“This event offers a small taste of what the Israeli diamond industry has to offer. For the full experience we invite buyers to the International Diamond Week in Israel (IDWI), January 28-30, 2019, where they can restock their diamond needs.”

Registration for the Israel Diamond Week in New York is free for bourse members and approved members of the trade. ...

- Category: News Archives

- Hits: 1271

Janet Burke, 71, opens the door of her Hollywood apartment with a smile. That’s how she greets Britt Weatherhead every Friday when he delivers a box of food that will keep hunger away.

Cheese, milk, bread and fruit are some of the items Burke finds in the box. Five frozen meals complete the Meals on Wheels delivery.

“It would be very hard if I did not have this,” Burke said as she held a frozen tray of chicken and rice. But her favorites are the cannelloni, she added.

Burke is one of the nearly 9 million elderly people at risk of hunger in the United States. In Florida, with the highest percentage of people 60 and older, more than 750,000 elderly need food assistance, according to experts.

The problems confronting the elderly have become one of the hot topics for candidates this election year. Candidates in South Florida have pointed to the needs of the elderly as one of the key concerns voiced by voters.

“South Florida was the mecca for retirees,” said Mark Adler, regional executive director of Meals on Wheels. “But now many people are suffering to get to the end of the month.”

One out of every five state residents are older than 65. That makes Florida the state with the highest number of elderly. Only 15.6 percent of U.S. residents are older than 65.

Although the number of elderly has been growing, their purchasing power has not kept pace, according to several reports. The percentage of elderly who declared bankruptcy across the United States rose fivefold since 1991, according to the study “Graying of U.S. Bankruptcy: Fallout from Life in a Risk Society.”[1]

Food delivery services like the one that benefits Burke are...

- Category: News Archives

- Hits: 1414

(Bloomberg) — South African Mineral Resources Minister Gwede Mantashe issued a new Mining Charter last week, seeking to reduce uncertainty and boost investment in the sector.

The Background:

The set of rules, aimed at distributing the industry’s mineral wealth more equally among citizens after the injustices of apartheid, was first issued in 2004 and updated in 2010.

Previous Minister Mosebenzi Zwane published his own version last year, which was challenged in court by the industry. Mantashe, who was appointed in February and promised to consult everyone involved, issued an initial draft for comment in June. The Minerals Council South Africa, which represents most producers, says it’s studying the latest version.

Here are five key takeaways from the latest Mining Charter:...

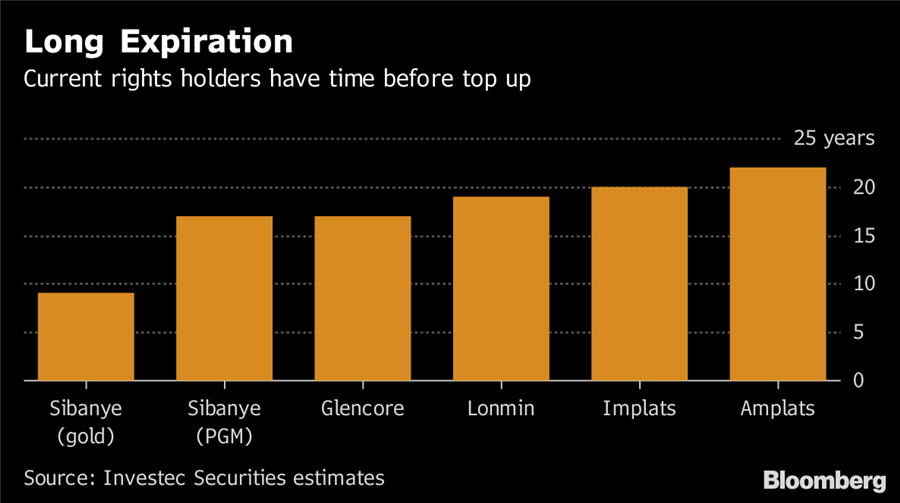

- Minimum Black Ownership (Existing Mine Rights) What happened before? The first two charters set it at 26%. Zwane wanted a top-up to 30% within one year, while Mantashe’s first draft said 30% in 5 years. New charter says: The minimum stays at 26% for the duration of existing mine right. (New mining right holders will need 30%.) This means: Mining companies that met the original requirements get to avoid diluting existing shareholders by being forced to add more black ownership.

- ‘Once Empowered, Always Empowered’ What happened before? There’s been an ongoing debate of whether previous black-empowerment transactions should be recognized even after the black shareholders exited. New charter says: The “recognition of continuing consequences” is clearly spelled out. This means: Companies that met the requirements previously won’t be forced to issue or sell new shares to black investors.

- Mine Right Renewal/Sale What happened before? Mantashe’s earlier draft said ‘once empowered, always empowered’ won’t apply if the mining right changes ownership or needs to be renewed. New