Diamond News Archives

- Category: News Archives

- Hits: 788

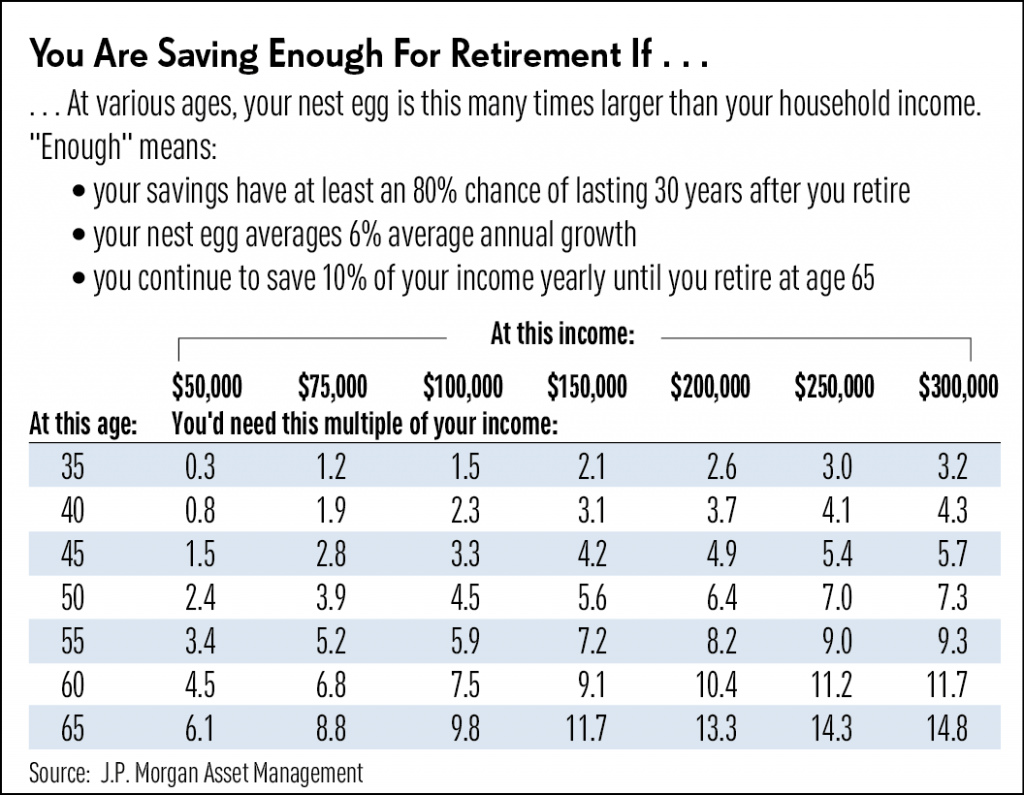

The average American is more likely to own a home than to have saved enough money for retirement[1]. In fact, for many Americans, their house is their retirement plan: They’re counting on the value of that nest egg to fuel their golden years. But while real estate can be a good investment, it isn’t wise to rely on a house to fund your retirement. To explore why, Barron’s spoke with Teresa Ghilarducci, the Irene and Bernard L. Schwartz Chair in economic policy analysis in the Economics Department at the New School, and the author of How to Retire With Enough Money[2].

“You can’t eat your house a sandwich at a time,” she says.

This interview has been edited and condensed for clarity.

BARRON’S: For a lot of Americans, their house is their retirement plan. Is that wise?

GHILARDUCCI: It’s not a great retirement plan at all. For instance, let’s say you own your house, and you have Social Security. You are going to have to live only on Social Security, because you can’t eat your house a sandwich at a time. And also, your house will often be a liability as it needs continual repair. You still need money to pay your taxes. As every homeowner knows, even though you paid it off, it isn’t free.

But is paying off your house a form of saving?

Absolutely. If you don’t manage your debt, it is as bad as not saving. If you pay off your debt, that’s the same thing as saving. If you’ve maxed out on your 401(k)[3] and you want to know...

- Category: News Archives

- Hits: 993

April 30, 2019

Working hard and doing what you're told is no longer yielding the promised American Dream of security, agency and liberty.

Volume One of Fernand Braudel's oft-recommended (by me) trilogy Civilization & Capitalism, 15th to 18th Century is titled The Structures of Everyday Life[1]. The book describes how life slowly became better and freer as the roots of modern capitalism and liberty spread in western Europe, slowly destabilizing and obsoleting the sclerotic tyrannies of feudalism.

Today I want to discuss the erosion of everyday life as a manifestation of the endgame of the current version of state capitalism, more precisely neofeudal state-cartel financialization, which combines financial predation of the home (core) economy and global exploitation of the Periphery (a.k.a. neocolonialism.)

Unlike the era Braudel describes, our era is characterized by the decline of liberty and the distortion of capitalism to serve the few at the expense of the many.

The over-used analogy of the boiled frog remains apt in understanding the erosion of everyday life: everyday life has become increasingly more difficult, more stressful, less rewarding financially, more deranging and less free for the past two generations. This erosion has gathered momentum in the 21st century as the status quo has ramped up its dysfunctional dynamics to keep the increasingly unequal distribution of wealth, power and liberty in place.

Consider the costs and capital flows of planned obsolescence. The consumer, who once was implicitly assured decades of reliable service from an American-made appliance, now gets an appliance that rarely lasts more than a decade, regardless of the brand or origin.

In the relentless...

- Category: News Archives

- Hits: 792

Alrosa, the world's largest diamond miner in volume, said it had generated $9.65 million from the sale of special sized diamonds (+10.8 carats) at its diamond auction in Vladivostok which took place on April 8-19.

Alrosa hosted 29 companies from Belgium, India, Israel, the UAE, the USA, Hong Kong and Russia at the auction. A total of 150 diamonds with a total weight of 2481.9 carats were offered for viewing and consequent bidding, with 121 stones (2030,32 carats) sold. The sale included two larger diamonds, weighing 58.92 and 41.48 carats.

"This diamond auction again showed decent results. We selected the stones of good color and quality, and got high revenues about $10 million. This is a good result, and we plan to further develop our sales here," said Evgeny Agureev, member of the Executive Committee, Director of the United Selling Organization of Alrosa....

- Category: News Archives

- Hits: 857

HTTP/2 200 server: nginx date: Mon, 29 Apr 2019 20:00:05 GMT content-type: text/html; charset=UTF-8 content-length: 82698 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Mon, 29 Apr 2019 19:54:01 GMT etag: W/"1556567641" x-backend-server: drupal-c7d5497d5-wrwhg age: 364 varnish-cache: HIT x-cache-hits: 316 x-served-by: varnish-0 accept-ranges: bytes ...

Boomers Are Facing A Financial Crisis | Zero Hedge Skip to main content [1]References

- ^ Skip to main content (www.zerohedge.com)

- Category: News Archives

- Hits: 1023

Dollar Hegemony is a tough nut to crack.

China is taking another baby step in promoting the internationalization of the renminbi and nibble on the hegemony of the US dollar: It’s pushing a proposal to add a pile of yuan to the $240 billion currency swap agreement between ASEAN plus China, Japan, and South Korea, in order reduce the system’s reliance on the US dollar and to enhance its own economic clout in the region, according to the Nikkei[1].

On May 2, the finance ministers and central bankers of ASEAN – Singapore, Brunei, Malaysia, Thailand, Philippines, Indonesia, Vietnam, Laos, Cambodia, and Myanmar – along with those from China, Japan, and Korea will meet in Fiji to discuss modifications to the swap agreement, the Chiang Mai Initiative.

China, which co-chairs the meeting with Thailand, has added language to the draft joint statement concerning use of Asian-currency contributions to the pool – which for now is still entirely in dollars – as “one option” to enhance the swap arrangement.

“Allowing participants to access Asian currencies in an emergency could encourage their use in other contexts, including foreign exchange reserves, the thinking goes,” the Nikkei said. “The idea also anticipates a long-term rise in demand for these currencies in regional investment and trade.”

“China in particular sees it as another step on the path to internationalizing the yuan and expanding its economic influence in the region. But the proposal is likely to be complicated by U.S. alarm at the prospect of Beijing expanding its currency’s role at the dollar’s expense.”

The Chiang Mai Initiative was a response to the 1997 Asian currency crisis. It consists of a pool of US dollars, contributed by members, that members can draw on when their currencies...