Diamond News Archives

- Category: News Archives

- Hits: 977

The economy is doing great, according to most estimates[1].

Jobless claims dipped to 228,000 in early May and the U.S. labor market is on track to break the record for the longest expansion on record[2]. Mortgage rates have hit their lowest level this year[3]. Consumer sentiment rose to a 15-year high of 102.4 in May[4], up from 97.2 in April, helped in part by a decade-long bull market. But not everyone is A-OK.

“Many adults are financially vulnerable,” according to the Board of Governors of the Federal Reserve System. “In addition, volatile income and low savings can turn common experiences — such as waiting a few days for a bank deposit to be available — into a problem for some.” As a result, people supplement income through gig work and seek financial support from family members.

‘Many adults are financially vulnerable.’

The rich benefit from a rising stock market. The richest people in the U.S. have increased their share of stock ownership over the last 30 years, Daan Struyven, senior economist at Goldman Sachs GS, -1.71%[5] said recently. “The wealthiest 0.1% and 1% of households now own about 17% and 50% of all household equities, respectively, up from 13% and 39% in the late 1980s,” he said.

This gap between the rich and everyone else can be seen in overall stock ownership. Just over half of Americans own stocks, this Gallup report...

- Category: News Archives

- Hits: 878

Junior diamond miner Mountain Province Diamonds published a forward looking report on the prospective Faraday 2 diamond mining project. The report said the future mine holds 5.45 million carats of diamonds contained in 2.07 million tonnes of kimberlite, with an overall grade of 2.63 carats per tonne and an average value of US$140 per carat. This represents a 49% increase in total tonnes and a 74% increase in total carats for the Faraday 2 kimberlite.

The Inferred Mineral Resource at Faraday 2 has been updated to include the northwest extension, which was discovered in 2017 and extended the kimberlite by 150 meters. The average value of US$140 per carat is a 25% increase from the 2017 average values of US$112 per carat, using a recoverable (+1 mm) diamond size frequency distribution for each geological domain.

The updated resource was determined by Aurora Geosciences Ltd. ('Aurora') and SRK Consulting Inc. ('SRK'), who were engaged by the Company to conduct the exercise.

Stuart Brown, President and CEO of Mountain Province commented: "We are very pleased with the diligent efforts of our technical team in bringing to fruition the updated technical report for the Faraday 2 kimberlite. I thank the authors of the report, Mr. Gary Vivian of Aurora Geosciences, and Mr. Cliff Revering and Mr. Casey Hetman of SRK Consulting for delivering a professional product that enhances our value portfolio for the Kennady North Project."

The Faraday 2, Faraday 1-3, and Kelvin kimberlites are located approximately 10 kilometers northeast of the Gahcho Kué Mine....

- Category: News Archives

- Hits: 852

Share this page with your friends:

Print[1]Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance[2] page.

May 28, 2019

Markets were decisively in “risk-off” mode last week. Following weak manufacturing news last Thursday, the yield on the 10-year Treasury sunk to its lowest level since October 2017. The spread between the 10-year yield and three-month yield, in fact, inverted once again, with the shorter-term bond yield higher by 6 basis points. As such, the “boring” yet mostly reliable utilities sector rotated to the top.

I’m not going to use the R-word here. All I’m going to say is that it might be time for investors to brace for a significant correction—especially with debt at record levels and the Federal Reserve left with very little firepower to combat a full-blown crisis.

Let’s take a look at what the smart money is doing.

Many successful, ultra high-net-wealth individuals (UHNWIs) favor municipal bonds, not only because they’re tax-free at the federal and often state and local levels, but also because they’ve managed to perform well even during equity bear markets. According to the first-quarter asset allocation report[3] for Tiger 21, a peer-to-peer network for UHNWIs, members had an average weighting of 9 percent in fixed income, which includes muni bonds.

As many of you know, U.S. Global Investors is known for gold and natural resource investing, but we also have longstanding experience in muni bond investing.

Speaking of gold, Ray Dalio said back in 2015[4] that “if you...

- Category: News Archives

- Hits: 1050

Back in the 1980s, Japan was portrayed as the greatest economic threat to the United States, and allegations of intellectual property theft were only part of Americans' vilification. Thirty years later, Americans have made China the villain, when, just like three decades ago, they should be looking squarely in the mirror.

NEW HAVEN – “When governments permit counterfeiting or copying of American products, it is stealing our future, and it is no longer free trade.” So said[1] US President Ronald Reagan, commenting on Japan after the Plaza Accord was concluded in September 1985. Today resembles, in many respects, a remake of this 1980s movie, but with a reality-television star replacing a Hollywood film star in the presidential leading role – and with a new villain in place of Japan....

- Category: News Archives

- Hits: 974

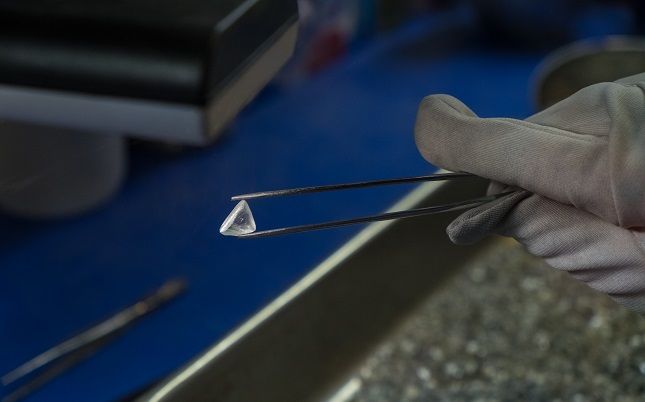

Gemological Science International (GSI), the New York headquartered, global gemological organization and a leader in diamond identification and screening, recently identified synthetic white sapphire melee in jewelry. The synthetic sapphires were detected during a routine jewelry screening procedure.

GSI's New York Screening and Testing Department received diamond pendants for screening and found the "diamonds" to be near-colorless synthetic white sapphires. These stones ranged from one to 10 points and were set next to natural diamonds.

"This finding is a great example of the extraordinary work the team at GSI is doing for the screening and detection of undisclosed lab-grown diamonds and simulants," said Debbie Azar, President & Co-Founder of Gemological Science International.

"What makes this finding unusual and very atypical was the use of melee sized synthetic white sapphires."

In addition to its grading and certification services, GSI opened facilities in New York, Hong Kong, and India dedicated to the screening and testing of jewelry for undisclosed lab-grown diamonds and simulants. "While the industry has taken considerable steps to address this issue, the problem still persists" said Azar. "We continue to identify undisclosed lab grown diamonds and simulants in jewelry on a daily basis in all our global facilities."...