Diamond News Archives

- Category: News Archives

- Hits: 805

Gold has a chance to be an interesting investment in the coming year, says Blackstone investment luminary Byron Wien:

That is how the veteran investor, whom U.S. News & World Report[1] report described as a modern-day cult figure on Wall Street and one of the most influential investors, described the outlook for the yellow metal in the coming 12-month stretch, during a CNBC interview, ahead of the release of his well-read list of market surprises.

Wien didn’t provide further clarity on his gold estimates or the precise direction of gold trading in 2020.

However, his comments came as the precious commodity was on pace to enjoy one of its strongest daily gains since late November and its highest finish since early last month, rising past a psychologically significant level above $1,500 an ounce. Gold for February delivery GCG20, +1.05%[2] was most recently trading up $14.20, or 1%, at $1,503.10 an ounce on the Comex exchange.

Gold has gained 17.3% so far this year, based on the most active contract, according to FactSet data. That is a relatively healthy run-up for the metal considering that stocks, which tend to move in the opposite direction of gold, have been trading near all-time highs.

Indeed, the Dow Jones Industrial Average DJIA, -0.13%[3] has gained 22.3% so far in 2019, the S&P 500 index SPX, -0.02%[4] ...

- Category: News Archives

- Hits: 591

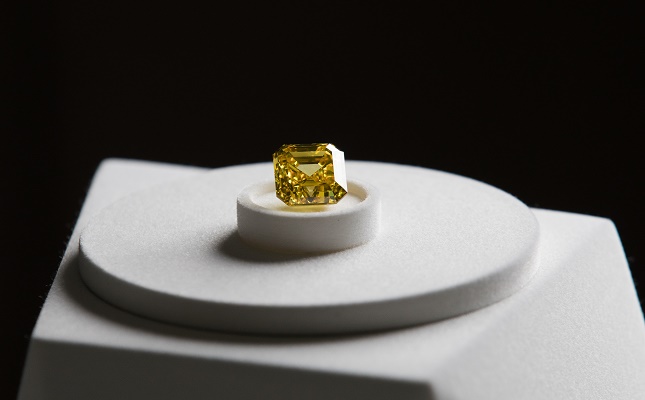

(IDEX Online) - Graff Diamonds has acquired the 20.7-carat Firebird diamond directly from Alrosa. While no price has been disclosed, the sale is apparently one of the highest prices per carat for such a stone in recent years.

The GIA graded the Asscher-cut diamond as Fancy Vivid Yellow / VS1 with excellent polish and symmetry. "It is extremely rare and very special in the world of diamonds to see [a] unique yellow diamond like this," said John King, GIA chief quality officer.

It was cut from "Stravinsky," a 34.17-carat rough diamond that was discovered at the Ebelyakh mine in Yakutia in 2017. That stone was one of the largest rough diamonds of such color and quality ever extracted in Russia.

The Firebird diamond is a part of "The Spectacle" unique diamonds collection, which is dedicated to the Russian ballet. The other named diamond is "Spirit of the Rose," a 14.8-carat fancy vivid purple-pink stone. The third diamond in the collection is still being cut and polished. ...

- Category: News Archives

- Hits: 693

By Sven Henrich[1] on [2] • ( 5 Comments[3] )

It was exactly a year ago today, December 23, 2018, when I made the case for a technical bullish reconnect of markets that had overshot to the downside.

Back then in Imbalance[4] I said, among other things, this:

“As of now we have massive imbalances to the downside and these disconnects will cause an effort at a reconnect…Bears are now screaming for ever lower targets in December. Ignore the screaming. Focus on the technicals. Everybody chill. Imbalances don’t last.”

And now with this Q4 being the polar opposite to last year and its current party like it’s 1999[5] atmosphere I find myself in the same spot: Making a case for technical reversion first before the next bull/bear debate. And yes, I’ve been making the Sell Case[6] earlier with recognition that the Fed induced liquidity program may well extend into Q1 2020 and this still applies. After all the Fed’s current liquidity interventions are unprecedented:

That said the technicals are screaming imbalance as they did exactly a year ago.

So I’ll share a few charts for your consideration.

First off, let me point out that the Q4 move here is not dissimilar to what we saw leading up to the January blow-off topping move:

As then this move here being driven by liquidity, tax cuts then, the Fed now.

A basic imbalance then, as in December last year and now: $SPX far disconnected from its 200 day moving average:

- Category: News Archives

- Hits: 787

HTTP/2 200 date: Mon, 23 Dec 2019 16:00:07 GMT content-type: text/html; charset=utf-8 set-cookie: __cfduid=d8c7a9c034e5060bf0b9d3d8a286fa6111577116807; expires=Wed, 22-Jan-20 16:00:07 GMT; path=/; domain=.scmp.com; HttpOnly; SameSite=Lax; Secure vary: Accept-Encoding x-dns-prefetch-control: off x-frame-options: SAMEORIGIN strict-transport-security: max-age=15552000; includeSubDomains x-download-options: noopen x-content-type-options: nosniff x-xss-protection: 1; mode=block access-control-allow-origin: * x-url: /business/banking-finance/article/3043288/traders-bullish-gold-price-poised-strongest-growth-almost x-cache-control: public, max-age=2592000, must-revalidate age: 4011 cache-control: public, max-age=0, must-revalidate, must-revalidate x-cf-ipcountry: CA x-hits: 260 x-cached-by: production-varnish-scmp-pwa-67f8c84686-wk9tk cf-cache-status: DYNAMIC expect-ct: max-age=604800, report-uri="https://report-uri.cloudflare.com/cdn-cgi/beacon/expect-ct" alt-svc: h3-24=":443"; ma=86400, h3-23=":443"; ma=86400 server: cloudflare cf-ray: 549b8befbd31ecea-YUL

Traders bullish as gold price is poised for strongest growth in almost a decade, having gained 15 per cent amid Hong Kong protests, US-China trade war | South China Morning PostPolitical and diplomatic turmoil led to fears of a global recession, which has driven investors to buy into gold and drive the price up, analysts said. Photo: Shutterstock

Advertisement

Political and diplomatic turmoil led to fears of a global recession, which has driven investors to buy into gold and drive the price up, analysts said. Photo: Shutterstock

Advertisement

Advertisement...

- Category: News Archives

- Hits: 631

(IDEX Online) - International exhibitors are being invited to participate in the 2020 International Diamond Week in Israel (IDWI). This is the first time the IDWI has been open to exhibitors from all markets.

Ezra Boaron, IDWI chairman said the decision to open up the doors of the show came from interest shown by international companies. "The diamond world thrives on trading and I believe that this step will enable the event to attract additional buyers from new markets," he said.

IDWI is a boutique show exclusively for diamond traders. To encourage trade, there are minimal costs for exhibitors and incentives for eligible buyers, who receive three complimentary nights at a local hotel.

IDWI 2019 attracted over 350 foreign buyers from over 30 countries, one-third of whom were new to the Israel Diamond Exchange. Over 150 Israeli companies exhibited at the show.

The next IDWI will be held from February 10-12, 2020....