Diamond News Archives

- Category: News Archives

- Hits: 576

HTTP/2 200 server: nginx date: Sat, 04 Jan 2020 16:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 80232 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Sat, 04 Jan 2020 15:10:06 GMT etag: W/"1578150606" x-backend-server: drupal-b54cf6c8f-65n7x age: 2997 varnish-cache: HIT x-cache-hits: 2108 x-served-by: varnish-0 accept-ranges: bytes ...

Winter Is Coming... | Zero Hedge- Category: News Archives

- Hits: 601

HTTP/2 200 server: nginx date: Fri, 03 Jan 2020 20:00:05 GMT content-type: text/html; charset=UTF-8 content-length: 44495 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Fri, 03 Jan 2020 19:40:14 GMT etag: W/"1578080414" x-backend-server: drupal-b54cf6c8f-8k5pn age: 1190 varnish-cache: HIT x-cache-hits: 196 x-served-by: varnish-1 accept-ranges: bytes ...

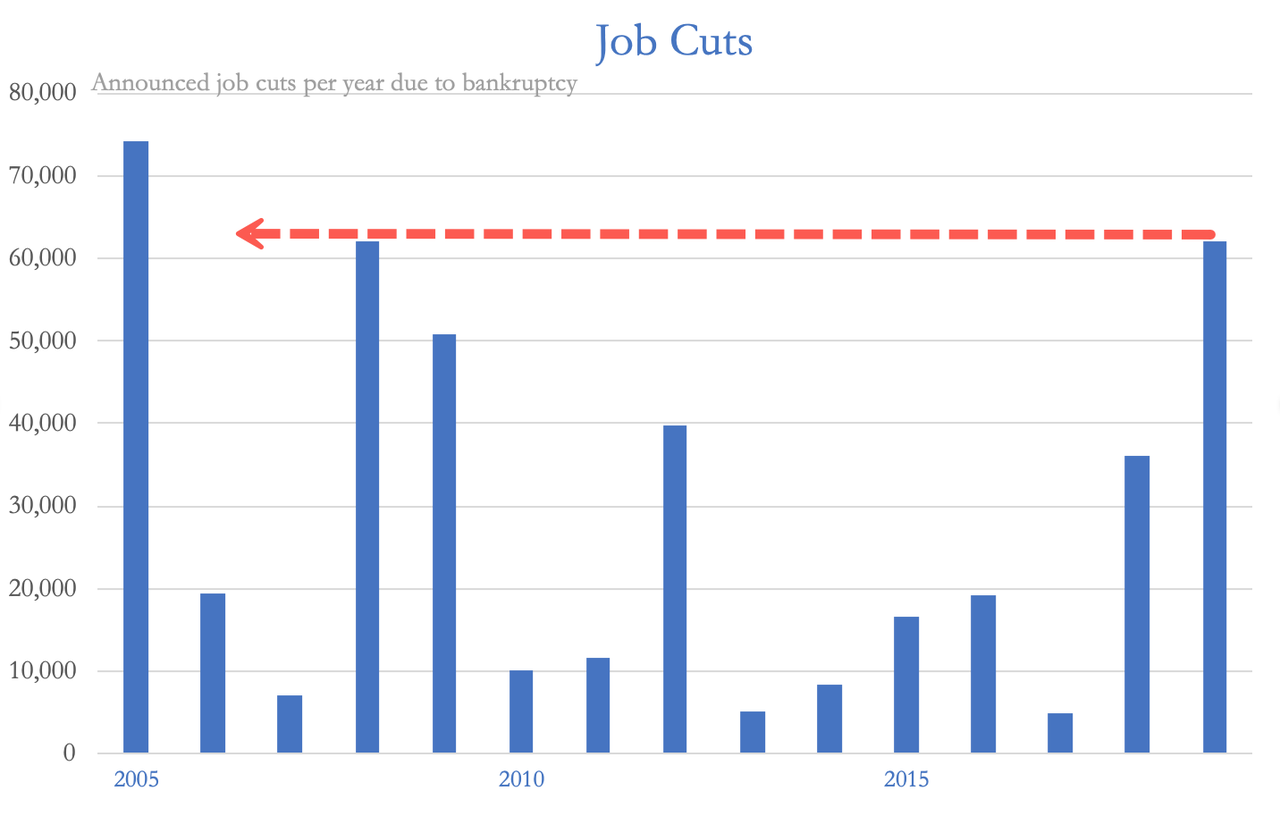

Job Cuts Sparked By Bankruptcies Hit Highest Level Since 2005 | Zero Hedge- Category: News Archives

- Hits: 629

Ignoring problems rarely solves them. You need to deal with them—not just the effects, but the underlying causes, or else they usually get worse.

In the developed world and especially the US, and even in China, our economic challenges are rapidly approaching that point. Things that would have been easily fixed a decade ago, or even five years ago, will soon be unsolvable by conventional means.

Central bankers are the ones to blame. In a sense, they are far more powerful and dangerous than the elected ones[1].

Hint: It’s nowhere good. And when you combine it with the fiscal shenanigans, it’s far worse.

Fixing Their Own Mistakes

Central banks weren’t always as responsibly irresponsible.

Walter Bagehot, one of the early editors of The Economist, wrote what came to be called Bagehot’s Dictum for central banks: As the lender of last resort, during a financial or liquidity crisis, the central bank should lend freely, at a high interest rate, on good securities.

The Federal Reserve came about as a theoretical antidote to even-worse occasional panics and bank failures. Clearly, it had a spotty record through 1945, as there were many mistakes made in the ‘20s and especially the ‘30s. The loose monetary policy coupled with fiscal incontinence of the ‘70s gave us an inflationary crisis.

Paul Volcker’s recent passing (RIP) reminds us of perhaps the Fed’s finest hour, stamping out the inflation that threatened the livelihood of millions. However, Volcker had to do that only because of past mistakes.

History’s Loosest Monetary Policy

Beginning with Greenspan, we have now had 30+ years of ever-looser monetary policy accompanied by lower rates. This created a series of asset bubbles whose demises wreaked economic...

- Category: News Archives

- Hits: 969

By Pam Martens and Russ Martens: January 2, 2020 ~

John Williams, President of the Federal Reserve Bank of New York

Consumers represent two-thirds of GDP in the United States. And yet, when consumers run into trouble, they don’t get a handout from the Federal Reserve – they are forced to file bankruptcy. There are no Fed handouts to small business owners, farmers, or main street merchants either.

So why is it exactly that the trading houses on Wall Street, with a serial history of crimes and with the most overpaid and under-punished executives on the planet, are able to perpetually have secret communications with the New York Fed and magically turn on the flow of trillions of dollars of ridiculously cheap loans to bail out their hubris and corruption.

The obscene money spigot from the New York Fed to Wall Street’s trading houses didn’t start with the epic financial crisis of 2008, as most Americans believe. It started following the dot.com bust, which was fueled by fraudulent research from Wall Street’s trading houses. The money from the Fed to Wall Street simply flowed under the cover of the 9/11 crisis.

The emotional toll of 9/11 has caused a memory lapse among most Americans to the reality that the stock market and Wall Street were in freefall before 9/11 occurred. The Nasdaq stock market had closed at 1695 on the day before September 11, 2001 – a stunning 66 percent drop from its peak in March of 2000. The dot.com bust had led to one of the largest destructions of U.S. wealth in stock market history. The New York Times’ Ron Chernow wrote[1] about the dire conditions on Wall Street six months before...

- Category: News Archives

- Hits: 984

Many investors know that silver is undervalued relative to gold. Many also know that silver remains undervalued relative to the stock market.

But check out just how undervalued silver is in this new video with Mike Maloney and Ronnie Stoeferle[1].

This chart shows the silver/gold ratio (the gold/silver ratio inverted) vs. the S&P 500. Note the strong correlation for two decades—until it abruptly ended in 2011.

What happened? Ronnie explains that we had monetary inflation (QE) from 2008 to 2011, then asset price inflation beginning in 2011, a process that pushed up asset prices and thus pushed this ratio to an extreme.

He points out that based on Murray Rothbard’s research, inflation occurs in three stages—and we’ve now seen the first two stages. Next up is stage three: price inflation.

It’s a contrarian call, but a recent Bloomberg cover referred to the “death of inflation.” As Ronnie says, this is a reliable contrarian indicator and investors should thus prepare for price inflation.

If he’s right, big inflation is ahead—and much higher gold and especially silver prices.

Tune it to also hear Mike talk about the wealth disparity[2]… it isn’t because Jeff Bezos created the world’s biggest shopping center and made billions of dollars, for example, but because currency creation has lifted asset prices and made him worth more at a much faster pace than the average investor.

It’s all very eye-opening, and has clear implications for investors that want to maximize their profit opportunity in silver....