Diamond News Archives

- Category: News Archives

- Hits: 662

(Bloomberg) -- Sign up here to receive the Davos Diary, a special daily newsletter that will run from Jan. 20-24.

Former Treasury Secretary Lawrence Summers dismissed the optimism of former Federal Reserve Chairman Ben Bernanke, who recently said the central bank could likely fight off the next recession despite the low level of interest rates.

Bernanke’s speech was “a kind of last hurrah for the central bankers,” Summers said in a taping of Bloomberg Television’s “Wall Street Week” with David Westin, which will debut Friday at 6 p.m. in New York.

“He argued that monetary policy will be able to do it the next time,” Summers said. “I think that’s pretty unlikely given that in recessions we usually cut interest rates by 5 percentage points and interest rates today are below 2%.”

The Fed’s target range for its benchmark policy rate is currently at 1.5%-1.75%.

Speaking Jan. 4 at the annual meeting of the American Economic Association in San Diego, Bernanke said crisis-era policies of large-scale bond purchases, known as quantitative easing, and commitments to keep rates low for a very extended period via forward guidance, could be used effectively again if rates drop to zero. Combined, they packed the equivalent of 3 percentage points of additional rate cuts, Bernanke estimated.

Summers disagreed.

“I just don’t believe QE and that stuff is worth anything like another 3 percentage points,” he said. “We’re going to have to rely on putting money in people’s pockets, on direct government spending.”

Also at the AEA conference, Summers presented a paper written with ex-International Monetary Fund chief economist Olivier Blanchard saying governments should put in place “semi-automatic stabilizers,” or policies that would automatically increase government spending -- perhaps through temporary tax cuts or credits -- once...

- Category: News Archives

- Hits: 896

Gold prices pulled back on Wednesday after climbing above $1,600 for the first time in seven years as tensions between Iran and the United States simmered. Still, the commodity has been one of the best performing assets in the world and one strategist says it’s only getting started.

“I think by 2025 gold will be at least $2,500 to $3,000 an ounce,” Heritage Capital’s Paul Schatz told Yahoo Finance’s On the Move[1]. “I don't think the rally is over in gold by any means.”

Gold prices are up nearly 4% in just the first few weeks of 2020. Earlier this week, the commodity jumped as much as 2.4% after Iran attacked U.S.-led forces in Iraq in retaliation for a U.S. drone strike that killed an Iranian military commander last week.

“Gold sentiment's really hot right now—everybody loves gold,” Schatz said. “ I think gold's a trading vehicle. If you like gold, what do you do? You find a leverage way to play it.”

Schatz has one particular pick that he calls “the big granddaddy of the industry.”

“I chose Newmont (NEM[2]),” he said. “It typically has a leverage effect, so gold goes up $2, that stock goes up 2%. That stock may go up 3%.”

Newmont is a leading gold mining company with jurisdictions in North and South America, Australia and Africa. Newmont shares have gained over 24% in the past year alone.

Gold is often looked at as a flight to safety, but investors have been putting their money into the commodity despite stocks doing well.

“Be very careful with the whole flight to safety thing,” Schatz said....

- Category: News Archives

- Hits: 703

HTTP/2 200 content-type: text/html; charset=UTF-8 expires: Thu, 09 Jan 2020 20:00:08 GMT date: Thu, 09 Jan 2020 20:00:08 GMT cache-control: private, max-age=0 last-modified: Thu, 09 Jan 2020 13:13:02 GMT x-content-type-options: nosniff x-xss-protection: 1; mode=block server: GSE alt-svc: quic=":443"; ma=2592000; v="46,43",h3-Q050=":443"; ma=2592000,h3-Q049=":443"; ma=2592000,h3-Q048=":443"; ma=2592000,h3-Q046=":443"; ma=2592000,h3-Q043=":443"; ma=2592000 accept-ranges: none vary: Accept-Encoding ...

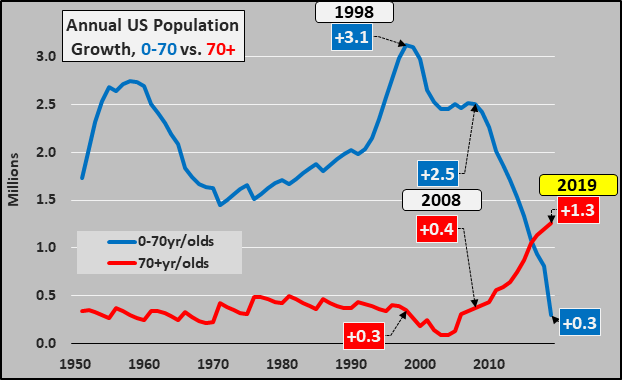

Econimica: 2019...US Population Growth Tanks, Federal Debt Blows Out, & Assets Rocket Higher- Category: News Archives

- Hits: 614

- Category: News Archives

- Hits: 651

(IDEX Online) - The Canadian Jewellers Association has appointed Kelly Ross as its managing director, Loss Prevention. Kelly has over two decades of law enforcement experience as a police officer with the Royal Canadian Mounted Police (RCMP).

During his time in the RCMP, Kelly specialized in crimes that involve diamonds, gemstones and precious metals, investigating hundreds of criminal cases involving diamonds, gemstones and precious metals. He was also the lead Canadian delegate to the FATF Diamonds/Money Laundering typology review and is a Judicial Expert on the criminal use of diamonds, gemstones and precious metals in several Canadian Jurisdictions.

For over 17 years Kelly has trained hundreds of police officers over dozens of police agencies on the criminal use of diamonds, gemstones and precious metals. Much of this training was in partnership with Jewellers Vigilance Canada (JVC).

Since 2018, he has volunteered as co-chair of CJA's Loss Prevention Committee....