Diamond News Archives

- Category: News Archives

- Hits: 647

(Bloomberg) -- With most U.S. households spending more and paying their bills on time, their creditors are feeling more confident than ever. To hear the CEOs of the nation’s largest banks tell it this week, rarely has the American consumer been in better shape.

But look deeper and it’s clear that view of the broad U.S. economy has its limits. They’re basing their assessments on clients lucky enough to bank with eight of the biggest lenders, with a combined $11 trillion in assets.

Roughly a decade after being burned by the most punishing financial crisis since the onset of the Great Depression, it’s increasingly clear that the nation’s largest lenders are targeting a narrower slice of consumers: The wealthy and those with excellent credit.

At JPMorgan Chase & Co., which on Tuesday reported the most profitable year of any bank in American history, executives anticipate a paltry 1.76% loss rate on their $504 billion of household loans, filings show. Five years ago, the bank expected to lose almost $2 billion more on a loan portfolio that was $78 billion smaller. The rate of severely delinquent consumer loans at Wells Fargo & Co. has fallen for at least 22 consecutive quarters, while at Bank of America Corp. soured household debt has dropped 23 quarters in a row.

In many ways, big banks’ flawless consumer loan books represent the underlying strength of an expanding U.S. economy, where wages are rising and nearly everyone who wants a job already has one. Bankers’ confidence that their loans will be repaid also reflects optimism about this year, when expectations are for a tight labor market, rising wages and continued gains in consumer spending.

“In the history of banking, we probably have the most pristine amount of credit,” Richard...

- Category: News Archives

- Hits: 592

HTTP/2 200 server: nginx date: Thu, 16 Jan 2020 20:00:04 GMT content-type: text/html; charset=UTF-8 content-length: 47340 vary: Accept-Encoding, Cookie cache-control: max-age=3600, public x-ua-compatible: IE=edge content-language: en x-content-type-options: nosniff x-frame-options: SAMEORIGIN expires: Sun, 19 Nov 1978 05:00:00 GMT last-modified: Thu, 16 Jan 2020 19:07:03 GMT etag: W/"1579201623" x-backend-server: drupal-b54cf6c8f-zbdvx age: 3180 varnish-cache: HIT x-cache-hits: 672 x-served-by: varnish-0 accept-ranges: bytes ...

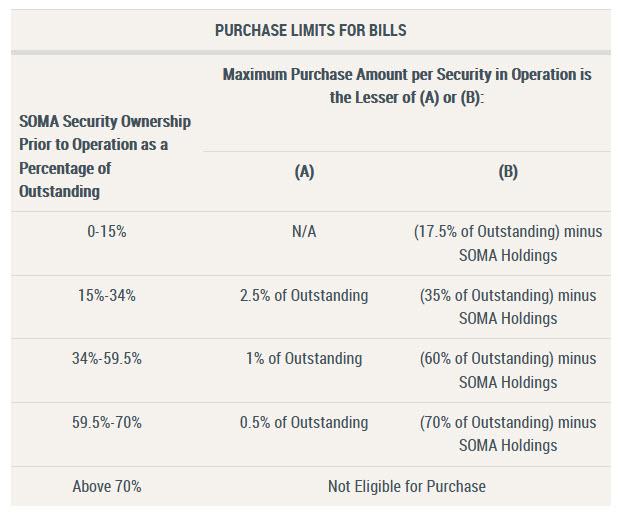

Fed To Cap How Many Bills It Buys As Part Of QE4 | Zero Hedge- Category: News Archives

- Hits: 537

HTTP/2 307 server: Varnish retry-after: 0 location: https://www.bloomberg.com/tosv2.html?vid=&uuid=429b3e50-3879-11ea-931f-13e9114ec1d8&url=L25ld3MvYXJ0aWNsZXMvMjAyMC0wMS0xNi91LXMtY29uc3VtZXItY29tZm9ydC1pbmRleC1hZHZhbmNlcy10by1tb3JlLXRoYW4tMTkteWVhci1oaWdoP3V0bV9zb3VyY2U9Z29vZ2xlJnV0bV9tZWRpdW09YmQmY21wSWQ9Z29vZ2xl accept-ranges: bytes date: Thu, 16 Jan 2020 16:00:04 GMT via: 1.1 varnish set-cookie: _pxhd=4d1ff59dcd6e56b2519159782f822bbd000f06e5ed3d7118aceeed9ae636828a:429b3e51-3879-11ea-931f-13e9114ec1d8; Expires=Fri, 01 Jan 2021 00:00:00 GMT; path=/; x-served-by: cache-yul8924-YUL x-cache: HIT x-cache-hits: 0 content-length: 0 HTTP/2 404 cache-control: public, max-age=5 content-type: text/html server: nginx accept-ranges: bytes date: Thu, 16 Jan 2020 16:00:04 GMT via: 1.1 varnish age: 0 x-served-by: cache-yul8924-YUL x-cache: MISS x-cache-hits: 0 x-timer: S1579190405.816259,VS0,VE31 vary: Accept-Encoding content-length: 162 ...

404 Not Foundnginx

- Category: News Archives

- Hits: 761

(IDEX Online) - Lucara Diamond Corp. is collaborating with Louis Vuitton and the Antwerp manufacturing HB Company to transform the 1,758-carat Sewelô diamond into a fine jewelry collection. The record-breaking diamond was recovered from the Karowe Diamond Mine in Botswana in April 2019.

Lucara will receive an up front non-material payment for the Sewelô and keep a 50-percent interest in the individual polished diamonds that result.

The company also announced that it will invest 5-percent of the retail sales proceeds generated from the collection back into Botswana through its community based initiatives.

"We are delighted to be partnering with Louis Vuitton, the famous luxury House, to transform the historic, 1,758 carat Sewelô, Botswana's largest diamond, into a collection of fine jewelry that will commemorate this extraordinary discovery and contribute direct benefits to our local communities of interest in Botswana," said Lucara CEO Eira Thomas.

Sewelô, which means "rare find" in Setswana, is the second diamond weighing over 1,000 carats recovered from Karowe in four years and the largest ever recovered in Botswana. The diamond is near-gem of variable quality, with recent analysis confirming that it also includes domains of higher-quality white gem....

- Category: News Archives

- Hits: 716

January 15, 2020

When will the American wage-earner finally tire of the skims, scams, fraud and lies that are now the foundations of everyday life?

You'd think that with the Federal Reserve printing trillions of dollars since 2008, we'd all be able to afford nice things. But you'd be wrong: after 11 years of Fed money-printing, nice things are even more out of reach for all but the favored few who've received the Fed's bounty of freshly created currency.

The Fed's trillions were supposed to trickle down into the real economy, but they never did. All those trillions boosted asset prices and the wealth of the $100 million yachts and private jets elite.

Instead costs have soared while wages have stagnated. If this widening gap between wages and costs were accurately presented, there would a political revolt against the Fed and those few who have benefited so immensely from Fed money-printing: the banks, financiers, corporations buying back their own shares, the owners of high-frequency trading computers, etc.

Despite the best efforts of the government's "suppress all evidence of runaway cost inflation" functionaries, a few facts have slipped through. Let's start with income from 1980 to the present, as per the Congressional Budget Office (CBO). Note that this is all pre-government-transfer (Social Security, food stamps, etc.) income, both earned (wages) and unearned (investment income).

The top households have done very, very well in the past 20 years of Fed largesse, while the incomes of the bottom 80% have gone nowhere.

Meanwhile, big-ticket costs of living such as rent have skyrocketed: so how do we buy nice things if our wages are stagnant but the cost...