Diamond News Archives

- Category: News Archives

- Hits: 727

Today the federal government will release a nearly $5 TRILLION annual budget proposal for Fiscal Year 2021 (which begins on October 1st of this year).

Needless to say, that’s more money than any government has ever spent in the history of the world.

And there are a few things in particular that are worth highlighting:

First– this budget proposal would create yet another trillion dollar annual deficit. And that’s simply astonishing.

Think about it: this is supposed to be the ‘everything is awesome economy’. The stock market is at a record high. Corporate profits are at record highs. Unemployment is at record lows.

If the government can’t make ends meet when the economy is this good, how many trillions will these people burn when the next economic downturn arrives?

Second– and perhaps even more importantly– the budget proposal aims to *cut* funding to Medicare and Social Security by hundreds of billions of dollars over the next decade.

Bear in mind that these programs are already insolvent, i.e. they can’t pay for the obligations they’ve already promised. AND they also lose money according to their own financial statements.

Right on page 5 of the 2019 Social Security annual report, the trustees explicitly state that “Trust Fund asset reserves become depleted and unable to pay scheduled benefits in full on a timely basis in 2035.”

And on page 2 of the report, they state that “Social Security’s cost has exceeded its non-interest income since 2010,” and that the cost of Social Security for 2019 exceeds non-interest income by $81 billion.

The Medicare annual report is even more bleak in its outlook:

“The Board projects that expenditures will increase in future years at a faster pace than either...

- Category: News Archives

- Hits: 710

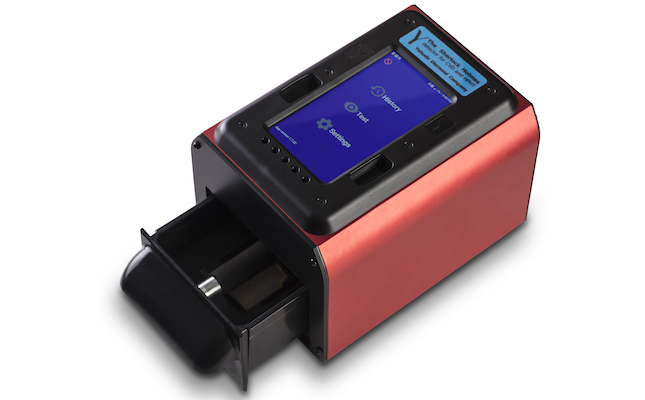

(Press Release) - IDEX and Yehuda Diamond Company are pleased to announce that IDEX is now using the Sherlock Holmes Detector[1] to check single and melee stones as part of its authentication process in Antwerp.

The two companies are also making the detector available for any supplier who wants to check their diamonds at the IDEX Office.

The Sherlock Holmes Detector is a manually operated portable desktop diamond verification instrument for loose and mounted stones of all shapes and sizes with a color of D-K.

The detector, which has been verified by the Diamond Producers Association's Assure Program, identifies mounted and unmounted diamonds in bulk and can instantly detect both lab-grown diamonds created through the HPHT process and CVD lab-grown diamonds. It also detects loose cubic zirconia (CZ) and Moissanite as well as coated CZs and diamond-coated moissanite.

The detector is also capable of identifying natural diamonds that have been color-enhanced through the HPHT process as natural diamonds.

To find out more, contact Anish Kuriakose on +32-3-234-1157.

To learn more about Yehuda Diamond Company, click here[2]....

- Category: News Archives

- Hits: 658

Gold futures climbed on Monday to tally a fourth consecutive gain, as investors fretted about the economic impact on China of the fast-moving outbreak of the coronavirus.

Prices for the yellow metal “continue to benefit on uncertainty, with how much and how long the coronavirus will weigh on global growth,” said Edward Moya, senior market analyst at Oanda. “Expectations are growing for the virus to peak in a few weeks, but if we see any new outbreaks or continued spreading of the disease outside of China, demand for safe-havens will soar.”

Gold for April delivery GCJ20, +0.36%[1] on Comex rose $6.10, or 0.4%, to settle at $1,579.50 an ounce, scoring a fourth consecutive gain, with the most-active contract at its highest finish in a week. The bullion on Friday showed a 0.9% decline for the week based on the most-active contract, according to FactSet data.

March silver SIH20, +0.64%[2], meanwhile, added 9.3 cents, or 0.5%, to $17.785 an ounce, after putting in a 1.8% weekly drop last week.

Gold “seems poised to make another run at the $1,600 level and if it can get there, we could easily see a failed triple-top pattern open the door for a move to the $1,640 region,” said Moya, in a daily update.

The death toll for the novel strain of coronavirus climbed to more than 900 in mainland China, exceeding that of the severe acute respiratory syndrome, or SARS, that claimed 774 lives...

- Category: News Archives

- Hits: 588

(IDEX Online) - Over the past 10 years, fancy color diamond prices have increased 77 percent. That's according to newly released information from the Fancy Color Research Foundation (FCRF).

Tracking the Fancy Color Diamond Index for the past decade shows that the price of pink diamonds has increased 116 percent, blue diamond prices have risen 81 percent and yellow diamond prices have moved up 21 percent.

Among the best-performing goods of the last 10 years are 5-carat pink diamonds, whose prices have increased 99 percent; 1-carat fancy vivid blue diamonds, which have seen increases of 135 percent and 3- and 5-carat fancy vivid yellow diamonds, which have risen 30 percent in price.

The story for 2019, however, is not as positive. The general index fell 1.4 percent, mainly because of a 5.4-percent decrease in the price of yellow diamonds, says the FCRF. The pink and blue categories showed more stability.

In the pink category, fancy vivid pinks increased by 4.4 percent, while 3-carat fancy vivid pinks increased by 9.1 percent.

In the blue category, the 1-carat, 1.5-carat and 2-carat categories increased by 2.5 percent, 3.7 percent and 2.7 percent and 1.5-carat fancy vivid blue diamonds increased 7.2 percent.

In the yellow category, 10-carat fancy vivid yellow diamonds decreased by 6.1 percent and 3-carat fancy intense yellow diamonds saw a price decrease of 5.3 percent.

Q4 2019

Pink

In Q4 2019, pink diamond prices fell 0.2 percent. Fancy vivid pinks in the 2-carat category rose by 1.7 percent while 1-carat and 8-carat fancy pink items declined by 1.2 percent and 1.1 percent respectively. The 5-carat fancy pink category decreased by 2.7 percent during the quarter and also declined...

- Category: News Archives

- Hits: 715

Despite the dangers of high-interest debt[1], more consumers are testing the limits of plastic.

To that point, more than 1 in 3 Americans — or 91 million people— said they're afraid they'll max out their credit card when making a large purchase, according to a new WalletHub credit cards survey[2]. (Most of those polled considered a large purchase as anything over $100.)

"A healthy amount of fear is justified," said Odysseas Papadimitriou, CEO of WalletHub. "Issues stemming from large purchases more often concern people making too many of them, for the wrong reasons."

More from Personal Finance:

How to buy a house despite student debt[3]

Here's one way to help determine a good cash cushion[4]

One in 5 fear they'll owe the IRS money this spring[5]

More than one-third, or 37%, also said they have already maxed out their credit card and 14% said they have maxed it out more than once. WalletHub polled more than 700 people in January.

Still, most Americans continue to take on ever-increasing amounts of debt. According to data from the Federal Reserve[6], the U.S. surpassed $1 trillion in credit card debt[7] — the highest level since the Great Recession.

U.S. households with revolving credit card debt owe nearly $7,000, on average, costing them roughly $1,100 a year in interest payments, according to NerdWallet's 2019 household debt study[8].

At the same time, about 35% of cardholders are starting 2020 with more credit card debt than they had in the beginning of 2019, according to a separate CompareCards survey[9].

And fewer cardholders said they paid their monthly balance in full...