Diamond News Archives

- Category: News Archives

- Hits: 610

-- Published: Friday, 21 February 2020 | Print[1] | Disqus[2]

Richard (Rick) Mills, Ahead of the herd

Minsky Moment refers to the idea that periods of bullish speculation will eventually lead to a crisis, wherein a sudden decline in optimism causes a spectacular market crash.

Named after economist Hyman Minsky, the theory centers around the inherent instability of stock markets, especially bull markets such as the current one that has been in place for over a decade.

As Investopedia defines it[3], A Minsky Moment crisis follows a prolonged period of bullish speculation, which is also associated with high amounts of debt taken on by both retail and institutional investors.

The Levy Economics Institute of Bard College describes his seminal theory as follows:

Minsky held that, over a prolonged period of prosperity, investors take on more and more risk, until lending exceeds what borrowers can pay off from their incoming revenues. When overindebted investors are forced to sell even their less-speculative positions to make good on their loans, markets spiral lower and create a severe demand for cash an event that has come to be known as a Minsky moment.

There are five stages in Minskys model of the credit cycle:

- Displacement investors get excited

- Boom - bullish speculation, the mania

- Euphoria extended credit to evermore dubious buyers

- Profit taking insider/ trader aka smart money cashes out

- Bust/ Panic

Two examples of Minsky Moments are the Asian Debt Crisis of 1997, blamed on speculators who put so much pressure on dollar-pegged Asian currencies that they eventually collapsed; and the 2008 financial crisis, which started with...

- Category: News Archives

- Hits: 593

(Bloomberg) -- Small investors are back. In a big way.

Their fingerprints are on Apple Inc.’s staggering rally. They piled into Tesla Inc. as it tripled, and turned speculative fliers like Virgin Galactic Holdings Inc. into some of the most heavily traded shares in the country. Why the enthusiasm? Some see a link to decisions by brokerages to cut commissions on trades to nothing.

While it’s tough to know what’s causing what -- bull markets are fueled by new converts but also lure them -- trading volume at online and discount brokers has exploded. TD Ameritrade Holding Corp., which started offering free trading in October, has seen million-trade days multiplying at a record pace.

Along with E*Trade Financial Corp., daily average revenue trades -- a standard industry metric that may be a bit of a misnomer now since buying and selling is free -- have almost doubled to an all-time high since last September, data compiled by Sundial Research showed.

“When you take a bull market and juice it with zero commission trading, we can expect it to generate interest among retail accounts. That, it did,” said Jason Goepfert, president of Sundial. “Retail traders have become manic.”

Individual investors were seen as indifferent participants for much of the 11-year bull market. No more. The latest leg of their emergence times closely with October, when E*Trade, Charles Schwab and TD Ameritrade slashed commission fees to zero. Not that it’s firm proof of anything, but since the start of that month, the S&P 500 is up 13% and the Nasdaq 100 has surged 24%.

Conversations with a handful of clients found lots of praise for zero-commission trades but mostly conservative purchases -- index funds and blue chips. Matt Hermansen, 23, who works for a...

- Category: News Archives

- Hits: 606

If Congress does not reign in the ballooning budget deficit, inflation in the U.S. will begin to rapidly increase, former Federal Reserve[1] Chairman Alan Greenspan warned on Thursday.

Continue Reading Below

"Unless we bring those extraordinary budget deficits under control, history tells us this is going to be a much more rapid rate of price increases than we’ve seen," Greenspan told FOX Business.

The Fed's preferred inflation metric has remained persistently low, but underlying prices picked up in January, with the so-called core CPI ticking up to 2.3 percent in the 12 months through January.

FORMER FEDERAL RESERVE HEADS AND THEIR LEGACIES[2]

The warning from Greenspan, who led the Fed from 1987 to 2006, comes as the U.S. federal debt has grown by about $3 trillion since President Trump took office. At the beginning of February, Trump proposed a staggering $4.8 trillion budget that would be funded in part by cuts on Medicare and Medicaid.

A number of Democratic presidential candidates are also campaigning on a slate of multitrillion-dollar plans, including Medicare-for-all, aimed at transforming the country and its economy.

FED CAUTIOUSLY OPTIMISTIC ON ECONOMY DESPITE NEW RISKS, MINUTES SHOW[3]

"This is going to be a very significant problem," Greenspan said. "Nobody wants to cut spending, or raise taxes. But if you look at the data that the Congressional Budget Office put out, we need very significant changes."

According to a recent Congressional Budget Office report[4], the U.S. government's budget deficit is projected to surpass $1 trillion in 2020. It would mark the first time since 2012 that the deficit has topped $1 trillion, alarming some economists.

While testifying before Congress at the beginning of the month, Fed Chair Jerome Powell sounded...

- Category: News Archives

- Hits: 593

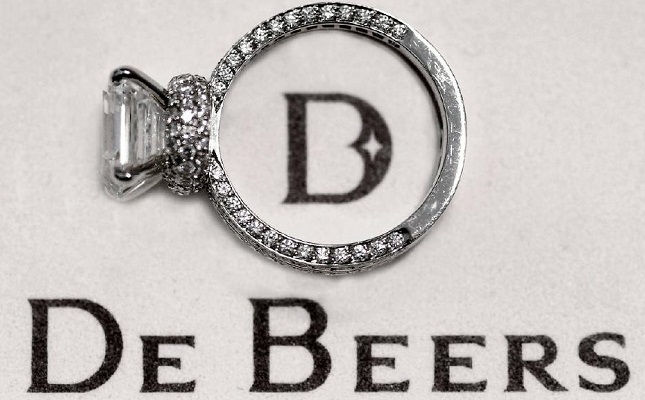

(IDEX Online) - De Beers has reported lower production, sales and underlying earnings for 2019 as it faced "significant challenges for rough diamond demand".

It predicted the return to "a more balanced position" of stock levels and an increase in production in 2020 in its preliminary financial results for last year, published today.

But it sounded a note of caution over a range of risks, namely retailer destocking a result of increased online purchasing, coronavirus and tensions in the Middle East.

Production for the year was down 12.8 per cent at 30,776,000 carats, primarily driven by a significant reduction of 59 percent in South Africa.

Total group revenue was down almost a quarter (24.3 per cent) at $4.6 billion (2018: $6.1 billion) and sales volume was down 7.8 percent to 29,186,000 carats.

Underlying earnings (EBITDA) were driven down 55 percent, at $558 million, because of the lower sales volumes and lower rough diamond prices.

De Beers said demand for rough diamonds had been lower and global consumer demand for diamond jewelry had been flat....

- Category: News Archives

- Hits: 571

While the U.S. economy is strengthening – and Americans’ wages[1] are rising – many are having trouble saving for retirement[2].

According to a new survey from the First National Bank of Omaha, more than half (53 percent) of respondents said they do not have an emergency fund that covers at least three months of expenses.

Meanwhile, 49 percent of Americans say they expect they will be living paycheck to paycheck this year.

RENTING AN APARTMENT? HERE’S THE CREDIT SCORE YOU NEED [3]

WHICH STUDENT LOANS SHOULD YOU PAY OFF FIRST?[4]

“For individuals and families in the early stages of saving, building that emergency fund should always be a top priority, and using a high-yield savings account is often the best way to do that,” Jerry J. O’Flanagan, executive vice president, First National Bank of Omaha, said in a statement.

And when it comes to longer-term saving, 37 percent of people said they had no plans to stash cash away for retirement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE[5]

Despite the aforementioned data, more Americans were optimistic about their financial prospects for the coming year. Nearly 60 percent said they expect to earn more this year – and 63 percent said they expect to save more.

When it comes to financial priorities, increasing savings was the most cited goal, followed by sticking to a budget. Only 10 percent of people said they planned to prioritize contributing to their retirement savings.

As previously reported by FOX Business, the Trump administration is looking to help more Americans make retirement saving[6] a priority. The Tax Cuts 2.0 package – which is expected to be released by September – could include...