Diamond News Archives

- Category: News Archives

- Hits: 814

The brutality continues for the equity markets, and the U.S. futures are trading sharply lower once again today. Nobody can think of anything but Coronavirus. In Italy, the cases continue to escalate, four hundred and twenty-four people have been infected, and twelve individuals have died. Investors are much concerned about the impact of Coronavirus on global growth. Obviously, with no vaccine at present, traders don’t feel comfortable, and the equity markets will probably remain rattled.

Yesterday, The Dow Jones index suffered its worst two-day sell-off in nearly four years, and sadly, there is still more to come. The Dow Jones index dropped 0.46%, the S&P500 fell 0.38%, but the Russell index closed higher with a gain of 0.17%. The volatility index, VIX closed lower with a loss of 1.04% but remained above the critical level of twenty that stimulates fear in the equity markets.

Yesterday’s session was intriguing because the U.S. equity markets began the day on a positive note; however, optimism faded away as new cases of Coronavirus virus emerged.

The market is sensitive, and everything is headline-driven. Investors continue to weigh their options between risk-on and risk-off assets. Policymakers are still downplaying the risk associated with Coronavirus despite that over 81K people have been infected worldwide, and nearly 27K have died.

Why Gold may reach 1700

The precious meta[1]l is back in the green. Investors have ignored the strong reading from the U.S. new home sales yesterday as well as disregarded the comments by the U.S. president, Donald Trump, who claims the media has exaggerated the...

- Category: News Archives

- Hits: 603

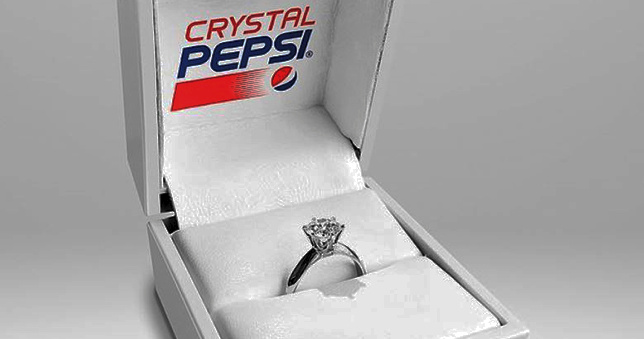

(IDEX Online) - It's a 1.53-carat lab-grown diamond … and it's made of Pepsi.

A clear, caramel-free version of the soft drink, Crystal Pepsi, was boiled down to its most basic form, according to the ad agency that dreamed up the idea, and the resulting carbon powder was used in the HPHT process.

Pepsi describe the cola stone, set in a platinum band, a an "IGI Laboratory Grown Diamond Crystal Pepsi engagement ring" with a value of about $3,000.

It's being offered as a prize in a US competition to find the most romantic offer of marriage, ahead of National Proposal Day on March 20. ...

- Category: News Archives

- Hits: 915

There’s something different about the threat COVID-19 poses to the global economy. And that’s what has investors worried.

“Because of its genesis in China, coronavirus is both a demand and a supply shock to the global economy,” said Brian Nick, chief investment strategist at Nuveen, in a Tuesday note. “Outside of China, however, evidence based on February’s survey data suggests that demand remains solid, and supply issues are the key risk.”

Coronavirus update: 81,245 cases, 2,770 deaths; Trump to hold virus news conference[1]

And it’s that threat of a supply shock — an unexpected change in the supply of a product or commodity — that is particularly unnerving for investors. They are more used to dealing with the occasional threat of negative demand shocks — an unexpected hit to demand for goods and services.

As Erik Nielsen, group chief economist at UniCredit Bank, explained in a Sunday note, investors know that efforts by policy makers to stimulate the economy can partly address demand shocks.

But it is “much more complicated, if at all possible” to offset supply shocks, he wrote, offering the following example:

Big, negative supply shocks are rare, Nielsen noted, with the oil shocks of the early and late 1970s offering perhaps the most well-known examples. Other examples of supply shocks include storms, tsunamis, earthquakes, wars, and strikes. The problem is that there’s little that looser monetary policy or additional fiscal stimulus can do to offset the impact because those stimulus measures work by boosting demand.

Opinion: If the coronavirus isn’t contained, a severe global recession is almost certain[2]

...

- Category: News Archives

- Hits: 743

(IDEX Online) - A power outage halted ore treatment at Firestone's Liqhobong, mine in Lesotho, for almost a month and cost $4.6 million, the company said today.

The disruption increased costs in Q2 - $14.90 per tonne treated compared with $10.32 in Q1, according to the quarterly operations update.

The number of tonnes treated was reduced to 668,120 (Q1: 963,986 tonnes) and diamond recoveries were down to 138,000 carats (Q1: 201,091 carats).

The mine suffered unexpected and damaging voltage fluctuations when its main power supplier, the Muela Hydropower Station, shut down for two months of planned maintenance.

As a result, all treatment of ore was halted from 1 to 16 October 2019. It resumed at around 90% capacity when diesel generators were sourced from South Africa and grid power was restored on 1 December.

The company has revised down its 2020 forecasts, suggesting diamond recoveries will fall to between 720,000 and 750,000 carats (previously 820,000 to 870,000 carats) and tonnes of treated ore from, 3.3 and 3.6 million (previously between 3.6 and 3.8 mt).

CEO Paul Bosma said: "The unexpected power disruption had a devastating impact on production and revenue generation. The team however, did well to salvage the situation by procuring and installing generators from South Africa in record time to allow for operations to recommence.

"Due to the production setback and continued lacklustre market conditions, the Board has decided that it is imperative that it does all it can to reduce costs in order to survive the prolonged downturn."...

- Category: News Archives

- Hits: 600

Proceed with caution value-seeking investors. The hammer job done on stocks[1] at the hands of the spreading coronavirus may just be getting started if history and common sense are any guides.

SunTrust chief markets strategist Keith Lerner thinks there is another 5% to 7% of downside possible for the S&P 500. His call is supported by two factors.

The first is a heavy dose of market history. Lerner notes that since the current bull market began in March 2009 (S&P 500 up 400% since then) there have been 19 pullbacks of at least 5%. Every pullback came with uncertainty and bad news, Lerner says, pointing to several virus-related outbreaks such as the Swine flu in 2009, the Ebola scare in 2014 and Zika in 2016. These corrective periods have lasted an average of 47 days and have seen an average pullback of 9.4%.

The current correction spurred by fears of the coronavirus morphing into a global pandemic[2] — where $2.5 trillion has been wiped off the value of U.S. stocks since last Wednesday’s high per S&P data — is approaching the average bull market percentage pullback. But the losses have come in only four days and there remains significant uncertainty as to how bad Corporate America’s profits will be hit.

Trust me, I talk to loads of top executives — off the record they are saying it’s hard to even estimate the impact not only in the first quarter, but into the summer. But you could hear the concern in their voices.

That uncertainty and financial risk has to get priced into stocks. It likely will as infection and death tolls from coronavirus stand to rise globally in the weeks ahead....

- Warning over Laser Treatment to Lab-Grown Diamond

- 10Y Treasury Yield Hits Lowest Level In Modern History (Kocherlakota Calls For 25-50 Basis Point Cut) – Confounded Interest

- Angola Seizes 6,579 carats of Illegal Rough Diamonds

- World Health Organization holds press conference on the coronavirus outbreak