Diamond News Archives

- Category: News Archives

- Hits: 600

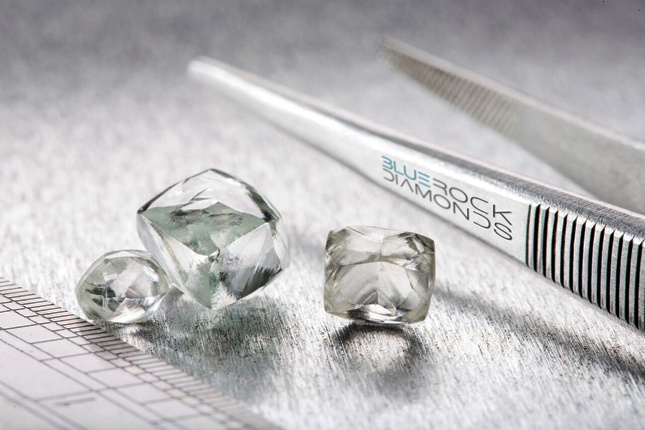

(IDEX Online) - British miner BlueRock says COVID-19 knocked 15 per cent off the price of rough diamonds sold from its Kareevlei mine, in South Africa.

The company yesterday announced the private sale of 2,400 carats for a total of $700,000, averaging $290 a carat.

"The parcel sold did not contain any notable high value diamonds and therefore the price achieved is approximately 15% below what we would have expected to achieve for this parcel pre the Covid-19 pandemic," said executive chairman Mike Houston.

Bigger miners, such as Alrosa, De Beers and Rio Tinto, have been pursuing price-over-volume strategies rather than lowering prices.

BlueRock announced last month that it will brand its stones as Kareevlei Diamonds and sell them in Antwerp to attract more buyers.

Mr Houston said: "It remains our plan to sell our future production through Bonas-Couzyn N.V, in Antwerp as per our arrangement announced on 13 May 2020.

"We now anticipate that the first sale of Kareevlei diamonds in Antwerp will be in September with June to August production pre-financed monthly at 70% of value by Delgatto Diamond Finance Fund LP in accordance with our non-binding letter of intent."

BlueRock has reported record output, up almost two-thirds on Q4 of 2019, since it re-opened after the lifting of COVID-19 restrictions....

- Category: News Archives

- Hits: 530

- Category: News Archives

- Hits: 570

- Category: News Archives

- Hits: 672

(IDEX Online) - French luxury conglomerate LVMH is now expected to go ahead as planned with its $16.2bn acquisition of US jeweler Tiffany & Co, after days of fevered speculation.

Reports in the fashion Bible Women's Wear Daily (WWD) suggested late last week that LVMH Moët Hennessy Louis Vuitton could use COVID-19 and the George Floyd aftermath to negotiate down a price agreed last November.

But current indications are that LVMH has been deterred by legal hurdles from seeking a discount.

LVMH chief executive Bernard Arnault had reportedly been seeking ways to lower Tiffany's cash price of $135-a-share.

The proposed deal would help consolidate LVMH's position in hard luxury - high-end jewelry and timepieces - following its acquisition of the Italian watchmaker Bulgari for $5.2bn in 2011.

New York-based Tiffany reported a $4.4bn of sales for last year, matching its record high in 2018.

...

- Category: News Archives

- Hits: 532

(IDEX Online) - Alrosa blamed a Q1 plunge in profits of 87 per cent on revaluation of its foreign currency debt, and, to a lesser extent, COVID-19.

The Russian state-owned miner reported a good start to the year and said prices were recovering, until the coronavirus pandemic in mid-February.

Net profit for the first three months of 2020 were RUB 3.1bn ($45m), down from RUB 11.7bn ($170m) in Q4 2019 and RUB 24.1bn ($350m) in Q1 2019.

The company said it was prepared for the impact of coronavirus to continue into Q2 and beyond, but sounded a note of optimism over a bounce-back of sales in China and other Asian markets.

Earnings before interest, tax, depreciation and amortisation (EBITDA) fell four per cent to RUB 30bn ($440m) on lower Q1 sales volumes.

Diamond sales for Q1 amounted to 9.4 m carats (down 1% q-o-q) and total revenue was $904m (down 11% y-o-y).

"In March, the situation escalated, with sales dropping considerably as the restrictions were being introduced around the world," said chief financial officer Alexey Philippovskiy in a statement.

"In April, the company began to provide its long- term customers with unprecedentedly flexible terms, allowing them to completely suspend purchases and transferring the contractual volumes to subsequent months.

"Today, we see diamond jewellery sales bouncing back in China and other Asian markets, which is expected to drive diamond demand up as soon as July-August."

He referred to an earlier announcement that the production target for 2020 had been cut from 34.2m carats to 28-31m carats.

Pic courtsey Alrosa...