Graph background image: Strike Drilling

Australia is the world’s number two gold producer; the country's tightening its grip on the trade in iron ore and coking coal; comes in at no 6 for copper; and is set to increase output of mineral-du-jour lithium from the current 38% to nearly half the global total within five years.

That’s the result not only of a rich mineral endowment but massive amounts of money spent on exploration across the continent.

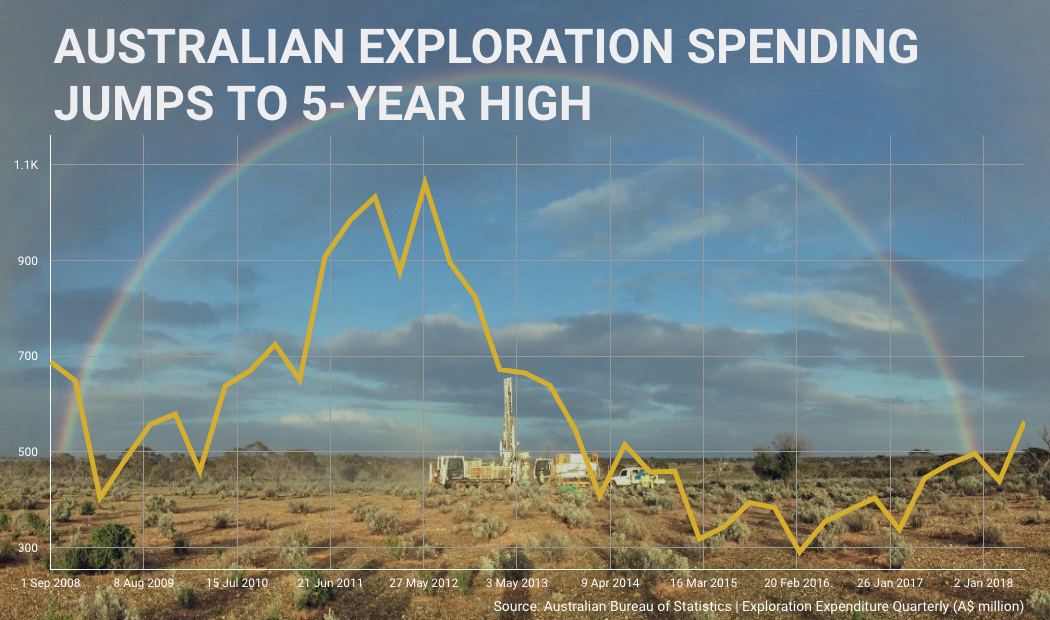

After a sharp drop-off when it became clear that boom times for Chinese economic growth were beginning to taper, new data from the Australian Bureau of Statistics shows the country’s miners and explorers are once again pouring money into the sector.

Graph background image: OZ Minerals

ABS announced this week the country’s mineral exploration expenditure jumped by 26.6% during the second quarter compared to last year to total $563.4m. That’s the highest level since the third quarter of 2013.

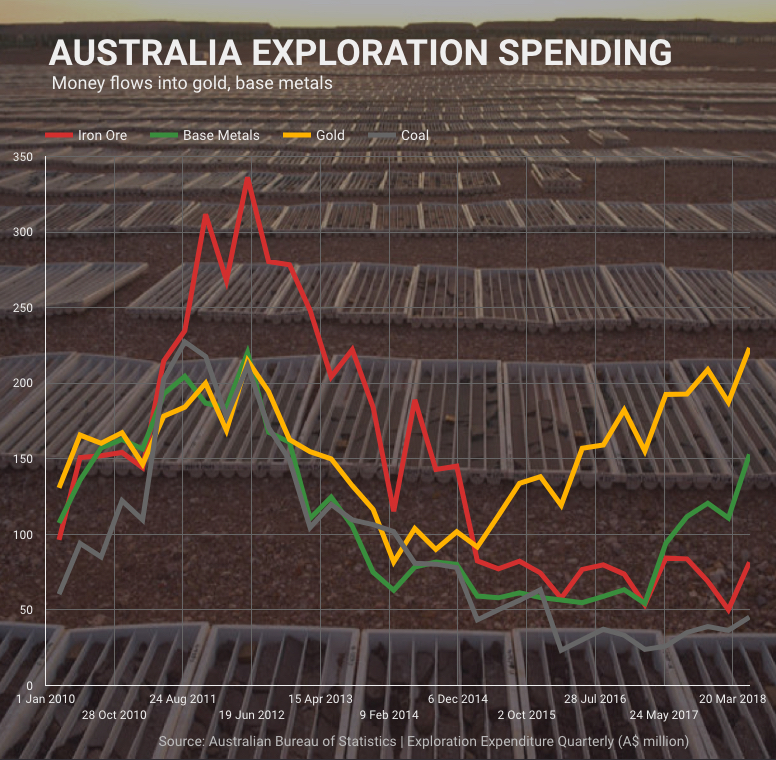

Spending on base metals rose at the fastest pace, up 38%, to the highest since the final quarter of 2012. Iron ore exploration also appears to be escaping the doldrums after two quarters of sequential growth (although nothing close to spending from 2011 to 2014 when iron ore was worth double it is now).

Most striking is the amount of money chasing gold. Spending on gold exploration at $223m was the highest since the second quarter of 1997. The June quarter also exceeded spending in the second half of 2011 when gold prices reached all-time highs above $1,900 an ounce.

Graph background image: OZ Minerals

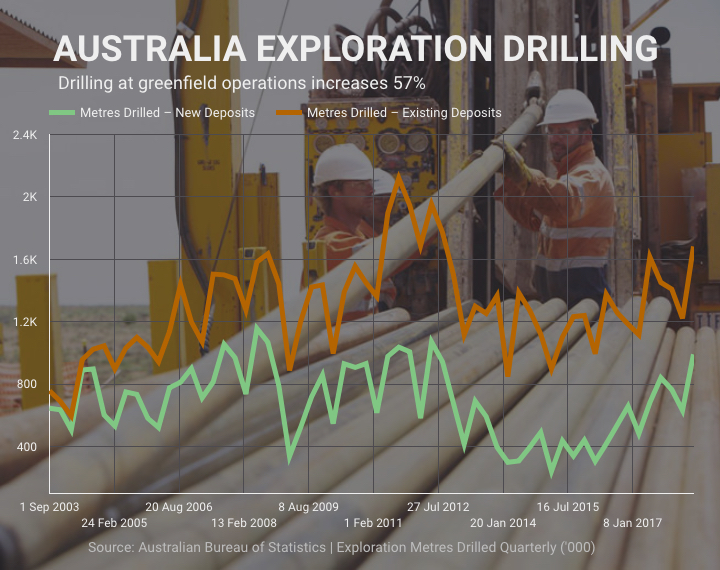

Although smaller in absolute terms, greenfield capex is back in focus with investment in...