The price of garbage on Wall Street keeps going up, despite the best efforts of the Fed.

The dregs of the bond market, CCC and worse, are issuances that are at very active risk of default. The definition of a CCC rating: “An obligor is CURRENTLY VULNERABLE, and is dependent upon favorable business, financial, and economic conditions to meet its financial commitments.”

Since the Fed started raising rates, the yield on the equivalent of bond trash has gone down 2%, incredibly falling below 10% annual yield. For super speculative debt at very high risk for default. Nearly everyone is drinking the Kool Aid now.

The Fed’s efforts to raise interest rates across the spectrum have borne fruit only in limited fashion. In the Treasury market, yields of longer-dated securities have not risen as sharply (prices fall when yields rise) as they have with Treasuries of shorter maturities.

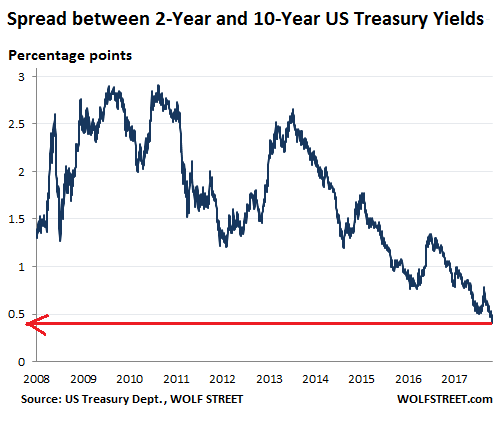

The two-year yield has surged to 2.41% on Tuesday, the highest since July 2008. But the 10-year yield, at 2.82%, while double from two years ago, is only back where it had been in 2014. So the difference (the “spread”) between the two has narrowed to just 0.41 percentage points, the narrowest since before the Financial Crisis.

This disconnect is typical during the earlier stages of the rate-hike cycle because the Fed, through its market operations, targets the federal funds rate. Short-term Treasury yields follow with some will of their own.

But the long end doesn’t rise at the same pace, or doesn’t rise at all because there is a lot of demand for these securities at those yields.

Investors are “fighting the Fed”— doing the opposite of what the Fed wants them to do – and the difference between the shorter and...