Canada-listed Fura Gems (TSX-V:FUR), a new gemstone mining and marketing company headed by former COO of Gemfields (LON:GEM) Dev Shetty, is stepping up efforts to kick off operations at some of its key assets and so take advantage of a growing demand for coloured precious rocks.

The company, which began operations less than a year ago, in May 2017, has good reasons to be in a rush. Sales of emeralds, rubies and sapphires are picking up to the point they are outpacing the increase in demand for diamonds. That, in turn, is fuelling prices for coloured stones, with the market expected to grow from the current $2 billion to $10 billion, in the next ten years, according to the Natural Resource Governance Institute.

Fura’s assets are all located in areas known for holding diamonds deposits, including operating mines currently undercapitalized and that need to be modernized.

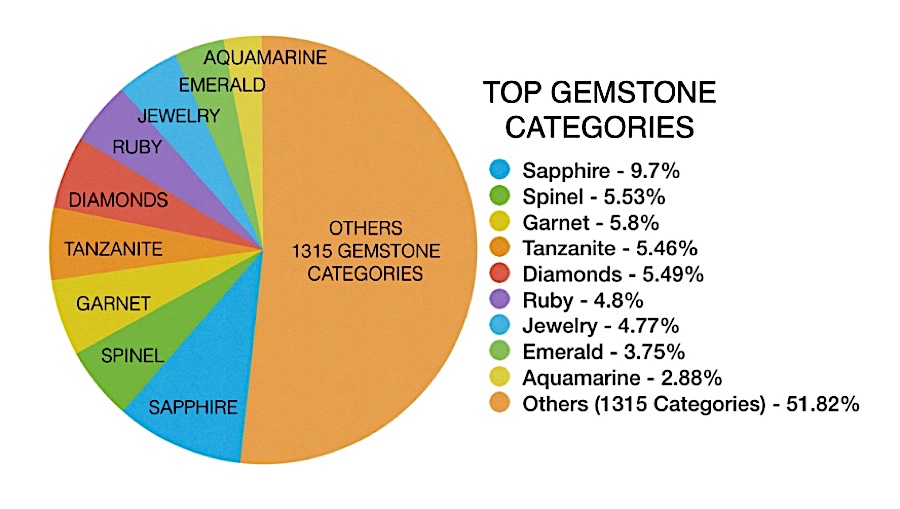

Graphic courtesy of Gem Rock Auctions.

A good example of those assets, Fura Gems chief executive officer Dev Shetty told MINING.com, is the company’s Coscuez emerald mine in Colombia, which it grabbed from Gemfields in October.

Located in the mountainous department of Boyacá, Coscuez is probably one of the best-known emerald deposits in the world, said Shetty, adding it’s known to have produced over 95% of Colombia’s emerald supply in the 1970s.

Company believes its Coscuez emerald mine in Colombia has only been ‘scratched on the surface’ and that the best is yet to come.

“We firmly believe that mine has only been scratched on the surface, and the best is yet to come,” Shetty said. “We estimate that if we capitalize it from the current state itself, [Coscuez] will have a minimum life of about 25 years or more, and there is a potential to expand the life by doing core drilling.”

The executive noted Fura Gems already has a core management team on ground, with plans to restart mining there in April.

Similarly, in Mozambique, the company acquired four licences in the area known as “the ruby belt” and it believes is in position to start mining those assets “very soon.”

Messy market

Unlike diamonds, which come mainly from known actors such as De Beers, Alrosa and Rio Tinto, and which are subject to clear regulations, 90% of the coloured gemstones supply comes from an unorganized sector.

90% of the global supply of coloured gemstones comes from a highly disorganized and fragmented industry, says CEO Dev Shetty.

“It is a highly disorganized and fragmented industry,” Shetty said, “but there is considerable scope for growth.”

Fura’s plans in this regard are ambitious, as it aims to organize between 15% and 20% of the current trade, mostly done these days on a small-scale, artisanal basis. Shetty acknowledges that trying to whip the sector into shape won’t be easy, but he thinks is possible and necessary.

“Fura’s...