Rio Tinto (ASX, LON, NYSE:RIO), the world’s No.2 mining company, showed investors Wednesday how well it has ridden the wave of higher commodity prices by announcing a record dividend on the back of a big surge in annual profit and its cost cutting drive.

The company, which admitted it hunting for acquisitions, including in new commodities such as lithium, handed shareholders $1.80 per stock, taking its payout for 2017 to $2.90. The figure is the highest in Rio’s history and almost 71% more than the one it paid last year. As a result, cash returns to investors for 2017 totalled $9.7 billion.

Net profit for the year rose 90% (you read that right) to $8.8 billion, compared to the $4.6bn recorded in 2016. Underlying net profit after tax, in turn, was $8.62bn, up from $5.1bn in 2016, slightly ahead of market forecasts. Analysts expected the company to report $8.5bn.

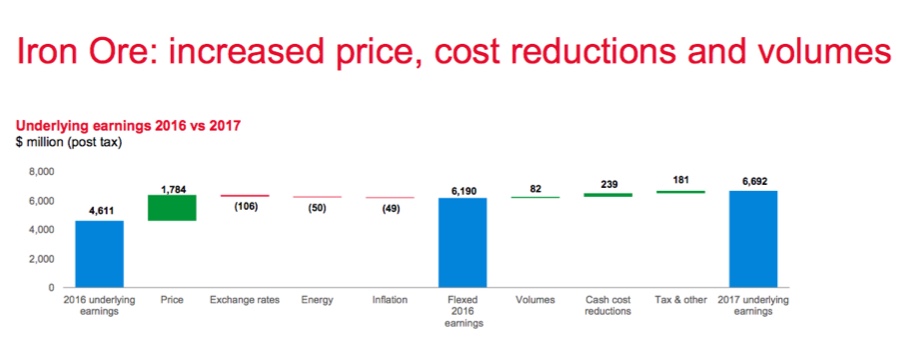

Rio's largest division, iron ore, delivered the lion's share of revenue, as prices have recovered and remained relatively stable — trading around $75 a tonne — in the past year.

Iron ore accounts for almost 90% of Rio's earnings. (Taken from: Rio Tinto’s 2017 Full Year Results Presentation.)

The record results are the first annual report for chief executive Jean-Sébastien Jacques, who took over from former boss Sam Walsh in July 2016.

Under Jacques, Rio has focused on cutting costs, generating cash and returning as much of it as possible to investors through dividends and share buybacks.

"I'm very proud of what the team has achieved. Biggest dividend ever in the 125-year history of the company and we believe that we’ll be able to generate a lot of cash again this year,” told reporters on an earnings call.

With net debt below $4 billion, Rio Tinto is once again in a position where look for fresh opportunities and projects.

Tainted reputation

The company, however, is still battling reputational damage brought by a series of incidents, including a probe into a questionable payment made to an external consultant over the Simandou iron ore project in Guinea.

It is also facing fraud charges from the US Securities and Exchange Commission (SEC), the country’s top securities regulator, over the company’s and two former executive’s alleged covered-up of multi-billion-dollar losses on a coal investment in Mozambique, allegations which the two men and the company deny.

The company has also been accused of dodging $700 million in taxes at its massive Oyu Tolgoi copper and gold mine in Mongolia.

More to come…

The post Rio Tinto pays biggest divvy in history as profit hits three-year high appeared first on MINING.com....